Here comes the best GDP report on record*: Morning Brief

Thursday, October 29, 2020

Get the Morning Brief sent directly to your inbox every Monday to Friday by 6:30 a.m. ET. Subscribe

Making sense of Thursday’s historic GDP data.

Later this morning, the Bureau of Economic Analysis will publish the first estimate of economic growth in the third quarter.

And the number will likely be historic.

A consensus forecast of Wall Street economists saw gross domestic product (GDP) expanding at an annualized rate of 32% in the third quarter, the fastest on record. The third quarter surge stands in contrast to the 31.4% annualized contraction we saw in the second quarter, which was also the most on record.

Yet compared to last year, total economic output in 2020 is still expected to fall by about 3.5%.

That we’re seeing back-to-back record swings in output this year, of course, makes total sense.

The economy was forced into a shutdown in late March through the month of April, in an effort to slow the spread of the coronavirus. Since May, all 50 states have taken steps to re-open the economy.

And while some regions are implementing new restrictions amid a resurgence in COVID-19 cases, through much of the third quarter — which covers July 1 through September 30 — the country remained on a re-opening trajectory.

After peaking in late July, COVID-19 cases across the country declined through the summer. The benefits of stimulus from the CARES Act have had a durable impact on household finances and consumer spending over the last few months, as we’ve covered extensively in The Morning Brief.

And so it isn’t that the economy “shrank” and then “grew” in the second and third quarters — but that the economy was forced to close, then allowed to open anew. Against this backdrop, then, this morning’s data release isn’t anything new. Or at least not groundbreaking.

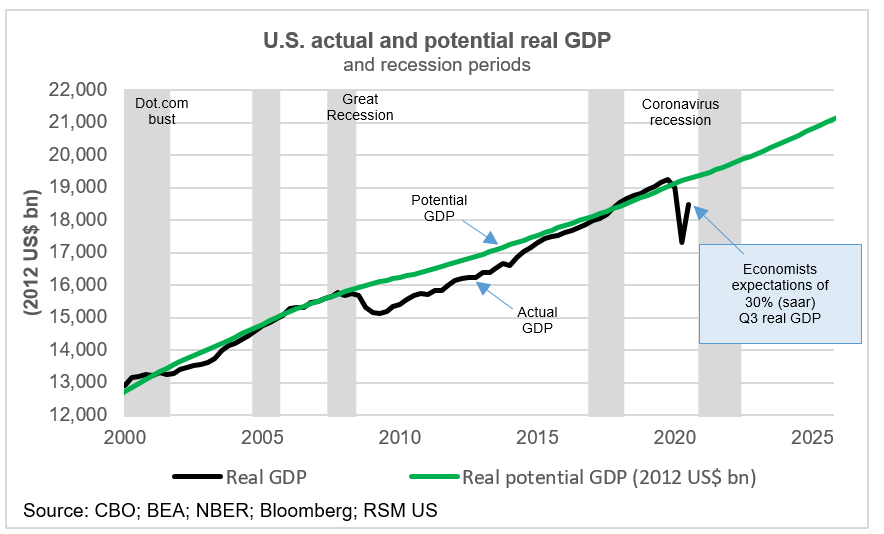

And the fact remains that growth is still far below potential.

“It is not just the size of the rebound that should be of paramount interest,” said Joe Brusuelas, chief economist at RSM. “Rather, policymakers should focus on the size of the economic gap that has left small firms, and the poor and working class, struggling to keep up.”

“Even with a record rebound in GDP, it will take at least another two years before policymakers can start talking about economic growth nearing its potential,” the economist said. “And that prospect assumes that there is substantial policy aid, in contrast with the current impasse, which will almost surely define the remainder of the year.”

Last month, The Morning Brief covered the cuts that Wall Street economists have been making to their fourth quarter growth forecasts. These experts cited the lack of additional stimulus as a drag on growth, as the economic situation around the globe grows more uncertain. Economists don’t expect the economy to return to pre-COVID trends until at least the middle of next year.

And so financial markets have long been looking past this kind of economic data. But Thursday’s report comes at a pivotal time for the country.

The presidential election is just five days away. Daily COVID-19 positives are at record highs. And stocks have hit a rough patch this week and on Wednesday declined by the most since June 11, as both worries shake investors.

And while record numbers of voters have already cast their ballots in this year’s election, Thursday’s report also serves as a kind of “closing argument” for President Donald Trump as he seeks to reinforce to voters his record on the economy — which was indeed doing well before the pandemic. Over the last few months, it has been more resilient than expected.

But just as the second quarter drop-off in activity was a managed outcome, so too will the third quarter snapback be the same.

It will only be with the benefit of hindsight, perhaps years down the road, that we can take the full measure of the pandemic’s economic impact.

