Grab, Uber fined a combined $13 million for March merger

Ride-hailing firms Grab and Uber were fined a combined $13 million by Singapore’s competition watchdog on Monday (24 September) for their merger in March 2018.

Uber was fined $6.6 million, while Grab was penalised $6.4 million for the merger, which saw Uber sell its Southeast Asia business to Grab for a 27.5 per cent stake in Grab.

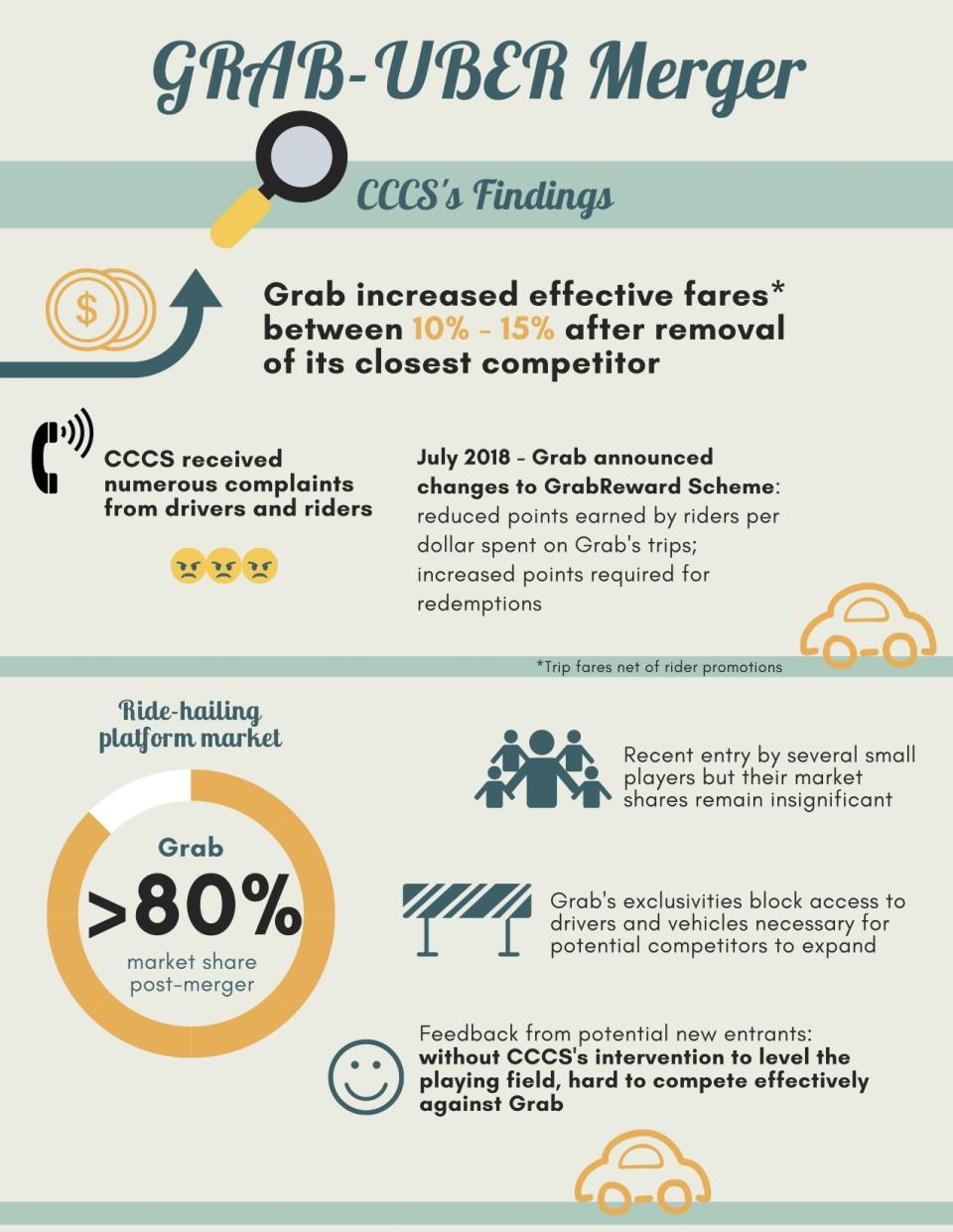

In addition, the Competition and Consumer Commission of Singapore (CCCS) ordered both parties to “lessen the impact of the transaction” on drivers and riders, as well as to open up the market and level the playing field for new ride-hailing firms.

These measures include:

Ensuring Grab drivers are free to use any ride-hailing platform and are not required to use Grab exclusively

Removing Grab’s exclusivity arrangements with any taxi fleet in Singapore

Maintaining Grab’s pre-merger pricing algorithm and driver commission rates

Requiring Uber to sell the vehicles of Lion City Rentals to any potential competitor who makes a reasonable offer based on fair market value, and preventing Uber from selling these vehicles to Grab without CCCS’s prior approval

CCCS started their investigations a day after Uber and Grab completed their merger on 26 March, on the basis that the deal might have infringed the Competition Act as an anti-competitive merger. On the same day, reports emerged that the two companies had not officially informed CCSS of the deal.

It found that, had the merger not taken place, Uber would not have left the Singapore market by simply terminating its business. It also found that Grab currently holds more than 80 per cent market share Singapore, and that its effective fares have increased between 10 per cent and 15 per cent post-merger.

CCCS chief executive Toh Han Li said, “Mergers that substantially lessen competition are prohibited and CCCS has taken action against the Grab-Uber merger because it removed Grab’s closest rival, to the detriment of Singapore drivers and riders. Companies can continue to innovate in this market, through means other than anti-competitive mergers.”

Lim Kell Jay, Head of Grab Singapore, said in a media statement that Grab is glad that CCCS did not require the merger to be unwound.

He added: “It is unfortunate that the CCCS is taking a very narrow market definition in arriving at its conclusion that the (merger) has led to a substantial lessening of competition. Commuters are free to choose between street-hail taxis and private hire cars, and it is a fact that private-hire car drivers’ incomes are directly impacted by intense competition with street-hail taxis.

“Grab is committed to fair pricing and has not raised fares since the (merger). Grab will continue to adhere to our pre-transaction pricing model, pricing policies and driver commissions. We have been and will continue to submit weekly pricing data to the CCCS for monitoring.

“Grab believes it should not be the only transport player subjected to non-exclusivity conditions. This is inconsistent with taxi industry practices and does not create a level playing field.”

Uber’s chief business officer international Brooks Entwistle said that it is disappointed by the CCCS decision, and that it is reviewing the decision and considering its options, including an appeal.

“We believe it is based on an inappropriately narrow definition of the market, and that it incorrectly describes the dynamic nature of the industry, among other concerns,” he said.

Indonesian start-up Go-Jek said that it welcomes the infringement decision by CCS, and that it is glad that the CCCS has recognised that new entrants to the market are facing a very high barrier to entry.

Said its spokesman: “We are encouraged to see the measures being taken to level the playing field – it will have a significant effect on our strategy and timeline. We are now confident that Singapore will have a robust, efficient and competitive market, and that our arrival will have a significantly positive impact on the lives of people in Singapore.”

The Land Transport Authority (LTA) has also supported the decision. It added: “The conditions within the infringement decision are in line with LTA’s ongoing review of the regulatory framework for the point-to-point sector, which aims to keep the sector open and contestable.”

Related stories:

Grab: CCCS’s position on merger with Uber ‘overreaching’, against pro-business rules

Grab-Uber merger has led to ‘substantial lessening of competition’, fines proposed: CCCS

Over 500 Uber staff in Singapore placed on paid leave following Grab-Uber merger