Japan: The land of rising opportunities

View of Tokyo, Japan.

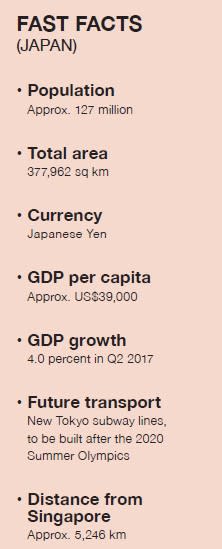

Strong capital appreciation, stable rental yields, a weakening yen, and the upcoming 2020 Olympics contribute to Japan’s buoyant housing market.

By Michelle Yee

According to reports, Japan’s property market has remained buoyant despite the global slowdown. A report by the Ministry of Land, Infrastructure, Transport and Tourism (MLIT) revealed that the country’s overall residential property

price index rose by 4.7 percent in January 2017 from the same period last year.

“In Tokyo, existing condominium units’ average prices rose by 3.1 percent during the year to end-Q1 2017,” said the Land Institute of Japan (LIJ).

A research report by CBRE, too, showed that total real estate transactions in Japan totalled ¥1.3 trillion (HK$90 billion) in Q1 2017, a 51 percent rise quarter-on-quarter and the highest first quarter since 2013.

Some of the factors attributed to growth in Japan’s property market include the upcoming 2020 Tokyo Olympics, as well as the introduction of Abenomics (Prime Minister Shinzo Abe’s own brand of economic stimulus). For instance, the quantitative easing introduced by Abe’s economic reforms deliberately marked the yen down, thus putting foreign investors in a very favourable position.

“Abenomics has clearly been positive for real estate investment, leading to better liquidity, deregulation in urban development and lower property taxes for investors. The message from the government is that Japan is very much open for business. Many foreign and local banks are also easing lending to foreign investors and opening more doors into Japanese property,” said Elizabeth Chu, Senior Investment Manager at property investment firm IP Global.

The strong demand from foreign investors is also driven by Japan’s relaxed rules on property and land ownership for foreigners. In fact, there are currently no laws or regulations in Japan that prohibit or control the purchase of Japanese real estate by foreigners.

Why buy properties in Japan?

A great investment

Sharing her thoughts on why Japan’s properties will make a great investment now, Mandy Wong, Head of International Residential Property Services at JLL Hong Kong said, “Thanks to the Bank of Japan’s negative interest rate policy coupled with the relatively weak yen, I believe that overseas investors will gain substantial returns in Japan’s real estate market.”

Foreigners can own freehold land

“The ability to own freehold property in any of Japan’s cities is appealing to foreign buyers, especially those living in Hong Kong, where for the price of a small flat there, you could buy a whole building in Japan,” shared Neo Cheung Wing-tat, CEO at Convoy International Property Consulting.

Author Christopher Dillon also points out in his book Landed Japan, which talks about buying property across international borders, that foreigners can own freehold land in Japan, which is not common in most other countries. In Hong Kong and Mainland China, most, if not all the land is on government leases, while in the Philippines and Thailand, foreigners can only own the property, but not the land that the building is sitting on.

Investors also do not need to pay extra fees or taxes when they buy a property in Japan. “This makes Japan an inviting and relatively safe place to invest,” Dillon said.

Affordable price tag

According to the Real Estate Economic Institute Co, Tokyo apartment prices have risen to their highest levels since the early 1990s, having advanced 11 percent over the past two years.

Yet for foreign buyers, Japan remains inexpensive. The average price of a three-bedroom apartment in Tokyo’s 23 wards and surrounding prefectures was ¥53 million (US$440,000) in April, compared with HK$8.4 million (about US$1 million) for a 600 sq ft apartment on Hong Kong Island, or US$554,000 for homes in New York.

“Global investors, including mainland and Hong Kong buyers, are attracted to Tokyo’s residential properties, which are relatively cheap compared to those in Singapore, New York and London,” Noritaka Noma, Head of Sales and Marketing Japan at Grosvenor Asia Pacific, was quoted as saying in a recent news report.

Japan set for more growth

Touted as Asia’s leading city, Tokyo has the world’s largest metropolitan economy – worth US$1.6 trillion – and is also the world’s largest metropolitan area, with a population that in 2014 reached 35.9 million – over four times the size of London or New York. While figures show that the population In Japan has begun to decline, central Tokyo is expected to continue attracting residents into the 2030’s, as more Japanese come to settle from rural areas outside the city.

And that’s not all. According to one of IP Global’s reports, the city is currently going through an infrastructure investment boom in the lead up to its hosting of the 2020 Olympics. “The Games themselves are forecast to directly inject some ¥3 trillion to the economy, but the associated regeneration and infrastructure investment will be even more beneficial, contributing up to ¥23 trillion to the metropolitan economy,” said the report.

The land of smart homes

Within the Asia-Pacific region, Japan, which is home to one of the densest populations in the world, was one of the first countries to embrace the idea of smart housing development to keep pace with mass urbanisation in the country.

In order to realise its smart nation ambitions, as well as to improve the lives of its citizens yet reduce energy consumption, Japan has been building smart homes around the country for a number of years now. But more than just building smart homes, Japan has gone one step further to developing smart cities within the country, one of them being Shioashiya smart city in Hyogo Prefecture, comprising 400 homes and an 83-unit condominium developed by PanaHome Corporation (a subsidiary of Panasonic Corporation).

Strategically located between the picturesque Mount Rokko and Osaka Bay, the houses within this smart city are kitted out with an array of smart technologies, including lithium-ion batteries that store solar power, a fuel cell in the backyard to generate electricity and heat for immediate consumption, and a smart home energy management system that displays on the television screen the household’s energy generation and consumption at any given time.

Residents who live there have shared that due to these smart technologies, their homes generate more power than it consumes. One of the residents Mayumi Hareguchi, who is a housewife, and lives in Shioashiya with her husband and son, shared in an interview that her smart home not only helps her family save ¥20,000 (S$230) in average monthly power bills, but they are also able to make about ¥15,000 (S$173) from selling excess energy generated every month.

Another surprising fact is that such “smart homes” are not a new trend in the country, in fact, there are already thousands of such smart homes dotted all over Japan.

What is a Smart Home Energy Management System (HEMS)?

HEMS not only allows homeowners to keep track of their consumption of electricity and gas, but it also allows them to control a slew of HEMS-compatible home appliances automatically including air conditioners, water heaters, lighting devices, and more. Due to its energy-saving properties, HEMS is an essential part of smart home technology.

INTERNATIONAL HIGHLIGHT

For investors looking to park some money in Japan and have a rather generous budget, here is one great option for you.

NEW PROJECTS

Tokyo World Gate

Toranomon, Minato, Tokyo

Type: Mixed-use development

Developer: Mori Trust

Facilities: Roof terrace, garden, gymnasium

Nearby Key Amenities:

Atago Shrine, Ark Hills, Tokyo Tower, Zojo-ji Temple

Nearest Transport: Kamiyacho station

Starting Price: TBA

Tokyo World Gate is centrally located in Tokyo’s Toranomon district. Developed by Mori Trust, this 38-storey skyscraper will comprise a hotel, condominium, offices and retail units once completed in 2020.

The 200-room hotel run by Marriott International will occupy the 31st to 36th floors, while the residential component will be on the 37th and 38th floors. The lower floors will house the offices and retail units.

Interested buyers should act fast as there will only be 12 residences from 150 to 400 sq m.

Among them, one will feature a duplex-style apartment with ceiling heights of up to six metres.

This article was first published in the print version PropertyGuru News & Views. Download PDFs of full print issues or read more stories now! | |||