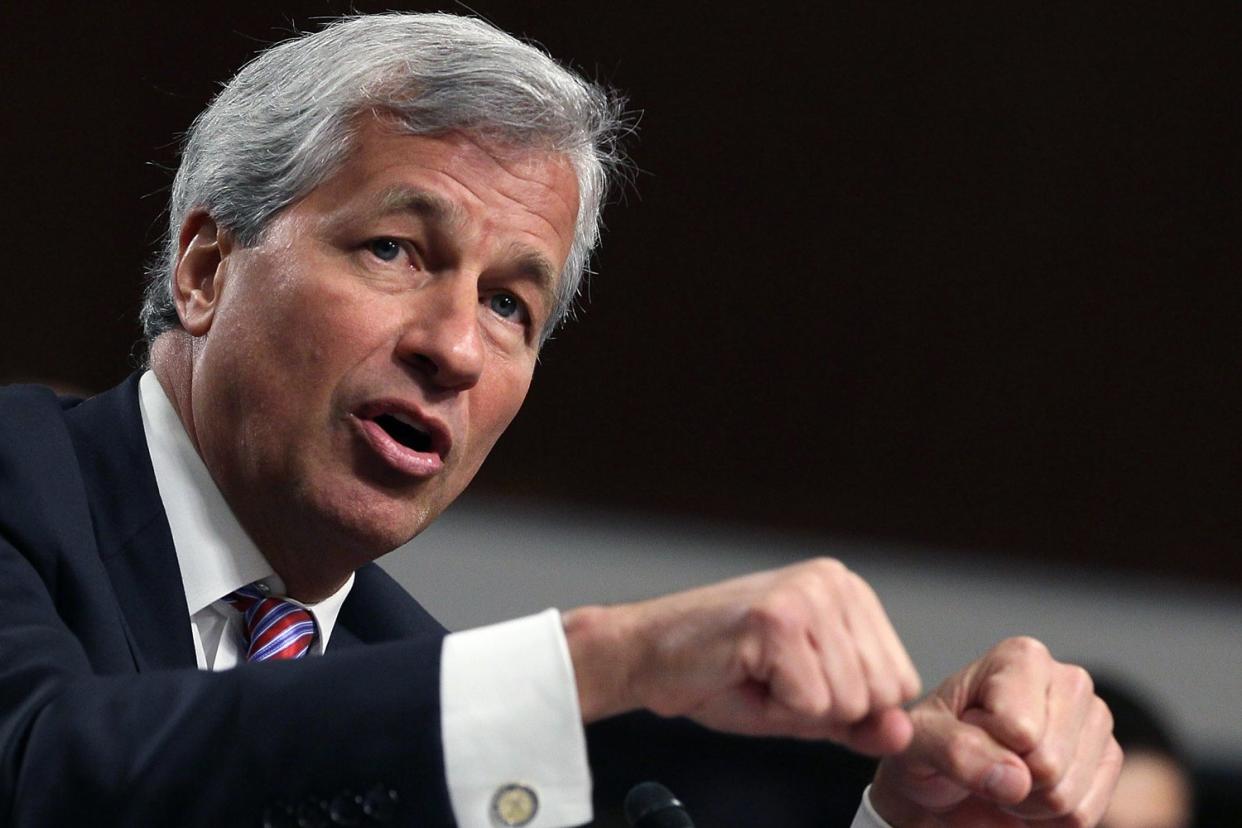

Comment: JPMorgan will find UK retail banking rules make it hard to challenge the Big Four

JPMorgan’s launch into UK retail banking can only be good news for consumers. The biggest bank in the world is already a leader on US High Streets and (London Whale rogue trader aside), has proved itself hugely competent since the financial crisis.

But, as other challenger banks have found, breaking into a market gripped by Britain’s Big Four is, well, challenging. Metro Bank and Revolut’s growing pains arguably reflect struggles building deposits rapidly. Virgin and Clydesdale were driven into each others’ arms to seek economies of scale. Other mergers will follow.

On top of the fight to compete with the big boys’ market clout, JP will face another hurdle, if Goldman Sachs’ new Marcus bank is anything to go by.

This is the “ringfence” regime.

After the financial crisis, big banks were forced to separate their UK retail arms from their international and investment banking operations.

The rules kick in when retail deposits reach £25 billion. That may sound a lot, but not when you consider Marcus is taking on

£1 billion of new deposits every month and is already at

£13 billion. Goldman does not want to enter UK mortgages or other cutthroat markets here. So, it has had to drop Marcus’s interest rates to put customers off.

JP may offer some UK loans, but will want to build up its deposits first, possibly to above £25 billion.

The cap is there for good reason — to prevent catastrophe in global banking markets from affecting the UK public. But if it is forcing well-funded challengers to be less competitive, regulators must have a rethink, and at least increase it.