HSBC could start charging for current accounts as profits plunge

Millions of consumers could be charged for having current accounts after HSBC became the first major lender to admit that ultra-low interest rates might force it to change course on free banking.

Experts warned that any introduction of a monthly charge could prompt swathes of major rivals to follow suit in an industry-wide shift, piling on extra costs for ordinary consumers.

At least one other large bank is understood to be considering paid-for accounts as profits are crushed by the Bank of England's record low base rate of 0.1pc and policymakers mull a further cut into negative territory - meaning banks would be charged for hoarding cash instead of lending it out.

The change would potentially earn lenders billions of pounds a year but consumer groups warned it would spell disaster for savers.

HSBC said that it is looking at charging for basic banking services in some markets because it is losing money on a "large number" of customers. It is thought any change by British banks would be gradual, follow discussions with regulators and would initially be targeted at those with the largest deposits.

Chief executive Noel Quinn said: "What we've got to do as an institution is look at ways we can continue to grow our revenue in a low interest rate environment."

The comments prompted warnings from experts that banks are considering a major shift.

Lord Myners, a former director at the court of the Bank of England who served as City Minister under Gordon Brown, said HSBC's rivals are faced with the same pressures and are also likely to be looking at ways they could charge for basic banking services.

He said: "We're in for low interest rates for the long-term and therefore banks will have to adjust.

"All credit to HSBC for their honesty - banking is an oligopoly, there's very little originality."

The peer said he is "confident" discussions will be happening with regulators about how to recoup costs, adding that savers with large deposits are considered the most likely to face fees. He added that retail customers with smaller deposits could ultimately be spared.

Banks traditionally earn their money by lending out depositors' cash and pocketing a chunk of the interest as profit. This allows them to offer banking services for free.

However, the model has been wrecked by a decade of low interest rates which have crushed margins. The UK could now be forced to follow other markets such as the US, where fees are common and typically stand at around $14 (£11) a month according to American finance firm Money Rates.

In a previous report, consultants at PwC claimed that British banks could charge an average £10 a month by 2025. There are around 73 million UK current accounts, meaning this could in theory generate revenues of £8.8bn a year.

John Cronin, a banks analyst at Goodbody, said there will be a "significant effort to introduce the concept of banking fees into consumers’ mindsets" across the industry.

However, he suggested that fees are likely be reserved for accounts with large balances only as the change is introduced.

James Daley, the boss of consumer group Fairer Finance, warned that customers are unlikely to tolerate blanket fees.

He said: "[Banks] can try bringing in £1 a month and see if they can get away with it, but they'll undoubtedly lose a large proportion of customers if they do that."

Gareth Shaw, head of money at Which?, said: “It would be a huge and risky move for one of the major banks to start charging for an ordinary account.

"The danger for consumers is that if one of the big banks opens the door to charging fees, the others may follow suit - but competition for customers would hopefully dictate that there will be a range of attractive free accounts available for the foreseeable future."

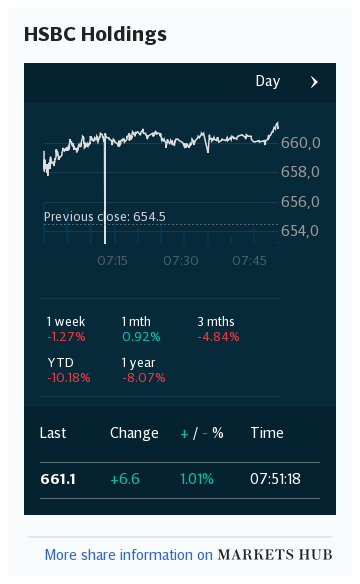

HSBC on Tuesday unveiled a 36pc slide in profits for the third quarter to $3.1bn (£2.3bn). Like most major lenders, it is counting the cost of coronavirus loans that may never be paid back, and labouring under tight margins with the threat of negative interest rates rising.

Earlier this month the Bank of England gave its clearest indication yet that it is considering turning rates negative amid fears of an economic meltdown as Covid cases mount.

Last week Virgin Money boss David Duffy told the Mail on Sunday that banks could begin charging for basic services if interest rates turn negative, estimating that the industry would make small changes over the next three to five years to test which services customers are willing to pay for.

A HSBC spokesman said the bank is "committed" to providing basic fee-free bank accounts. She added that it always keeps "under review the pricing for our standard current accounts and associated services".