HSBC Outlook Downgraded by Fitch on Coronavirus Concerns

HSBC Holdings plc’s HSBC outlook has been downgraded to negative from stable by Fitch Ratings, as the agency is of opinion that the U.K.'s GDP might fall in 2020 due to the impacts of the novel coronavirus outbreak. Also, long-term Issuer default Rating (IDR) has been maintained at 'A+'.

Per Fitch, HSBC’s ability to generate earnings, sound credit quality, and strong capital and liquidity position kept it well-poised to deal with the coronavirus-led crisis.

“The Negative Outlook reflects our view that the economic and financial market fallout from the pandemic creates material downside risks to the main operating environments in which HSBC is active,” stated Fitch.

Also, as an impact of the Covid-19 outbreak, the company’s ability to achieve targets, asset quality, earnings and capital levels might be affected.

Ratings’ Rationale

The ratings agency has upgraded HSBC’s two banking subsidiaries’ — HSBC Bank plc and HSBC UK Bank plc — long-term IDRs and senior debt ratings to 'AA-' from 'A+'. However, the outlook has been revised down to negative.

Also, the subsidiaries’ Viability Ratings (VRs) have been affirmed by the agency to reflect its view that HSBC has sufficient scope to absorb deterioration of its financial strength. However, the two banks' asset quality, earnings and capital strength are likely to deteriorate.

Further, Fitch revised the outlook of The Hongkong and Shanghai Banking Corporation Limited's (HKSB) IDR to negative. The move reflects an increase in the bank’s challenges in revenue generation and maintaining asset-quality, as the operating environment continues to weaken across many of the APAC markets in which the bank operates.

Long-term IDR and deposit rating of HSBC Trinkaus & Burkhardt AG (HSBC Germany) have been upgraded to reflect Fitch’s view that resolution plans are likely to result in HSBC Germany's external senior creditors being protected, even if the overall company fails.

Further, tier 2 debt ratings of HSBC and HSBC Bank have been downgraded by one notch to reflect the change in baseline notching for loss-severity to two notches from HSBC's VR, which acts as the anchor rating for both entities' debt.

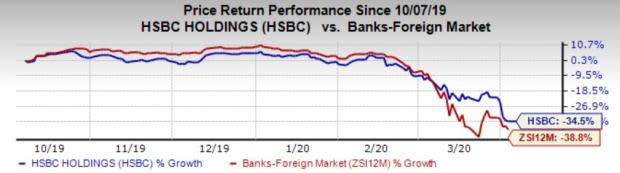

Shares of HSBC have lost 34.5% in the past six months compared with a 38.8% decline of the industry it belongs to.

Currently, the company carries a Zacks Rank #4 (Sell).

You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Notably, Fitch Ratings has downgraded ratings of several Canadian banks, including Canadian Imperial Bank of Commerce CM, Royal Bank of Canada RY and Bank of Montreal BMO, as the coronavirus outbreak has led to the disruption in economic activities and financial markets.

Breakout Biotech Stocks with Triple-Digit Profit Potential

The biotech sector is projected to surge beyond $775 billion by 2024 as scientists develop treatments for thousands of diseases. They’re also finding ways to edit the human genome to literally erase our vulnerability to these diseases.

Zacks has just released Century of Biology: 7 Biotech Stocks to Buy Right Now to help investors profit from 7 stocks poised for outperformance. Our recent biotech recommendations have produced gains of +50%, +83% and +164% in as little as 2 months. The stocks in this report could perform even better.

See these 7 breakthrough stocks now>>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Bank Of Montreal (BMO) : Free Stock Analysis Report

Canadian Imperial Bank of Commerce (CM) : Free Stock Analysis Report

Royal Bank Of Canada (RY) : Free Stock Analysis Report

HSBC Holdings plc (HSBC) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research