II-VI (IIVI) to Report Q4 Earnings: What's in the Offing?

II-VI Incorporated IIVI is slated to report fourth-quarter fiscal 2020 (ended June 2020) results on Aug 13, before market open.

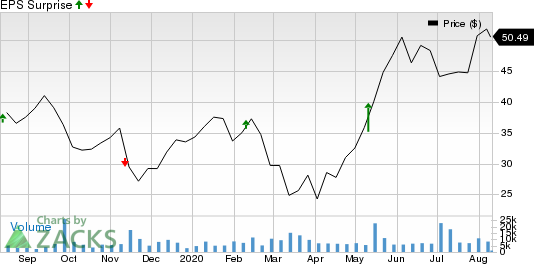

In the last four quarters, the company beat and missed estimates once each, while met estimates twice. Earnings surprise for the last four quarters was 52.08%, on average. In the fiscal third quarter (ended March 2020), II-VI reported adjusted earnings of 47 cents per share, which surpassed the Zacks Consensus Estimate of 15 cents by 213.33%.

In the past six months, the company’s shares have rallied 34.2% against the industry’s decline of 3.8%.

Factors at Play

II-VI is expected to have benefited from the growing demand for its products across key end markets combined with its market share gain in the fiscal fourth quarter. For instance, strength across datacom, telecom and wireless communications end markets, driven by solid demand for optical components, modules and subsystems along with 5G optical infrastructure buildout, is likely to have boosted the company’s top line in the quarter. Also, favorable trends across its life sciences, semiconductor capital equipment, and aerospace & defense end-markets, backed by growth in bookings, are likely to have supported its revenues in the to-be-reported quarter.

Also, the company’s acquisition of Finisar (September 2019), which has been complementing its compound semiconductors and photonic solutions platforms, and enhancing growth opportunities in the optical communications space, is likely to have supported fiscal fourth-quarter revenues. Moreover, II-VI is likely to have benefited from its solid backlog level in the fiscal fourth quarter, which stood at $893 million at the end of the previous quarter.

Moreover, its supply-chain initiatives and benefits from the focus on greater operational efficacy are likely to have boosted the company’s margins and profitability in the to-be-reported quarter. In addition, the effectiveness of its strong existing sales channels, particularly in the transceiver market is anticipated to get reflected in the to-be-reported quarter’s results.

However, high costs and expenses might have adversely impacted the company’s margin. Amid this backdrop, the Zacks Consensus Estimate for its fiscal fourth-quarter revenues is currently pegged at $711 million, indicating growth of 13.4% on a sequential basis.

Earnings Whispers

According to our quantitative model, a stock needs to have the combination of a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or at least 3 (Hold) to increase the odds of an earnings beat.

You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

But that is not the case here as we will see below.

Earnings ESP: II-VI has an Earnings ESP of 0.00% as both the Most Accurate Estimate and the Zacks Consensus Estimate is pegged at 76 cents.

IIVI Incorporated Price and EPS Surprise

IIVI Incorporated price-eps-surprise | IIVI Incorporated Quote

Zacks Rank: II-VI currently sports a Zacks Rank #1.

Key Picks

Here are some companies that you may want to consider as our model shows that these have the right combination of elements to post an earnings beat this quarter:

Deere Company DE has an Earnings ESP of +4.64% and it flaunts a Zacks Rank #1 at present. You can see the complete list of today’s Zacks #1 Rank stocks here.

ArcBest Corporation ARCB presently has a Zacks Rank #3 and an Earnings ESP of +3.07%.

Greif, Inc. GEF currently has a Zacks Rank #3 and an Earnings ESP of +3.41%.

Zacks’ Single Best Pick to Double

From thousands of stocks, 5 Zacks experts each picked their favorite to gain +100% or more in months to come. From those 5, Zacks Director of Research, Sheraz Mian hand-picks one to have the most explosive upside of all.

With users in 180 countries and soaring revenues, it’s set to thrive on remote working long after the pandemic ends. No wonder it recently offered a stunning $600 million stock buy-back plan.

The sky’s the limit for this emerging tech giant. And the earlier you get in, the greater your potential gain.

Click Here, See It Free >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Deere Company (DE) : Free Stock Analysis Report

Greif, Inc. (GEF) : Free Stock Analysis Report

IIVI Incorporated (IIVI) : Free Stock Analysis Report

ArcBest Corporation (ARCB) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research