UK economy has 'very little momentum' ahead of GDP data release

Economists have warned that the UK economy has “very little momentum,” ahead of a key economic data release.

How quickly the UK is recovering from the coronavirus will be laid bare on Wednesday, as gross domestic product (GDP) data for the second quarter is published.

Near-real-time data, such as Google Trends on online search volumes, point to a renewed decline in consumer services spending in mid-September, according to an analysis by Pantheon Economics.

The firm says this is partly in response to the sharp rise in confirmed cases of COVID-19.

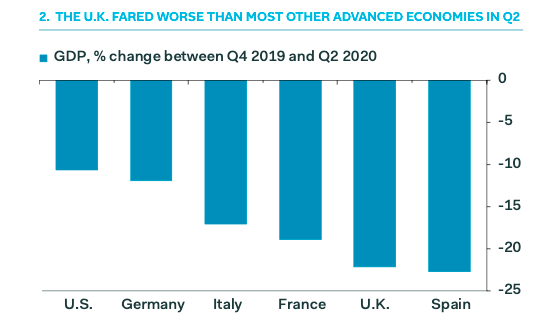

The UK has already lagged behind its European peers in tackling the virus in terms of a rebound in GDP.

In July, the data showed GDP had plunged 11.7% below its January peak. A marked improvement from the 25.6% shortfall in April.

Pantheon estimate that it has likely increased further by about 4.5% in August and 2.0% in September, leaving it close to 5% below its pre-Covid level.

But activity in August was boosted by households spending some of the “enforced savings” that they accumulated during the lockdown, as well as a sharp decline in overseas travel with people “staycationing.”

Most of the further predicted increase in GDP expected in September is linked to the reopening of schools.

Long-run estimates made by KPMG in September show that overall GDP could fall by 10.3% in 2020, leaving the economy about 6.4% smaller by the end of this year than before the pandemic struck.

KPMG have hedged their estimate on a “significant likelihood” a coronavirus vaccine will become available from April next year.

“While in this scenario the economy continues to partially recover until then, business closures and redundancies will also continue to rise,” they said.

A delay in rolling out the vaccine of just three months could therefore mean that GDP growth next year could fall to 7.1%, even with a Brexit deal.

READ MORE: What you need to know about the economy, jobs and the 'Winter Economy Plan'

Alongside shaky expectations for GDP, the downturn in the labour market is set to deepen in spite of a new employment scheme that was announced on Thursday.

Payroll employee numbers in August already were 2.5% below February’s peak, but surveys indicate that firms are pushing through more redundancies ahead of the closure of the Coronavirus Job Retention Scheme at the end of October.

Pantheon predicts that the new Job Support Scheme starting in November will not prevent layoffs.

The scheme requires firms to make up one third of the shortfall in wages for staff employed on reduced hours, with the government contributing a further third.

Firms enduring weak demand are better off employing some workers full-time and firing the remainder, than keeping on all staff part-time and topping up their pay, even though they would pay less national insurance and would receive a larger Job Retention Bonus in January, which is £1,000 ($1,300) per head.

READ MORE: Markets to focus on Brexit talks, US presidential debate and UK final GDP