Get the Guru View: Saving on toast today might not mean a home later

Global housing think tank Demographia has ranked Singapore’s housing market as “Seriously Unaffordable”.

Millennials, those born in the early 1980s and later, were recently criticised for not being more prudent in their habits. But in one of the most expensive housing markets in the world, can merely cutting back on hip brunches help one to buy a home?

By Chang Hui Chew

Millennials often get a bad reputation when it comes to certain bread and butter issues – buying homes, looking for jobs – and were recently characterised as the “avocado generation”. This refers to the ubiquitous café menu item, avocado toast, which is often charged at prices upwards of $12 at hip outlets.

The critique hence is that millennials are spending their hard-earned money on frivolous things like avocado toasts and expensive lattes, rather than saving up to own a home.

This often becomes wrapped up into a generic stereotype – millennials would rather pay for experiences than save up for their futures – for instance.

But is this mindset a result of structural circumstances or generational shift? In this edition of the Guru View, we take a deeper look at the numbers and try to get a sense of home buying for younger Singaporeans.

An issue of affordability

Millennials this writer has spoken to have suggested this mentality stems from the cost of housing in Singapore. It is far too high and as such, it is futile to try saving for it. To quote a friend who would rather remain anonymous – “It’s like trying to save for a trip to the moon”!

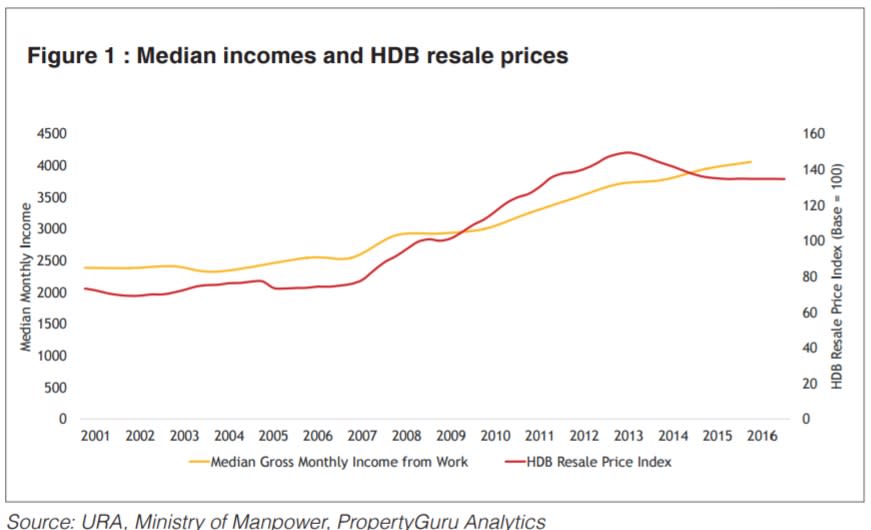

Figure 1 shows the growth in median monthly household income from full-time employment, compiled by Singstat, as well as the HDB Resale Price Index from HDB.

The median gross monthly income from work, from 2001 to 2006 has increased from $2,387 to $4,056 as of end 2016, an increase of 70 percent.

In contrast, HDB resale prices have increased 83 percent over the same period. Prior to the capping of the mortgage service ratio for HDB loans to 30 percent of income however, HDB resale prices had soared to over 104 percent of 2001’s figures.

It’s therefore quite clear that median incomes have not risen as rapidly as the cost of homes in Singapore, when it comes to the most ubiquitous form of housing – HDB flats.

The Housing Board however, has increased the quantum of grants available to subsidise the cost of housing and offset these increments. In February 2017, the government increased the CPF grant for resale flats from $30,000 to $50,000 for those buying 4-room or smaller resale flats. In conjunction with other subsidies, first-time applicants can apply for up to $110,000 in grants to offset their first home purchase.

Affordability in Singapore however, remains a pain point, despite the availability of grants.

Annually, the global housing think tank Demographia publishes their statistics on housing affordability across the world. Singapore’s housing market is ranked as “Seriously Unaffordable”, with a median multiple (i.e., median house pricing divided by gross annual median household income) of 4.8 in the latest 2016 report, which is a slight improvement from 5.0 in the previous year.

