Honeywell (HON) Q3 Earnings & Revenues Top Estimates, Down Y/Y

Honeywell International Inc. HON has reported better-than-expected third-quarter 2020 results, wherein both earnings and revenues surpassed estimates.

Earnings & Revenues

Adjusted earnings were $1.56 per share, surpassing the Zacks Consensus Estimate of $1.49. However, the bottom line declined 25% year over year on account of lower sales.

Honeywell’s third-quarter revenues were $7,797 million, beating the consensus estimate of $7,656 million. The top line recorded a decline of 14% year over year, both on reported and organic basis on account of weakness in end markets due to the coronavirus outbreak-led issues.

Segmental Breakup

Aerospace’s revenues were $2,662 million, down 24.9% year over year. Honeywell Building Technologies’ revenues declined 7.8% to $1,305 million. Performance Materials and Technologies’ revenues totaled $2,252 million, down 15.7%, while that for Safety and Productivity Solutions increased 8.3% to $1,578 million.

Costs/Margins

The company’s total cost of sales for the reported quarter was $5,383 million, down 10.8% year over year. Selling, general and administrative expenses declined 14.9% to $1,103 million. Interest expenses and other financial charges were $101 million compared with $96 million a year ago.

Operating income margin in the third quarter was 16.8%, down 250 basis points year over year.

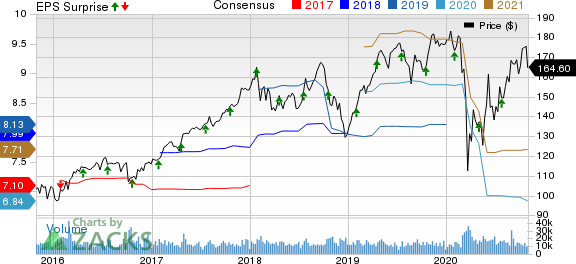

Honeywell International Inc. Price, Consensus and EPS Surprise

Honeywell International Inc. price-consensus-eps-surprise-chart | Honeywell International Inc. Quote

Balance Sheet/Cash Flow

Exiting the third quarter, Honeywell had cash and cash equivalents of $14,036 million compared with $9,067 million as of Dec 31, 2019. Long-term debt was $17,687 million, higher than $11,110 million recorded at the end of 2019.

During the first nine months of 2020, the company generated $3,426 million in cash from operating activities compared with $4,283 million in the year-ago period. Capital expenditure was $615 million compared with $504 million incurred a year ago.

Adjusted free cash flow in the quarter was $758 million, down 41.1% year over year.

Outlook

Honeywell provided guidance for fourth-quarter and full-year 2020. For fourth quarter of 2020, it anticipates adjusted earnings to be in the range of $1.97-$2.02 per share. It expects revenues to be between $8.2 billion and $8.5 billion, with organic revenues expected to be down 11-14% on a year-over-year basis.

For full-year 2020, the company anticipates adjusted earnings to be in the range of $7.00 to $7.05 per share. It anticipates revenues to be between $31.9 billion and $32.2 billion, with organic revenues expected to be down 12-13% on a year-over-year basis.

Zacks Rank & Stocks to Consider

The company currently carries a Zacks Rank #4 (Sell).

Some better-ranked stocks from the same space are Crane Company CR, Danaher Corporation DHR and ITT Inc. ITT. All these companies carry a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Crane delivered trailing-four quarter positive earnings surprise of 14.59%, on average.

Danaher delivered a positive earnings surprise of 17%, on average, in the trailing four quarters.

ITT delivered a positive earnings surprise of 20.46%, on average, in the trailing four quarters.

Have You Seen Zacks’ 2020 Election Stock Report?

The upcoming election could be a massive buying opportunity for savvy investors. Trillions of dollars will shift into new market sectors after the election. The question is, which sectors will soar for each candidate? Zacks has put together a new special report to help readers like you target big profits.

The 2020 Election Stock Report reveals specific stocks you’ll want to own immediately after the results are announced – 6 if Trump wins, 6 if Biden wins. Past election reports have led investors to gains of +71%, +83%, even +185% in the following months. This year’s picks could be even more lucrative.

Check out Zacks’ 2020 Election Stock Report >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Honeywell International Inc. (HON) : Free Stock Analysis Report

ITT Inc. (ITT) : Free Stock Analysis Report

Danaher Corporation (DHR) : Free Stock Analysis Report

Crane Company (CR) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research