What Can Investors Expect From A Potential Privatisation Of Hotel Properties

By Tay Hock Meng

Examining The Privatisation Potential Of HPL

Following the conclusion of the privatisation of Wheelock Properties Singapore (WPS) on 2 October 2018 at $2.10 per share, and the subsequent delisting of the entity on 18 October, all eyes are on Hotel Properties (HPL) where WPS owns a 40 percent equity stake in 68 Holdings, which in turn owns a 56 percent interest in HPL. Readers might recall in April 2014, local property magnate Ong Beng Seng, through his investment vehicle, 68 Holdings and WPS launched a $3.50 cash offer for HPL and the total investment value of the deal was worth $748.93 million.

Investment Objective For Acquiring HPL In 2014

One of the main investment objectives to acquire HPL in 2014 was the potential for both WPS and HPL to redevelop the neglected assets along the western end of Orchard Road (from Far East Shopping Centre to Tanglin Mall) into a mega-development.

However, times have changed, and recently, there has been a revival in commercial, en-bloc and government land sales (GLS) deals in the area. These deals include the ongoing bulk sale of 59 strata shop units located at Ming Arcade for a guide price of $51 million or approximately $4,470 psf. There was also a successful en-bloc sale of Park House to Hong-Kong listed Shun Tak Holdings for $375.5 million or $2,910 psf in June and a GLS sale of a Cuscaden Road site to a joint consortium comprising of SC Global, Far East Consortium, and New World Development for $410 million in April.

Revival Of Privatisation Hopes For HPL

In a 15 October 2018 research note published by OCBC Securities, the analyst noted in the 2014 offer document by WPS that there was a paragraph mentioning that, “A delisting will also provide the Offeror (WPS and 68 Holdings Pte Ltd) and the management of the company (HPL) more flexibility to manage the business of the company, optimise the use of its management and capital resources and facilitate the implementation of any operational change.” OCBC Securities has also elaborated further in a 2014 research report that the three key factors to look at redevelopment revival in west Orchard Road include 1) The quieter part of the shopping district with more dated assets; 2) The area not as well served by the MRT system currently, and 3) The untapped potential for prime retail given authorities’ plans.

HPL currently has three hotels in the Orchard Road area including the Hilton Hotel Singapore, Four Seasons Hotel, and Concorde Hotel Singapore. Its prime properties located in, and near the Orchard Road area include Tomlinson Heights, and the d’Leedon condominium which is a joint development with CapitaLand. The latter is sitting on the land formerly occupied by Farrer Court which was sold for $1.3388 billion in 2007.

With the recent property cooling measures implemented in early July 2018, along with the recent change in the Urban Redevelopment Authority (URA) planning guidelines on unit sizes for non-landed properties, HPL is largely negated from the headwinds brought in by these measures as its current property portfolio is largely based outside of Singapore, and the company has not participated in any local land bids or development for quite a while.

How Do I Value HPL Using DCF

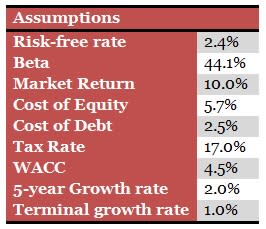

Unlike the revalued net asset value (RNAV) used in the 15 October OCBC Securities research note which had a fair value (FV) of $4.74 per share, my valuation per share using the discounted cash flow (DCF) method came up to be $1.81 per share, and my assumptions are as follows:

Source: Company, and my own estimates

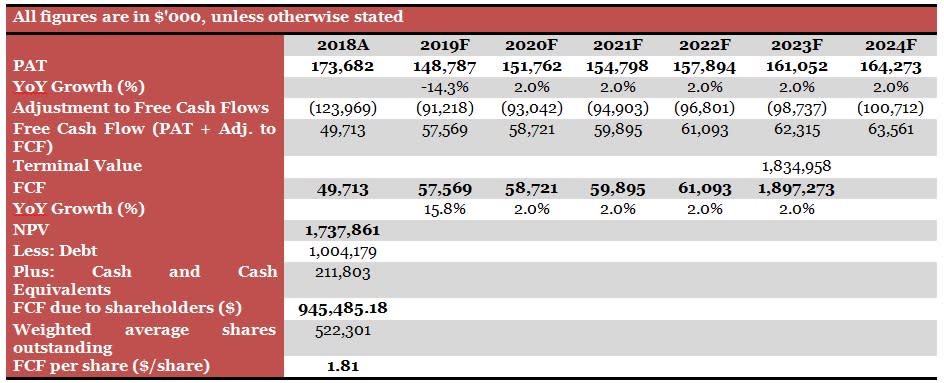

A snapshot of my DCF model is as follows:

Source: Company, and my own estimates

If we were to average both the OCBC FV of $4.74 per share, and my own DCF estimate per share of $1.81, the figure works out to be approximately $3.28 per share. This is not far from the price range of $3.70 and $3.90 over the last two weeks.

Should Investors Necessarily Jump On The News About HPL’s Potential Privatisation

We are not in the position to provide any specific recommendations. However, the company has previously disclosed about discussions over potential privatisation plans since 2014. This is coupled by the company’s relative valuation metrics where the stock price is now trading at a 12-month historical price-to-book (P/B) value of 0.936, along with a dividend yield of 1.05 percent, there may indeed be a case for privatisation. However, if one were to look from the discounted cash flow (DCF) valuation perspective, the model suggests that the stock price may be too frothy to take the company private. This is due to the risks that are tied to tighter financing requirements (interest rates), and a potential fall in mergers and acquisitions (M&A) deals if the current trade tensions with US and China worsen.

Related Article: