Grab to offer instant remittance product from early 2019

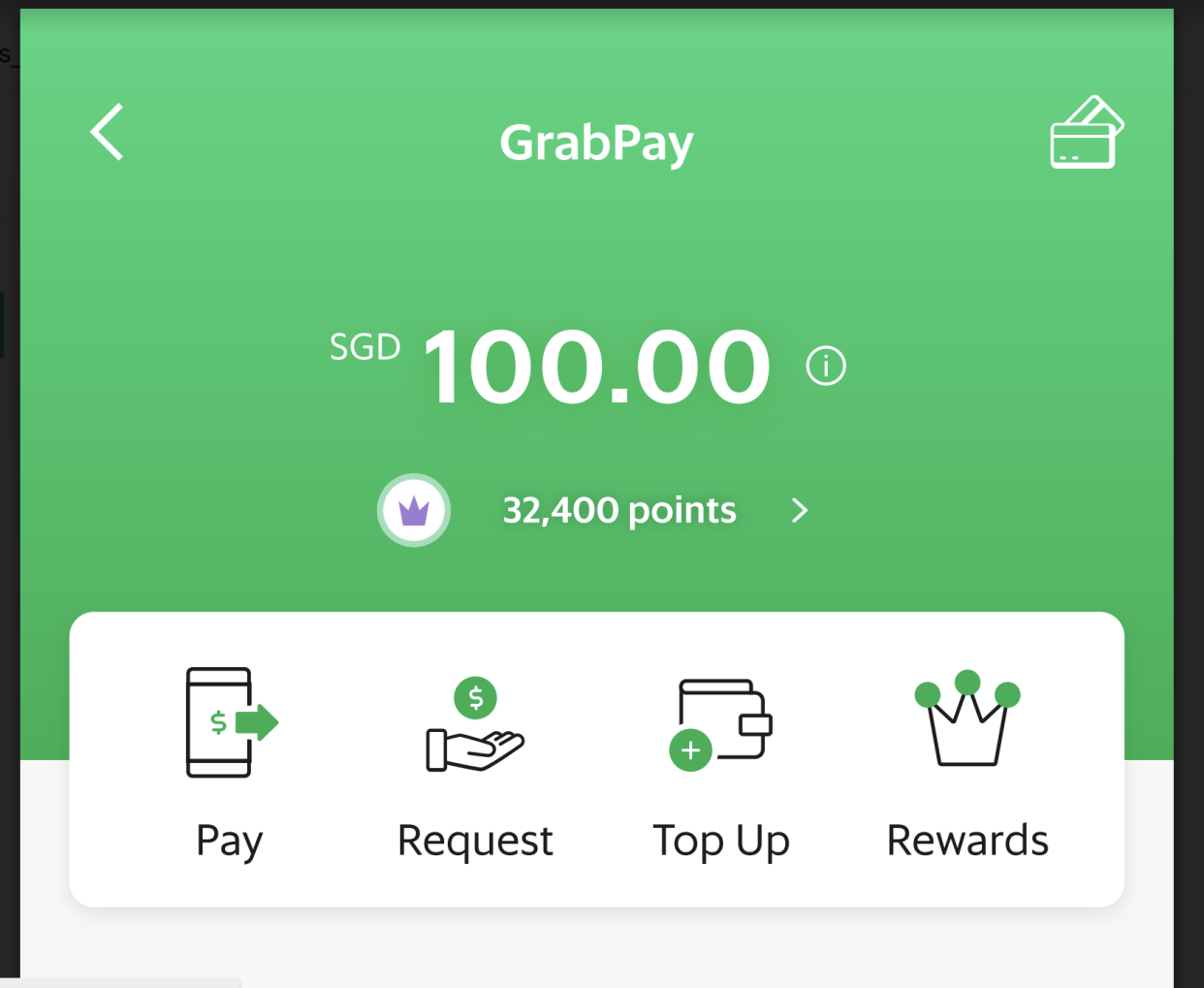

Grab on Thursday (15 November) announced a remittance product that would allow senders to remit money directly to receivers in another country using their GrabPay wallets.

Unlike existing options in the market, receivers can access transferred funds instantaneously, the ride-hailing company said in a statement. Receivers can either choose to get the remitted sum via the regular network of cash-out points such as ATMs or use it on everyday transactions, ranging from bill payments to mobile airtime top-ups.

The product will be launched early next year.

Grab said the remittance industry currently suffers from opaque and expensive pricing structures, and inefficient delivery operations. Among the active users of remittance services, foreign workers continue to be reliant on unlicensed agents, it added.

“Grab Financial is in a unique position to streamline the process of sending money to your loved ones and accelerate financial inclusion for everyone in the region,” said Reuben Lai, Senior Managing Director at Grab Financial.

Southeast Asia’s remittance market was estimated to be worth US$70 billion in 2017, according to the World Bank. The product can pave the way for a multi-currency Asean e-wallet that would help facilitate payments across the tourism industry while enhancing e-commerce opportunities in the region, the company said.

Minister for Foreign Affairs Vivian Balakrishnan, who witnessed the unveiling of the product at the 33rd Asean Summit, said, “Interoperable real-time regional payment systems will expand opportunities, especially for citizens and small businesses, to access products and services across Asean.”

Related stories: