Jones Lang LaSalle (JLL) Q2 Earnings Miss on Coronavirus Crisis

Jones Lang LaSalle Inc. JLL — popularly known as JLL — reported second-quarter 2020 adjusted earnings of 71 cents per share, missing the Zacks Consensus Estimate of 77 cents. The bottom-line figure also compares unfavorably with the year-ago quarter adjusted earnings of $2.94 per share.

The quarterly results reflect the adverse impact of the coronavirus pandemic on the company’s top line, with transaction-based service lines being hit hard due to delays in leasing and capital market transactions. However, the property & facility management business, led by Corporate Solutions, provided support.

Revenues for the second quarter came in at $3.67 billion, marking a 14% decline year over year. However, the reported figure surpassed the Zacks Consensus Estimate of $3.59 billion. Fee revenues were down 24% year over year to $1.2 billion.

Moreover, adjusted EBITDA margin, calculated on a fee-revenue basis, was 8.3% compared with the prior-year quarter’s 13.9%. The contraction reflects decline in fee revenues, particularly within transaction-based service lines. This was, nonetheless, partly mitigated by the cost-reduction measures and government relief programs.

Behind the Headline Numbers

During the June-end quarter, JLL’s Real Estate Services (RES) revenues slipped 14% year over year to $3.57 billion. Notably, RES revenues declined across all three geographic segments and in all service lines except Property & Facility Management that was supported by Corporate Solutions.

In the Americas, revenues and fee revenues came in at $2.2 billion and $683.1 million, respectively, reflecting 10% and 21% year-over-year decline. Notably, the Americas transaction-based service lines were affected by the pandemic. Also, soft investment sales and debt placement activity hurt Capital Markets revenues, though it included incremental revenue contributions from HFF. However, new client wins, Corporate Solutions client expansions and pandemic-response facility management projects helped Property & Facility Management register significant fee revenue growth.

Revenues and fee revenues of the EMEA segment came in at $626.2 million and $268.0 million, down 23% and 29%, respectively, from the year-ago period, with pandemic-related mandatory country lockdowns affecting performance. Transaction-based revenues were substantially lower, particularly in the U.K. and France.

For the Asia-Pacific segment, revenues and fee revenues came in at $715.3 million and $198.8 million, respectively, marking a year-over-year fall of 16% and 24%. Transaction-based revenues bore the brunt and in particular, office leasing revenues were substantially lower, most notably in India, Australia and Greater China. Pause on deal activity, especially large transactions, affected Capital Markets revenues. Nevertheless, new client wins and expansion of existing mandates for Corporate Solutions boosted Property & Facility Management fee revenues.

Revenues in the LaSalle segment decreased 23% year over year to $99.9 million. Solid advisory fees indicated strong private equity capital raising over the trailing 12 months, though it was offset by recent valuation declines in assets under management. However, an overall decline in revenues chiefly reflects lower incentive fees.

At the end of second-quarter 2020, assets under management were $65 billion, down 6% from the last quarter end.

Liquidity

JLL exited the second quarter with cash and cash equivalents of $413.5 million, down from $451.9 million as of Dec 31, 2019. Moreover, as of Jun 30, 2020, the company’s net debt amounted to $1.1 billion, marking a decline of $450 million from March end and reflecting the operating cash flow drivers.

JLL currently carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

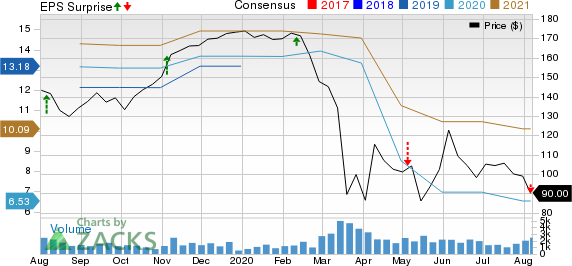

Jones Lang LaSalle Incorporated Price, Consensus and EPS Surprise

Jones Lang LaSalle Incorporated price-consensus-eps-surprise-chart | Jones Lang LaSalle Incorporated Quote

We, now, look forward to the earnings releases of other companies in the broader real estate sector like Simon Property Group, Inc. SPG, Taubman Centers, Inc. TCO and The Macerich Company MAC, all of which are scheduled to release quarterly numbers next week.

Just Released: Zacks’ 7 Best Stocks for Today

Experts extracted 7 stocks from the list of 220 Zacks Rank #1 Strong Buys that has beaten the market more than 2X over with a stunning average gain of +24.3% per year.

These 7 were selected because of their superior potential for immediate breakout.

See these time-sensitive tickers now >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Jones Lang LaSalle Incorporated (JLL) : Free Stock Analysis Report

Macerich Company The (MAC) : Free Stock Analysis Report

Taubman Centers, Inc. (TCO) : Free Stock Analysis Report

Simon Property Group, Inc. (SPG) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research