Here's Why You Should Buy ConocoPhillips Stock Right Now

ConocoPhillips COP stock appears to be a solid bet now, based on strong fundamentals and compelling business prospects. The company’s shares have popped 16.7% over the past three months.

Headquartered in Houston, TX, ConocoPhillips is primarily involved in the exploration and production of oil and natural gas. In terms of proved reserves and production, the company is one of the largest explorers and producers in the world. It has a strong presence across conventional and unconventional plays in 16 countries. ConocoPhillips’ low risk and cost-effective operations spread across North America, Asia, Australia and Europe. The upstream energy player has a solid foothold in Canada’s oil sand resources and has exposure to developments related to liquefied natural gas.

ConocoPhillips currently carries a Zacks Rank #2 (Buy), which implies that it is offering significant investment opportunities to investors.

Let's see what makes ConocoPhillips stock an attractive investment option at the moment.

Northbound Estimates

Earnings estimate revisions have the greatest impact on stock prices. Over the past two months, the Zacks Consensus Estimate for ConocoPhillips for the current quarter has improved 15.6%. During this time period, the stock has witnessed four upward revisions and one downward movement.

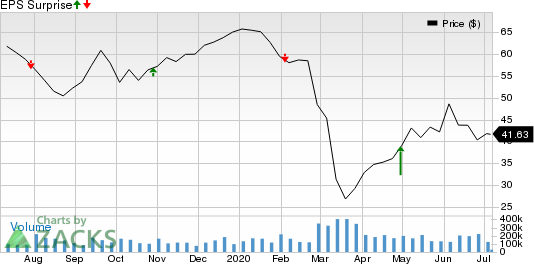

Positive Earnings Surprise History

ConocoPhillips outpaced the Zacks Consensus Estimate in two of the trailing four quarters. It delivered a four-quarter average positive earnings surprise of 27.6%.

ConocoPhillips Price and EPS Surprise

ConocoPhillips price-eps-surprise | ConocoPhillips Quote

Shale Footprint

The bulk of acres that ConocoPhillips holds in the three big unconventional plays — namely Eagle Ford, Delaware basin and Bakken shale plays — are rich in oil. The company has long-term plans to spend almost $4 billion per annum on the shale plays and operate around 20 rigs across four major fields. This is expected to ramp up production from the regions from more than 400,000 barrels a day to more than 900,000 barrels by the end of the next decade.

The three unconventional plays are expected to boost ConocoPhillips’ production in the long run. There are significant opportunities for the company in the Eagle Ford shale, wherein it owns 3,400 undrilled locations that could lend access to 2.3 billion barrels of oil equivalent estimated potential reserves.

Output Revival

ConocoPhillips is bringing back a portion of curtailed output in July. As crude prices have significantly improved in the last two months, the company is planning to start restoring output in Alaska and the Lower 48 area this month. Canada’s Surmont is also expected to witness a rise in production in the third quarter. The rise in production will boost the company’s bottom line.

Strong Balance Sheet

As of Mar 31, 2020, the company had $3,908 million in total cash and cash equivalents, and a long-term debt of $14,847 million. Its massive liquidity position will enable it to pay off short-term debt of only $113 million. Also, it has a debt to capitalization of 32%, lower than the industry average of 42%. As such, the balance sheet of ConocoPhillips is significantly less leveraged than the industry it belongs to. The company carries a high investment grade rating of A from Standard & Poor’s, which is quite encouraging.

Systematic & Strategic Plan of Action

It has an intention of slowing down the pace of 2020 stock buyback program. Starting from the second quarter, the program’s quarterly run rate has been lowered to $250 million from the prior figure of $750 million. With this move, ConocoPhillips believes that it will be able to save a total cash amount of $2.2 billion. This is even more crucial, given the current market uncertainty.

Other Stocks to Consider

Other top-ranked players in the energy space include NGL Energy Partners LP NGL, Antero Resources Corporation AR and Centennial Resource Development, Inc. CDEV, each holding a Zacks Rank #2. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

NGL Energy Partners’ bottom line for second-quarter 2020 is expected to rise 92.7% year over year.

Antero Resources’ bottom line for second-quarter 2020 is expected to rise 33.3% year over year.

Centennial Resource’s second-quarter earnings estimates have improved over the past 30 days, with three upward estimate revisions and no downward movement.

Zacks’ Single Best Pick to Double

From thousands of stocks, 5 Zacks experts each picked their favorite to gain +100% or more in months to come. From those 5, Zacks Director of Research, SherazMian hand-picks one to have the most explosive upside of all.

This young company’s gigantic growth was hidden by low-volume trading, then cut short by the coronavirus. But its digital products stand out in a region where the internet economy has tripled since 2015 and looks to triple again by 2025.

Its stock price is already starting to resume its upward arc. The sky’s the limit! And the earlier you get in, the greater your potential gain.

Click Here, See It Free >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

ConocoPhillips (COP) : Free Stock Analysis Report

NGL Energy Partners LP (NGL) : Free Stock Analysis Report

Antero Resources Corporation (AR) : Free Stock Analysis Report

CENTENNIAL RES (CDEV) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research