The Guardian view on a comeback for Keynes: revolutionary road

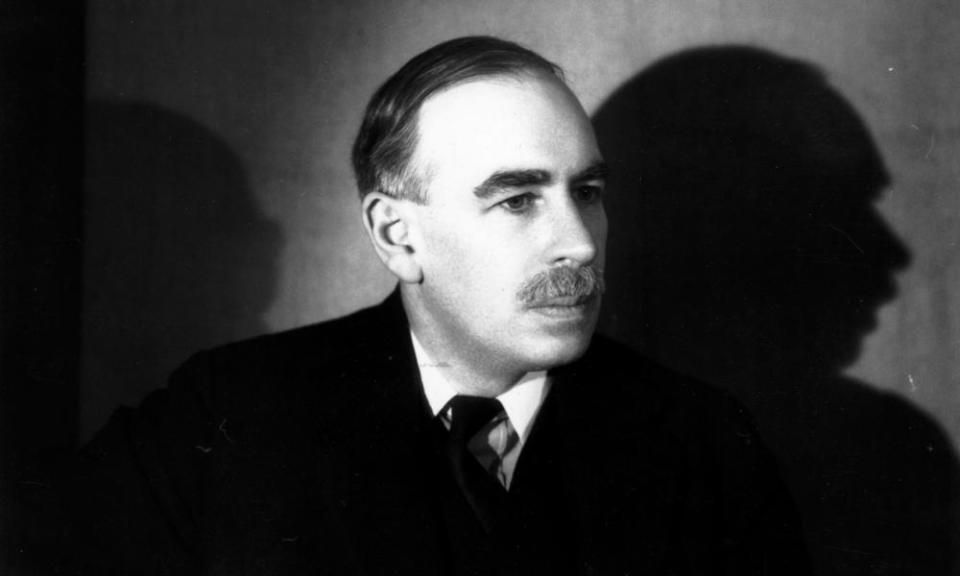

This month, 83 years ago, perhaps the greatest-ever economist published his greatest work. John Maynard Keynes’ The General Theory of Employment, Interest and Money did not invent monetary analysis. But it changed the way that money, finance, demand and unemployment in a modern economy were understood. Such is its enduring power that, three years ago, it was voted the most significant British academic book of the modern age. Keynes knew what he was on to when he wrote The General Theory. In a letter to the playwright and activist George Bernard Shaw, he wrote: “I believe myself to be writing a book on economic theory, which will largely revolutionise … the way the world thinks about economic problems.”

Keynes put his theory into practice. Entering the Treasury in 1940, he was central to the creation of the British government’s plans for the reconstruction of the economy after the second world war. He was not the only person involved, but his blueprint of a state-guided investment policy accompanied by a generous social welfare system, progressive taxes, a low interest rate, monetary policy run by a nationalised Bank of England, strict capital controls, managed trade, and non-casino financial markets built the postwar state. It proved remarkably successful: GDP per head growth averaged 2.44% a year in the period from 1950 to 1973. Keynes’s economic revolution was not some utopian dream but a politically feasible project.

What is interesting from a historical perspective is how such a dominant ideology can be toppled. By the late 1960s and early 1970s, a series of events sent shockwaves around western democracies – student revolts, Vietnam, oil shocks, stagflation and the end of the Keynes-inspired Bretton Woods system. Conservatives mobilised an argument that generous welfare spending did not just undermine capitalism, but had inflationary, destabilising consequences and hence was a threat to democratic governance. By 1975, it became an influential report titled The Crisis of Democracy. In 1976 it was a British Labour prime minister, James Callaghan, who pronounced Keynesianism dead.

Monetarism, the economic theory that took over, has failed. Growth in UK GDP per head since 2008 has been almost zero. The economist James Crotty writes in his book Keynes Against Capitalism that this flatlining takes place when “social democracy is in retreat, authoritarian oligarchies are on the rise” in a global system that punishes any country that does not play by the “rules of the game”. Many authoritarians are now using state power to lock in the dominance of the rich. That is what Iain Duncan Smith meant when he told the BBC “you need a dose of Keynesianism to restore monetarism”. Austerity meant the economy was starved of demand when inflation was low. The answer is for governments to spend. But Mr Duncan Smith was not talking about the state intervening on the side of labour, redistributing wealth or socialising investment. Instead, the right now proposes a Keynesianism without Keynes.