Japanese Yen to Hold Range Ahead of BoJ- Will Kuroda Deliver?

Japanese Yen to Hold Range Ahead of BoJ- Will Kuroda Deliver?

Fundamental Forecast for Japanese Yen: Bearish

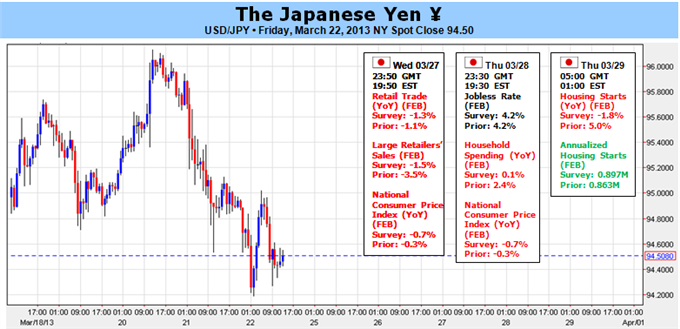

The Japanese Yen continued to consolidate against its U.S. counterpart, but the range—bound price action in the USDJPY may be short lived as Haruhiko Kuroda takes the helm of the Bank of Japan (BoJ). As the economic docket for the following week is expected to show a further slowdown in price growth, a weakening outlook for inflation may fuel speculation for more monetary easing, and the central bank may look to expand the balance sheet further at the next interest rate announcement on April 4.

Indeed, Mr. Kuroda pledged to ‘do everything we can to get the economy out of deflation’ during his first press conference as the BoJ governor and remained confident that the central bank will be able to achieve the 2% target for inflation as the new central bank head looks to broaden its asset purchases, with could include Real Estate Investment Trusts (REIT). As the new government pushes the central bank to further expand the monetary base, prospects for negative real interest rates (real interest rate = nominal interest rates – inflation) in Japan should continue to limit the appeal of the Yen, but Governor Kuroda may struggle to achieve the price growth target amid the underlying weakness in the real economy.

New to FX? Register for this free 20 minute course HERE and learn common FX terms like leverage and how to implement conservative amounts.

Former BoJ Governor Masaaki Shirakawa argued that ‘it’s necessary for a wide range of institutions to make efforts to boost competitiveness and growth potential’ as Prime Minister Shinzo Abe looks to obtain a greater influence over monetary policy, and warned threatening the central bank’s independence may dampen trust in the low-yielding currency while hosting his final press conference as the central bank head. At the same time, former European Central Bank (ECB) President Jean-Claude Trichet said that the ‘demographics are a big problem’ after encouraging the region to implement ‘structural reforms,’ and went onto say that the central bank should not carry ‘too much responsibility’ as there remains limits to what monetary policy can achieve. Despite expectations of seeing a major development at the April 3-4 meeting, we may see the new central bank head stick to the sidelines until the his second rate announcement on April 26, which could serve as the fundamental catalyst to spark a more meaningful reversal in the USDJPY.

As market participants weigh the outlook for monetary policy, the USDJPY looks poised to preserve the range from 94.00-96.50, but favor buying dips in the exchange rate as the broader trend remains tilted to the upside. At the same time, a look at the relative strength index shows support around the 49 region, and we will keep a close eye on the oscillator as the pair tracks sideways. - DS

DailyFX provides forex news and technical analysis on the trends that influence the global currency markets.

Learn forex trading with a free practice account and trading charts from FXCM.