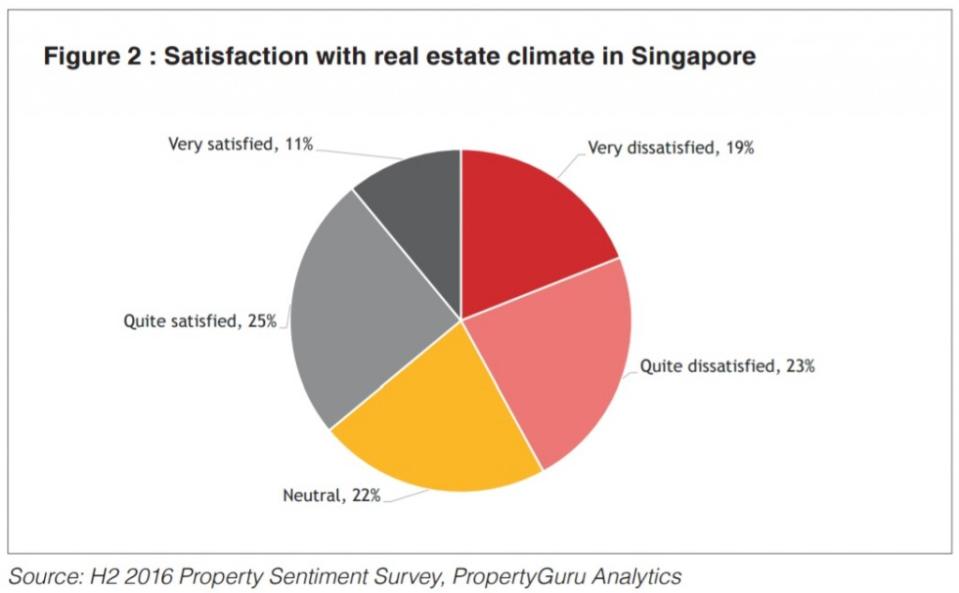

At the same time, PropertyGuru’s Property Sentiment Survey H2 2016 shows affordability sentiment to be at a score of 29 out of 100, due to a perception of high prices and general dissatisfaction with the real estate climate (refer to Figure 2). In the same survey, only 33 percent of respondents felt that the government was making a sufficient effort to make housing more affordable.

At the macro level

Despite this sense of housing unaffordability, the overall finances for Singaporean households remains healthy on the macro level.

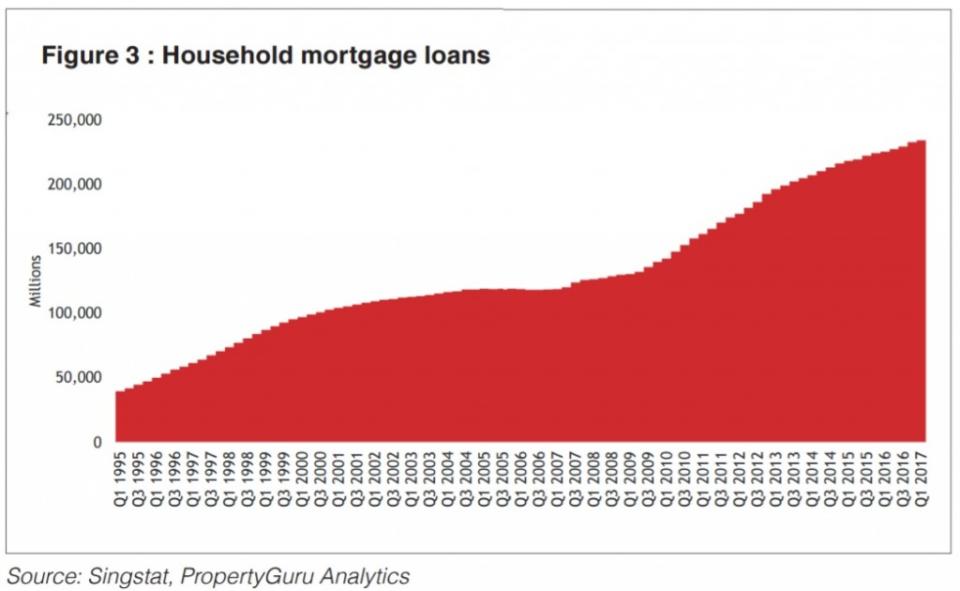

At first glance, mortgage loans held by Singaporean households have soared (Figure 3). Looking at data compiled from Singstat, liabilities on the household balance sheets stemming from mortgage loans, either from financial institutions like banks, or from the HDB, increased 126 percent between Q1 2001 to Q1 2017. It currently stands at $234.7 billion.

However, the household balance sheet remains relatively healthy, with the latest statistics indicating that total household liabilities, including mortgages and personal loans, stand at a very modest 15 or so percent of total assets. The reason for this is the vast deposits that Singaporean households have – $403 billion as at Q1 2017.

The overall healthy balance sheet however, is underpinned by assets more likely to be owned by older Singaporeans. In the first quarter of the year, Singstat reported figures showed that the net worth of residential property assets from both private and public housing stood at $867.6 billion. Meanwhile CPF monies were just under $338 billion, and life insurance at $159 billion.

While the balance sheet is currently quite healthy, these are assets that an older generation of Singaporeans have amassed over time.

With the current younger generation of Singaporeans putting off home purchases, the mix of assets on the household balance sheets is likely to change in the future.

Policies that favour marriage

For most young Singaporeans looking at purchasing a home, the most common property class is a HDB flat. Costs aside, there are specific conditions tied to ownership – marriage. For those who might be prioritising their careers and putting wedding bells on the backburner, saving for a home would likely be less of a priority, given that it is further off into the future.

Perhaps what we need to consider therefore, if we want to encourage younger people to enter the property ladder, is to liberalise homeownership.

If we could open public housing to singles below the age of 35, say with shoebox apartments or resale flats, younger Singaporeans could have a property class within their means and suitable for their circumstances. As a society, we have held homeownership as a yoke to get couples hitched, and it might be time to reconsider such a stance.

Is homeownership so important?

What we have not questioned hence, is the assumption that it is imperative to own a home. Is the asset more important than say, the experience of travelling to exotic locales or indulging one’s tastebuds?

That’s a question to be answered by the individual. However, what is clear to us is that without an immovable asset like property to grow one’s wealth, it would be rather hard for an individual, especially if he or she remains single, to have the wherewithal to retire comfortably in the future.

At the end of the day, perhaps Singapore is the victim of its own success. Our parents’ generation mostly own their own homes due to a public housing programme that is the envy of much of the world. For those of us who choose to live in the moment, we can do so because of the assurance of this legacy, be it adequate support from the state when we decide to enter the property ladder, or inheriting the assets that our parents will leave to us in the future.

This article was first published in the print version PropertyGuru News & Views. Download PDFs of full print issues or read more stories now! | |||