JetBlue's (JBLU) Q4 Earnings Surpass Estimates, Increase Y/Y

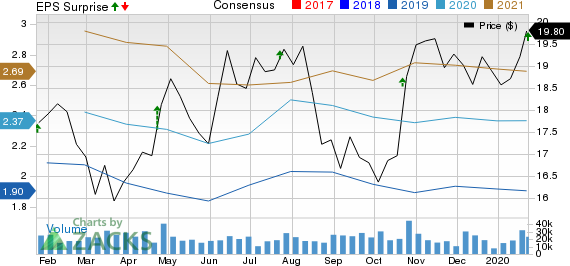

JetBlue Airways’ JBLU fourth-quarter 2019 earnings per share came in at 56 cents per share, which surpassed the Zacks Consensus Estimate by a penny. Moreover, quarterly earnings increased 12% on a year-over-year basis, mainly due to low fuel costs.

Operating revenues totaled $2,031 million, narrowly beating the Zacks Consensus Estimate. Moreover, it increased 3.2% from the year-ago number. Passenger revenues, which accounted for bulk of the top line (95.9%), improved 3% year over year in the quarter under review. Other revenues were also up 6.3%.

However, revenue per available seat mile (RASM: a key measure of unit revenues) in the reported quarter dipped 2.7% to 12.63 cents. Passenger revenue per available seat mile (PRASM) slid 2.8% to 12.12 cents. Average fare at JetBlue during the quarter inched up 1.3% to $185.96. Yield per passenger mile slipped 2.1% year over year to 14.79 cents.

Capacity, measured in available seat miles, expanded 6% year over year. Meanwhile, traffic, measured in revenue passenger miles, grew 5.2% in the final quarter of 2019. Consolidated load factor (percentage of seats filled by passengers) contracted 60 basis points year over year to 81.9% as traffic growth was outpaced by capacity expansion in the reported quarter.

In the fourth quarter, total operating expenses (on a reported basis) increased 3% year over year partly due to higher costs pertaining to salaries, wages and benefits. Average fuel cost per gallon (including fuel taxes) decreased 7.6% year over year to $2.07. JetBlue’s operating expenses per available seat mile (CASM) declined 2.9% to 11.22 cents. Excluding fuel, the metric was flat at 8.31 cents.

JetBlue, carrying a Zacks Rank #3 (Hold), exited 2019 with cash and cash equivalents of $929 million compared with $474 million at the end of 2018. Total debt at the end of 2019 was $2,334 million compared with $1, 670 million at 2018 end.

You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Outlook

For the first quarter of 2020, JetBlue expects RASM to either remain flat or increase up to 3% from the year-ago reported figure. For the same time frame, the carrier anticipates capacity to increase between 1.5% and 3.5%. The metric is projected to improve in the 5.5-7.5% range for 2020.

Consolidated operating cost per available seat mile excluding fuel is expected to increase between 1.5% and 3.5%in the first quarter. For 2020, the metric is expected to either remain flat or decrease up to 2%. The company expects effective tax rate of around 26% for the full year.

First-quarter fuel cost, net of hedges, is estimated to be $2.09 per gallon. The company expects first-quarter 2020 earnings between 10 cents and 20 cents. The Zacks Consensus Estimate for first-quarter 2020 earnings is currently pegged at 23 cents.JetBlueexpects 2020 earnings per share between $2.5 and $3. The Zacks Consensus Estimate for 2020 earnings is currently pegged at $2.37.

Total capital expenditures for the first quarter are expected between $325 million and $425 million. While the metric is forecast in the range of $1.35-$1.55 billion for the ongoing year.

Upcoming Releases

Investors interested in the Zacks Transportation sector are keenly awaiting fourth-quarter earnings reports from key players like United Parcel Service UPS, SkyWest SKYW and Old Dominion Freight Line ODFL. While UPS and SkyWest will report fourth-quarter earnings numbers on Jan 30, Old Dominion will release the same on Feb 6.

The Hottest Tech Mega-Trend of All

Last year, it generated $24 billion in global revenues. By 2020, it's predicted to blast through the roof to $77.6 billion. Famed investor Mark Cuban says it will produce "the world's first trillionaires," but that should still leave plenty of money for regular investors who make the right trades early.

See Zacks' 3 Best Stocks to Play This Trend >>

Click to get this free report SkyWest, Inc. (SKYW) : Free Stock Analysis Report JetBlue Airways Corporation (JBLU) : Free Stock Analysis Report Old Dominion Freight Line, Inc. (ODFL) : Free Stock Analysis Report United Parcel Service, Inc. (UPS) : Free Stock Analysis Report To read this article on Zacks.com click here. Zacks Investment Research