Jimmy Ng: 5 Key Takeaways That I Picked Up From Reviewing My Noble Trade

Noble Group’s (Noble) share price plunged 56 percent from its closing price of $1.295 on 9 May to a low of $0.57 on 15 May just within a short span of three trading days, before making a sharp recovery to a recent high at $0.74 on 18 May with 624.5 million shares changing hands. This was caused by market panic arising from Noble’s 1Q17 net loss of US$129.3m due to price dislocations in the coal markets. As one of the speculators participating in this frenzy, I would like to share five key takeaways that I learnt from reviewing my Noble trade.

11 May, Thursday, 5.30pm

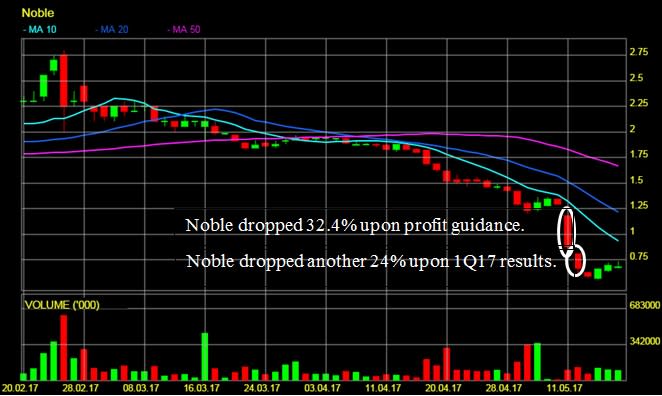

I first took notice of this counter when Noble’s share price tanked 32.4 percent on 11 May closing at $0.875. A quick search online revealed that this was due to a profit guidance issued by the company after market close in the previous trading day.

Source: Shares Investment

12 May, Friday, 5.30pm

Noble plunged an additional 24 percent to close at $0.665 after the group released its 1Q17 results confirming the net loss. Cumulatively, Noble’s share price has already dropped 48.6 percent from two days ago before the announcement. Now, that got me excited. As close to half of its market value had dissipated, my gut feel was that there could be a situation of Noble’s shares being oversold due to overwhelming fear, which presents an opportunity to long the stock for the short-term.

15 May, Monday, 9.30am

Noble opened at $0.625 and went to a low of $0.585 within the first half hour of trading, before rebounding back to its opening price at $0.625. The day’s low marked another 12 percent drop from yesterday’s close. I guessed the timing to go long has arrived. But because volume at the second peak is not as high as the first peak, I figured that buying interest may not be that high now and decided not to give chase. Therefore, I entered a limit order to buy at $0.605, slightly higher than the psychological support at $0.60. In the worst-case scenario, I will just miss the boat but there will always be a next boat coming.

Takeaway (1): Don’t chase the market, wait for the market to come to you.

Nevertheless, my order was filled at 11.05am when the share price corrected down to $0.595. As Noble dropped from $1.295 to a low of $0.585 losing $0.71 within three days, I estimated that if there could be a rebound to recover just 20 percent of the losses, Noble could probably jump back up to around $0.725, easily rewarding me with handsome contra gains for a few minutes of work.

Takeaway (2): Keep your greed in check

15 May, Monday, 5.30pm

A quick check on the market showed that Noble closed at $0.59 today. This was not what I had expected but I guess a small paper loss is probably something which I can stomach.

16 May, Tuesday, 12.00pm

Noble opened at $0.57, went to a high of $0.64 in the morning session before correcting back down to $0.63. Now I am getting hesitant. Mr. Market is offering me a chance to exit my position at breakeven after taking into account commission charges, shall I take it? No lah. What’s the point of entering and exiting a position at break-even without any gain or loss? I decided to bite my teeth and hang on to my position.

Takeaway (3): Trade don’t scared, scared don’t trade

16 May, Tuesday, 5.30pm

To my pleasant surprise, Noble closed today at $0.66 rising 11.9 percent. Not only that, technically, Noble’s chart is showing a strong bullish reversal pattern implying further upside tomorrow barring unforeseen circumstances. Yeah! Guess I’m in luck after all. Unfortunately, I am unable to exit my position as market is already closed. When there’s nothing you can do, pray! Oh my Goodness, please pray that tonight’s Dow Jones will close 400 points up.

Source: Shares Investment

17 May, Wednesday, 10.00am

Noble opened lower at $0.645 today much to my dismay, and fluctuated within a narrow range between $0.64 and $0.65 within the first one hour of trading as the bulls and bears were fighting it out. I became worried, as the Straits Times Index has plunged 1.1 percent the previous day and there were growing political uncertainties in the US. I simply cannot let a supposedly winning trade becoming a losing one. After all, it is always better to not win any money than to lose some money right? Therefore, I entered a stop loss order to exit at $0.63 and lowered my take profit target to $0.675. The position was ultimately closed when my stop-loss order was triggered at around 10.54am. To my disgust, Noble actually hit my stop-loss but went back up passing my take profit level at the later part of the day to close at $0.695. Damn! On hindsight, seems like my fear of loss had gotten the better of me after all.

Takeaway (4): Market don’t move in a straight line

Takeaway (5): $5 of profit, and 3 days of stress

Trading is not a game for everybody, and definitely not for the faint-hearted. Even though the position is now closed, I could still vividly feel the stress and anxiety which I am going through watching the prices go up and down. Perhaps that mug of beer is still needed after all, not for celebration but to calm my uptight nerves these few days.