HSBC to axe 35,000 jobs as profit slumps

HSBC (HSBA.L) on Monday announced a sweeping restructure alongside worse-than-expected annual results.

The Hong Kong-British lender said it would axe 35,000 jobs around the globe as it aims to cut annual costs by $4.5bn (£3.4bn) over the next two years.

“We would expect our headcount to decrease from the current level of 235,000 to be closer to 200,000 by 2022,” interim chief executive Noel Quinn told journalists on a call.

HSBC’s chief financial officer Ewen Stevenson said there would be “meaningful” job cuts in the UK but wouldn’t give a figure.

Quinn said HSBC would try to manage the cuts by not replacing staff who leave. He said the “natural attrition” of staff was around 25,000 each year and promised HSBC would manage layoffs in a “sensitive and appropriate manner”.

Read more: HSBC 'running hard to stand still' with restructure, say analysts

Restructure plans include shrinking HSBC’s European and US investment banking operations, merging its private banking, retail banking, and wealth management divisions, and merging back office functions.

The restructure will cost $7.2bn, with about 40% of that spent on severance costs. Quinn called the plan “one of the deepest restructuring and simplification programmes in our history.”

Profits crash

The new strategy — HSBC’s third significant shift of the last decade — was announced alongside worse-than-expected annual results.

Revenue rose by 4% in 2019 to $56bn, which was ahead of analysts expectations, but profit missed forecasts.

Pre-tax profit fell by a third to $13.3bn, against a City forecast of $20bn. Profit attributable to shareholders crashed by 53% to $6bn. Analysts had been expecting double that.

Return on tangible equity, a key measure of bank performance, slipped by 20 basis points to 8.4%. Analysts had forecast 8.9%.

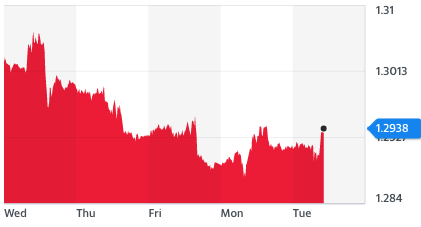

Shares in the bank dropped 4% at the open in London.

“The group’s 2019 performance was resilient, however parts of our business are not delivering acceptable returns,” Quinn said in a statement.

“We are therefore outlining a revised plan to increase returns for investors, create the capacity for future investment, and build a platform for sustainable growth. We have already begun to implement this plan, which my management team and I are committed to executing at pace.”

The profit slump was largely driven by a $7.3bn impairment charge. HSBC wrote down the value of its business in Europe due to “lower long-term economic growth rate assumptions” and wrote down the value of its investment bank due to plans to shrink it.

Read more: HSBC CEO leaving amid 4,000 job cuts

Chairman Mark Tucker blamed an “increasingly complex and challenging” global economy for the poor performance

All of HSBC’s core markets face challenges. Pro-democracy demonstrations pushed Hong Kong into recession last year, the UK’s exit from the EU has created more costs for the bank, and China’s economy has now come to a standstill in the face of the coronavirus outbreak.

However, Tucker said in a statement: “Even in this increasingly challenging competitive environment, there are many opportunities for a bank of HSBC’s scale and reach.

“We have made a good start in capturing these opportunities, but we need to go further and faster to capitalise fully on our heritage, network and financial strength. We are intent on driving through the necessary change at pace.”

HSBC aims to reach a return on tangible equity of 10-12% by 2022.

Read more: How Quinn promised to ‘remodel’ HSBC in October last year

The continued outbreak of coronavirus in Asia means things could get worse before they get better. Quinn said the epidemic could lead to increase losses in the region and lower revenue, as businesses pause activity.

“We continue to monitor the situation closely,” Quinn said.

However, he told journalists that “Asia as a whole is a core engine of growth over the next few years” and said HSBC would double down on operations there.

Quinn took the top job last August, after 30-year HSBC veteran John Flint was ousted as CEO. Quinn has not been confirmed as permanent chief executive and HSBC said the search for a full-time chief executive is “ongoing”.

However, Tucker said Quinn had “full authority to address areas of weakness, improve performance and create capacity to invest”.

Analysts at investment bank Jefferies said Quinn’s restructuring plan “looks ambitious and very credible.”