Get the Guru View: Is the new launch market heating up?

A crowd of potential buyers at the Park Place Residences showflat. (Photo: Lendlease)

Photos of thronging showflats and news of sell-out projects suggest that the new launch

market is escaping the doldrums.

By Chang Hui Chew

After a relatively long period of lacklustre performance, the new launch private condo market looks like it is finally on the rebound.

Earlier this month, the Urban Redevelopment Authority (URA) reported that developer sales for April 2017 doubled from the same period a year earlier. Month-on-month however, sales volumes fell by more than 12 percent.

Brisk sales in the month of April were attributed to the launch of Frasers Centrepoint’s Seaside Residences at Siglap Link, which saw massive crowds at the showflat prior to the ballot. According to URA’s developer sales figures for the month, the project sold 419 out of 560 units, at the median price of $1,736 psf.

The 99-year leasehold project saw keen interest due to the unique site, one of the last plots of land with sea frontage.

In the month of March, Australia headquartered Lendlease sold all 217 launched units in Phase One of their integrated Paya Lebar Quarter development for a median price of $1,805 psf. The launch was hotly anticipated by potential investors and buyers since the site was awarded in April 2015, as it is part of the Singapore government’s plans to revitalise the area as a regional centre.

The last time a new launch saw such soaring figures was CEL Development’s High Park Residences in July 2015, due to lower quantum prices, which appealed to Singaporeans whose affordability were curtailed by the Total Debt Servicing Ratio (TDSR).

Indeed, the first half of 2017 looks to be really promising for real estate developers. Figure 1 shows the volume caveats lodged for new sales of private non-landed properties and executive condos. For much of 2014 and 2015, figures were in the doldrums, chilled by the frigid winds of the state’s cooling measures.

However, sales of new homes began to recover towards the latter half of 2016, punctuated by spikes from sales in popular new launches like Queens Peak, The Alps Residences and Parc Riviera.

It’s all about the land

It’s a cliché because it is true – land is Singapore’s most valuable resource. For real estate developers, each square foot of land that they purchase is one that they can use to sell in the future to property buyers. Real estate developers are therefore highly dependent on the land that they purchased to become their future revenue stream.

However, when cooling measures such as the TDSR were introduced, causing transaction volumes to plummet, developers became more conservative when they bid for land.

When the state launched two adjacent Fernvale Road sites in June 2014, one plot received four bids while the other saw three. CEL was the top bidder for both sites, paying an average of $443 psf per plot ratio. They successfully launched High Park Residences on the site, selling out more

than a thousand units at a rapid pace.

This needs to be read in the context of the Singapore government’s land strategy. From 2013, the state started to taper the supply of land, in a future-looking move to increase the absorption of unsold units in the market. At the time, even though the supply of land, and hence future revenue, was gradually decreasing, real estate developers were more conservative with their bids.

However, with private property buyers looking to re-enter the market, real estate developers have begun to make their move.

A plot of land close to High Park Residences and the Thanggam LRT station was launched for sale by the URA in August 2016. It received 14 bids, with the parcel awarded to Sing Development for the top bid of $287 million, or about $517 psf per plot ratio.

Home seekers queueing up to view the show suites at Seaside Residences. (Photo: Frasers Centrepoint Singapore)

Heating up

Land bids have become more aggressive recently, with foreign developers expressing greater interest in Singapore’s real estate market.

A plot at Toh Tuck Road, close to the Beauty World MRT station, received a record 24 bids. The whopping top bid of $265 million, about $939 psf plot ratio, was made by Malaysian developer S P Setia. Industry experts are suggesting a breakeven price of more than $1,400 psf per plot ratio when the project launches.

Breakeven pricing is the estimate of how much a developer would need to charge per square foot when selling the project to cover the costs of land, development and construction. It does not factor in the expected profit margin.

Another Malaysian developer, IOI Group, through its subsidiary Wealthy Link, bid a record $2.57 billion for the white site at Central Boulevard, the highest bid on record for a white site. IOI Group’s offer was more than 16 percent higher than the second highest bid of $2.2 billion by Mapletree.

Initially placed on the Reserve List of the Government Land Sales (GLS) programme, a developer had to indicate to URA that it was willing to commit no less than $1.54 billion, before it was put up for open tender. Earlier news reports, which PropertyGuru has not been able to verify, suggested that the initial commitment was made by a mainland Chinese developer.

URA also announced that a joint venture between Hong Kong-listed Logan Property, and mainland Chinese firm Nanshan, had won the bid for a land parcel at Stirling Road for over $1 billion (or over $1050 per sq ft per plot ratio), setting a record for a residential land parcel. While aggressive, the bid was not entirely unexpected, given the large site area of 21,109.5 sq m.

Exploring en bloc opportunities

Land sales through the GLS are not the only way for real estate developers to increase their projects pipeline. The other is through the en bloc purchase of older projects for their land.

The recent successful en blocs of Shunfu Ville, near Marymount, and Raintree Gardens in Potong Pasir saw current owners cashing out at an average of $1.78 million and $1.9 million per household. The Raintree Gardens sale is especially encouraging, with more than five developers reportedly bidding for the site.

This has motivated the owners of older properties, such as Eunosville, to initiate the collective sales process in their own communities.

With the greater scarcity of GLS sites in prime locations and the city fringe, en bloc sales are a potential way for developers to launch new projects in these areas. Furthermore, a collective sale is likely the only option for those looking to build freehold properties, as all GLS sites are sold on a 99-year leasehold basis.

For many residents of current older projects however, the process can be arduous and expensive, with each household coughing up fees to the brokerage and if there are objections to the sale, fees for legal representation in the courts.

In general, we do observe a few commonalities when it comes to projects that have sold successfully. Sites that are within government planned growth areas for instance, provide greater impetus for future sales. The Raintree Gardens site, for instance, once redeveloped, will be able to capitalise on the Bidadari growth story.

Looking forward

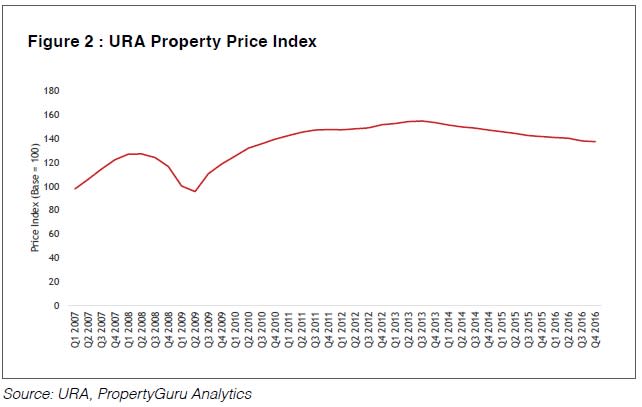

With new project sales on the rise, and competition for land heating up, home buyers looking to enter the market might need to consider their timeline for entry. While URA’s Private Property Price Index continues to fall less than a percent quarter-on-quarter (Figure 2), the downward movement is unlikely to persist in the medium to long term.

With the aggressive nature of land bids for GLS parcels and the cost of redevelopment for en bloc sites, developers will need to launch their new projects at commensurate prices. As such, it is unlikely that the current price climate for new launches will persist.

This article was first published in the print version PropertyGuru News & Views. Download PDFs of full print issues or read more stories now! | |||