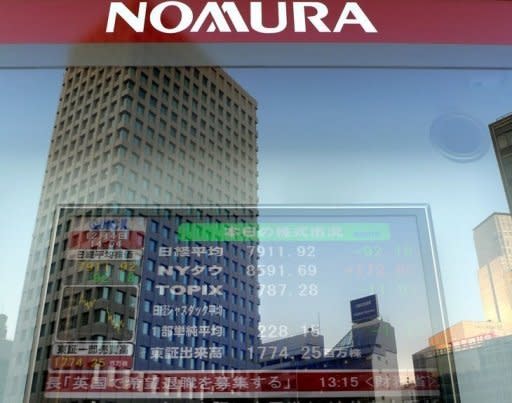

Japan's Nomura to cut executive pay over leaks

Top Japanese brokerage Nomura Holdings said Friday that it would temporarily cut its most senior executives' pay by as much as half in the wake of an embarrassing insider trading scandal at the firm. Nomura announced the penalties at a hastily convened press briefing at its Tokyo headquarters where it also released the findings of a damning report into the leaking of material information by some of its employees. The report said Japan's biggest brokerage was overrun with "serious systemic defects that would erode confidence in (Nomura) as a securities company". Two compliance and institutional equity sales executives would resign, while Nomura also said it would suspend operations at its institutional sales department for three to five business days as it reviews its operations amid the spiralling crisis. Nomura's top executives would take temporary pay cuts of between 10 and 50 percent, with Chief Executive Kenichi Watanabe's compensation to be chopped in half for six months, the company said. Nomura paid Watanabe about 128 million yen ($1.6 million) in its latest fiscal year, according to a company filing. "We sincerely apologise for causing a loss of confidence in this country's securities markets and we deeply regret the inconvenience we have caused all those affected," it said in a statement. Watanabe, who said he would not resign, told reporters that "after reviewing the investigation reports, we acknowledge internal problems". The report by a group of outside lawyers that Nomura hired to investigate its practices catalogued a culture that turned a blind eye to insider trading, which is illegal in Japan but usually carries token fines. Sales staff tipped off clients about share sales and information often flowed freely between sales and Nomura's investment banking and research side, usually barred through a so-called Chinese Wall, the report said. There was little or no training for younger employees about their ethical responsibilities, and "some instances of excessive entertainment of particular clients were found to be contrary to business ethics", it added. Although it usually draws huge fines and jail time in the West, insider trading is largely tolerated in Japan with recent fines coming in at around just $1,500, while criminal convictions are few and far between. But there has been renewed pressure to crack down on lax regulations and legal loopholes, which have dented Japan's corporate governance image. Local media reports about the impending pay cuts earlier Friday sent Nomura shares 3.88 percent higher at 294 yen in Tokyo. Japan's market regulators are probing a series of insider trading cases as they ramp up their investigation of the widespread practice. "Rigorous measures will be taken in line with the law," Financial Services Minister Tadahiro Matsushita told a news briefing Friday in response to questions about insider trading. On Thursday, Japan's top-selling Yomiuri Shimbun newspaper said Tokyo's bourse would search the offices of dozens of brokerage houses as part of a wider investigation. Earlier this month, Japan's market watchdog called for a New York firm to be slapped with a 14.7 million yen penalty for trading on confidential information about a $6.3 billion share sale by Tokyo Electric Power (TEPCO) in 2010. That was its first-ever action against a foreign company for insider trading. The probes by the Securities and Exchange Surveillance Commission have also focused on share sales reportedly underwritten by US-based investment bank JPMorgan.