By Myles Udland, reporter and co-anchor of The Final Round. Follow him at @MylesUdland

What to watch today

Economy

8:30 a.m. ET: Initial jobless claims, week ended Oct. 24 (783,000 expected, 787,000 during prior week)

8:30 a.m. ET: Continuing jobless claims, week ended Oct. 17 (7.700 million expected; 8.373 million during prior week)

8:30 a.m. ET: GDP Annualized quarter-over-quarter, 3Q advanced print (31.8% expected, -31.4% during 2Q)

8:30 a.m. ET: Personal Consumption, 3Q advanced print (38.7% expected, -33.2% during 2Q)

8:30 a.m. ET: GDP Price Index, 3Q advanced print (2.9% expected, -1.8% in 2Q)

8:30 a.m. ET: Core PCE quarter over quarter, 3Q advanced print (4.0% expected, -0.8% in 2Q)

10:00 a.m. ET: Pending Home Sales, September month-over-month (3.0% expected, 8.8% in August)

Earnings

Pre-market

6:00 a.m. ET: Dunkin’ Brands (DNKN) is expected to report adjusted earnings of 80 cents per share on revenue of $344.95 million

6:30 a.m. ET: Newmont Corp (NEM) is expected to report adjusted earnings of 84 cents per share on revenue of $3.23 billion

6:30 a.m. ET: Keurig Dr. Pepper (KDP) is expected to report adjusted earnings of 37 cents per share on revenue of $2.96 billion

6:45 a.m. ET: Tapestry (TPR) is expected to report adjusted earnings of 22 cents per share on revenue of $1.07 billion

7:00 a.m. ET: Yum! Brands (YUM) is expected to report adjusted earnings of 80 cents per share on revenue of $1.42 billion

7:00 a.m. ET: Shopify (SHOP) is expected to report adjusted earnings of 52 cents per share on revenue of $663.5 million

7:00 a.m. ET: ConocoPhillips (COP) is expected to report an adjusted loss of 32 cents per share on revenue of $4.68 billion

7:00 a.m. ET: Apollo Global Management (APO) is expected to report adjusted earnings of 49 cents per share on revenue of $482.90 million

7:00 a.m. ET: Molson Coors (TAP) is expected to report adjusted earnings of $1.00 per share on revenue of $2.66 billion

7:00 a.m. ET: Moody’s Corp. (MCO) is expected to report adjusted earnings of $2.10 per share on revenue of $1.25 billion

7:00 a.m. ET: Moderna (MRNA) is expected to report an adjusted loss of 39 cents per share on revenue of $80.59 million

7:00 a.m. ET: Comcast (CMCSA) is expected to report adjusted earnings of 51 cents per share on revenue of $24.73 billion

7:05 a.m. ET: Kraft Heinz (KHC) is expected to report adjusted earnings of 62 cents per share on revenue of $6.33 billion

7:30 a.m. ET: T Rowe Price (TROW) is expected to report adjusted earnings of $2.50 per share on revenue of $1.59 billion

8:00 a.m. ET: Kellogg (K) is expected to report adjusted earnings of 86 cents per share on revenue of $3.4 billion

8:00 a.m. ET: Overstock.com (OSTK) is expected to report an adjusted loss of 2 cents per share on revenue of $585.5 million

8:20 a.m. ET: PG&E Corp (PCG) is expected to report adjusted earnings of 26 cents per share on revenue of $4.81 billion

Post-market

4:00 p.m. ET: Twitter (TWTR) is expected to report adjusted earnings of 5 cents per share on revenue of $780.49 million

4:00 p.m. ET: WW International (WW) is expected to report adjusted earnings of 61 cents per share on revenue of $322.27 million

4:00 p.m. ET: Alphabet (GOOG, GOOGL) is expected to report adjusted earnings of $13.69 per share on revenue of $35.35 billion

4:05 p.m. ET: Shake Shack (SHAK) is expected to report an adjusted loss of 22 cents per share on revenue of $125.45 million

4:05 p.m. ET: Starbucks (SBUX) is expected to report adjusted earnings of 31 cents per share on revenue of $6.06 billion

4:05 p.m. ET: Facebook (FB) is expected to report adjusted earnings of $2.20 per share on revenue of $19.84 billion

4:05 p.m. ET: Activision Blizzard (ATVI) is expected to report adjusted earnings of 65 cents per share on revenue of $1.68 billion

4:10 p.m. ET: Amazon (AMZN) is expected to report adjusted earnings of $11.32 per share on revenue of $92.71 billion

4:15 p.m. ET: Cheesecake Factory (CAKE) is expected to report an adjusted loss of 39 cents per share on revenue of 489.33 million

4:15 p.m. ET: Mohawk Industries (MHK) is expected to report adjusted earnings of $2.10 per share on revenue of $2.49 billion

4:15 p.m. ET: MGM Resorts International (MGM) is expected to report an adjusted loss of $1.08 per share on revenue of $1.23 billion

4:15 p.m. ET: United States Steep Corp. (X) is expected to report an adjusted loss of $1.44 per share on revenue of $2.14 billion

4:30 p.m. ET: Apple (AAPL) is expected to report adjusted earnings of 70 cents per share on revenue of $63.48 billion

4:50 p.m. ET: Avis Budget Group (CAR) is expected to report adjusted earnings of 39 cents per share on revenue of $1.43 billion

Top News

European markets recover as governments struggle to contain COVID-19 [Yahoo Finance UK]

Apple 4Q earnings preview: All eyes on smartphone outlook after iPhone 12 debut [Yahoo Finance]

Walmart is leveraging its greatest competitive asset in the 'next era' of retail [Yahoo Finance]

LVMH and Tiffany agree on lower price for $16 billion takeover [Reuters]

Ford posts stronger-than-expected quarterly profit, forecasts full-year profit [Reuters]

YAHOO FINANCE HIGHLIGHTS

Facebook, Twitter, and Google need to answer for disinformation — not a fake anti-conservative bias

Here’s the largest US commercial real estate transaction post-COVID-19

Online holiday sales could hit a record $189 billion: Adobe Analytics

—

Follow Yahoo Finance on Twitter, Facebook, Instagram, Flipboard, SmartNews, LinkedIn, YouTube, and reddit.

Find live stock market quotes and the latest business and finance news

For tutorials and information on investing and trading stocks, check out Cashay