Fat Finger Blamed for $41 Billion Plunge in Top Singapore Stock

By Abhishek Vishnoi, Sofia Horta e Costa and Livia Yap

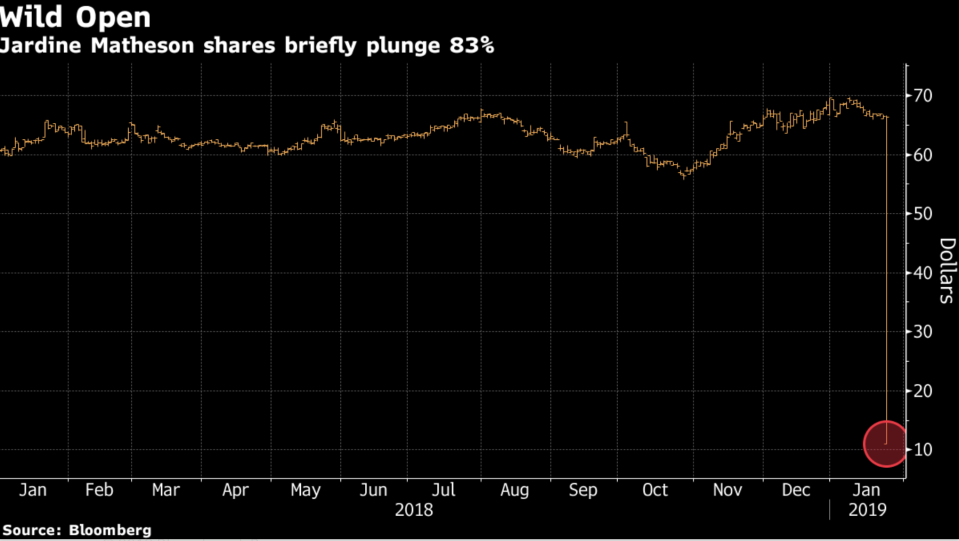

Jardine Matheson Holdings Ltd., the flagship investment firm of a 186-year-old conglomerate, plunged 83 percent before quickly recovering, with traders speculating that a fat finger error may have caused the dramatic drop.

The Singapore-listed stock sank in pre-market trading as about 167,500 shares changed hands at $10.99, compared with a Wednesday close of $66.47. It recovered all those losses and climbed 0.3 percent as of 1:48 p.m. Singapore. The price action suggested that the plunge could have been caused by human error, according to four traders.

“Looking at the price recovery, it looks like a fat finger at the moment until we have more updates,” said Marc Tan, a research analyst at KGI Securities Pte.

The group is aware of that an electronic trading error occurred and that “the exchange should have now stepped in to sort out the issues,” Jessie Tsui, a spokesperson for the conglomerate, said by e-mail. A spokesperson for Singapore Exchange Ltd. said the bourse is looking into the stock slide.

The Jardine Matheson group, founded in July 1832 in China and headed by the Keswick family, was one of the “hongs,” or trading houses that shaped the development of Hong Kong for more than a century. After moving its listing from Hong Kong to Singapore, the group has gradually shifted its business toward Southeast Asia. It also has investments elsewhere, including in Rothschild & Co.

The conglomerate’s units operate a wide range of businesses ranging from running Pizza Hut restaurants in Asia to supermarkets and Mercedes-Benz dealerships in the region. The group, also known as Jardines, generated more than $83 billion in revenue in 2017 and earned $1.57 billion in underlying profit, according to its website.

© 2019 Bloomberg L.P