Home Depot (HD) to Post Q4 Earnings: What's in the Offing?

The Home Depot, Inc. HD is slated to report fourth-quarter fiscal 2019 results on Feb 25, before the opening bell. In the trailing four quarters, the company’s earnings outperformed the Zacks Consensus Estimate by 3.1%, on average.

The Zacks Consensus Estimate for fourth-quarter earnings has remained unchanged at $2.10 over the past 30 days. This suggests a decline of 6.7% from the year-ago period’s reported figure. Further, the consensus mark for revenues is pegged at $25,765 million, indicating a decrease of 2.7% from the figure reported in the year-ago quarter.

The Zacks Consensus Estimate for full-year earnings is pegged at $10.08 per share, suggesting growth of 1.9%. Further, the Zacks Consensus Estimate for revenues is currently pegged at $11,020 million.

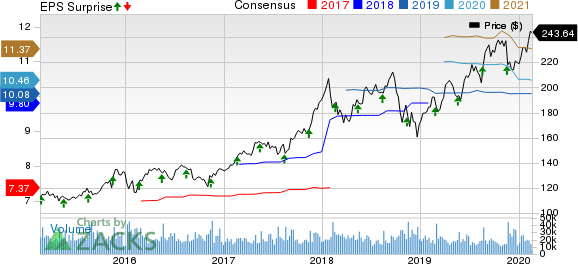

The Home Depot, Inc. Price, Consensus and EPS Surprise

The Home Depot, Inc. price-consensus-eps-surprise-chart | The Home Depot, Inc. Quote

Key Factors to Note

Home Depot has been witnessing soft sales trends owing to continued lumber price deflation. Further, an increase in supply-chain costs, mainly resulting from startup costs related to the company’s “One Home Depot” supply-chain initiative, is likely to have hurt its margin.

On the last earnings call, management stated sales growth of 1.8% for fiscal 2019 compared with an increase of 7.2% in fiscal 2018. The company anticipates comps (for the comparable 52-week period) growth of 3.5%, depicting a decline from 5.2% growth witnessed in fiscal 2018. This is also likely to get reflected in the performance of the quarter under review.

Nevertheless, the company has a robust earnings record backed by ongoing strategies including the integrated retail strategy and solid execution. Its efforts to connect offline and online channels as well as investments in front-end stores to optimize labor and merchandise space productivity have been aiding customer satisfaction scores and conversion rates in stores.

In addition, the company’s efforts to enhance the website and other applications along with investments in automated lockers are likely to have worked in its favor. Moreover, strength in the Pro business has been a key growth driver for Home Depot.

Management projected earnings per share of $10.03 for fiscal 2019, suggesting 3.1% growth from the year-ago reported figure.

What the Zacks Model Unveils

Our proven model does not predict an earnings beat for Home Depot this time around. The combination of a positive Earnings ESPand a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) increases the odds of an earnings beat. But that’s not the case here. You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

Home Depot carries a Zacks Rank #3 but has an Earnings ESP of -0.12%.

Stocks With Favorable Combinations

Here are some companies you may want to consider, as our model shows that these have the right combination of elements to post an earnings beat:

Burlington Stores BURL has an Earnings ESP of +0.20% and a Zacks Rank #2.You can see the complete list of today’s Zacks #1 Rank stocks here.

Ross Stores, Inc. ROST currently has an Earnings ESP of +0.09% and a Zacks Rank #2.

Dollar Tree, Inc. DLTR currently has an Earnings ESP of +1.00% and a Zacks Rank #3.

Biggest Tech Breakthrough in a Generation

Be among the early investors in the new type of device that experts say could impact society as much as the discovery of electricity. Current technology will soon be outdated and replaced by these new devices. In the process, it’s expected to create 22 million jobs and generate $12.3 trillion in activity.

A select few stocks could skyrocket the most as rollout accelerates for this new tech. Early investors could see gains similar to buying Microsoft in the 1990s. Zacks’ just-released special report reveals 8 stocks to watch. The report is only available for a limited time.

See 8 breakthrough stocks now>>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

The Home Depot, Inc. (HD) : Free Stock Analysis Report

Dollar Tree, Inc. (DLTR) : Free Stock Analysis Report

Ross Stores, Inc. (ROST) : Free Stock Analysis Report

Burlington Stores, Inc. (BURL) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research