Indian rupee hits record low

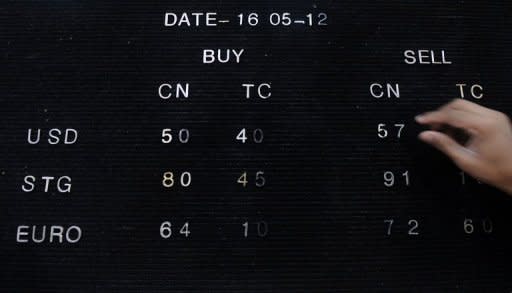

India's rupee hit a record low against the dollar Wednesday and stocks fell nearly two percent as uncertainty over the eurozone debt crisis and weak domestic indicators hit Asia's third-largest economy. The Indian unit fell to 54.52 rupees to the dollar, breaching its previous intraday lifetime low of 54.30 on December 15, and bringing its losses for the past 12 months against the US currency to over 20 percent. The rupee clawed back marginally from there, but still ended the day at a new closing low of 54.34, against its previous record closing low of 53.92 on Monday. Traders said they expected the rupee to fall further in coming days with risk aversion hitting global markets and sentiment souring over India because of its gaping fiscal deficit, slowing economy and political logjam. Finance Minister Pranab Mukherjee said the deteriorating international climate was the main reason for the falls and he sought to allay investors' worries about the domestic economic outlook. "The Indian growth story has not ended," he told parliament. "I have confidence in India's workers, farmers -- in its political system." The Indian central bank has sought to stem the rupee's fall and is thought to have intervened more than a dozen times by buying dollars this year. Last week, it announced new measures to support the local unit, ordering exporters and other foreign-exchange earners to convert half of their total foreign-exchange earnings kept in banks into rupees. But India's domestic woes are also hurting the currency, say analysts, who point to stubbornly high inflation, strained public finances and widening trade and current account deficits. Foreign investors have also been turned off the country of 1.2 billion people due to recent regulatory moves by the government, which has stalled on a pro-growth reform agenda aimed at opening up the economy. "The Indian government needs to stop the blame-game and take some measures to tackle the situation," said Abhishek Goenka, chief executive of India Forex, a consultancy firm. Investors across Asia have been dumping risk-sensitive assets on worries about the worsening political upheaval in Greece and buying up dollar holdings, perceived as safe havens in times of financial stress. Amid the turmoil, the benchmark Bombay Stock Exchange's Sensitive Index or Sensex ended the day down 1.83 percent at 16,030 points. "Global uncertainty is in the driver's seat," said Priyanka Kishore, forex strategist at Standard Chartered Bank. "There is a tangible risk of the rupee moving towards 55 rupee to the dollar levels," she told AFP. Yes Bank chief economist Shubhada Rao said the Indian currency was in "uncharted territory." The falling rupee is bad news for India's economy, pushing up import prices and aggravating inflation that is running at over seven percent, limiting the central bank's scope to roll back interest rate hikes and spur the economy. It will also further strain the government's budget because oil imports -- which are priced in dollars -- will become more expensive. Mukherjee already sees a fiscal deficit this financial year of 5.1 percent of gross domestic product (GDP) according to his latest budget. The government projects growth for this financial year at 7.6 percent, but many private economists see this as optimistic. "There will be obstructions, growth will move up, it will go down," Mukherjee said. "We will have to watch the (growth) compass for the next four or five year years -- not just one, two or three quarters.