'It was just unbelievably chaotic': Inside the brutal rivalry between Monzo and Starling Bank

They are two of Britain's most successful digital banking entrepreneurs, together amassing 6.5 million customers and attracting £747m in investment.

But the bitter personal and professional rivalry between Anne Boden, the boss of Starling Bank, and her former-protégé, Tom Blomfield, has threatened to overshadow their achievements.

In 2015, Blomfield led a walkout of key Starling executives just six months after joining the firm – a decision that risked the future of the fledgling bank. Months later, Blomfield's group launched rival digital bank Monzo.

Today, Monzo and Starling are fintech powerhouses, taking the fight to traditional high street banks with a new model of banking that takes place almost entirely on a smartphone.

Boden has, until now, stayed silent on Blomfield's abrupt departure.

That changed over the weekend when the Sunday Times published an explosive extract of Boden's tell-all memoir Banking On It: How I Disrupted an Industry, in which she accuses Blomfield of engineering a coup to steal key Starling employees.

'Reckless behaviour'

Boden, who was a senior executive at Allied Irish Bank before she founded Starling in 2014, claims that on his departure, Blomfield "gave few reasons other than that he could not work with my ‘reckless’ behaviour.”

However, insiders present during that period disagree with her depiction of events.

“It was just unbelievably chaotic,” says one source about that period.

Another claims Boden and Blomfield "were probably both difficult to work with for the other one by the end of it."

According to one source, the chief executive of one London technology start-up disagreed with the account so strongly that they purchased a copy of the newspaper in order to burn the page featuring the extract.

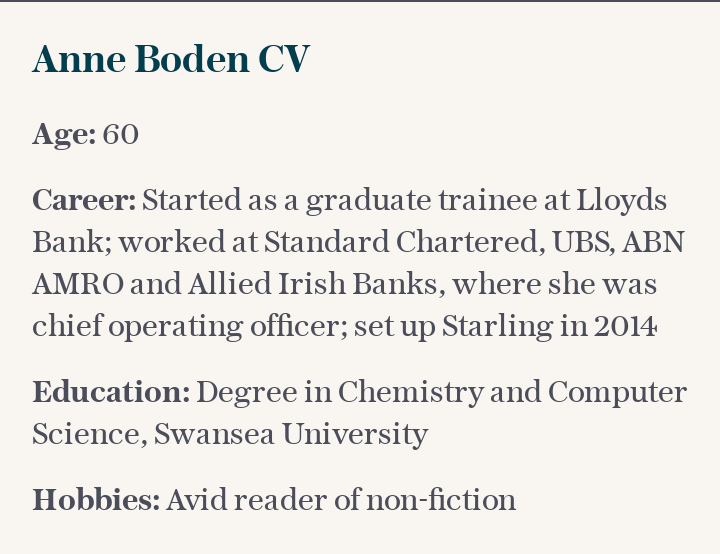

Boden, 60, is an industry veteran who worked at RBS, AIB, Lloyds Bank and UBS. Blomfield, 35, by contrast was a start-up founder who had co-founded direct debit business GoCardless, a promising early financial technology business.

Starling's chief executive had set her sights on remaking banking years before current giants like Revolut had formed the same plan.

This vision was clear to those who knew Boden at the time. "She's incredibly driven,” says one insider. “She is the Terminator. She will never, ever stop."

Her alliance with Blomfield should have led to a partnership which overthrew banking’s old guard and led to a golden age of hi-tech banking apps.

But according to Boden’s book, their relationship soured as they worked together. Blomfield - a bearded hipster 25 years her junior - was argumentative and disruptive.

“Certainly, we were having more regular disagreements,” she recalls. Insiders agree that arguments between the two become a major problem.

“They absolutely just did not get on after they started working together,” says one. “They started clashing and seemed to fight about a lot of things.”

The beginning of the end

Their disagreements reached fever pitch at the start of 2015.

The company had reached a deal with investment fund Passion Capital to raise millions of pounds in funding. But that deal fell through after Boden reached a separate agreement with a rival investment business in search of a higher valuation, according to one insider.

As January continued, the problems inside Starling became more serious. “She had rage-fired [Blomfield] about three times already,” an insider recalls. “He finally was fed up and quit."

In early February, investors and advisors held crisis talks to work out how to fix the company.

On 3 February, Boden agreed to step down. Then, on 6 February, she decided to stay but work on a separate floor to Blomfield.

At one point, she agreed to become chair of the company, handing control to Blomfield. Passion Capital, the snubbed investment firm, agreed to back the business under Blomfield’s leadership.

Employees celebrated, believing that the chaotic few weeks were finally over. But then Boden changed her mind and fired Blomfield for good, destroying the investment deal in the process.

"Anne walked back into the office and fired Tom,” one insider recalls. “She made this big speech about how we were all going to have to give up our equity but would go on long term management contracts. We all just got up and walked out."

"She did fire the entire team,” remembers another. “It was a matter of employees being in shock wondering 'What do we do now?’”

'Nothing less than a coup'

Boden’s business was left fighting for survival. Her attempts to persuade employees to return fell on deaf ears.

In her book, Boden claims the walkout was orchestrated by Blomfield, writing that he had “engineered what was nothing less than a coup.”

It was Blomfield's abrupt resignation, not any action by Starling's chief executive, which led to serious problems at the company, Boden writes.

“There was no chance of finding a suitable replacement CTO in the time we had. Starling would cease to exist,” she says in her book.

A source close to Starling says much of the criticism of Boden and her actions during this period are down to the sexism often encountered by women in the banking and technology fields.

Boden was particularly hurt by the departures of Paul Rippon and Gary Dolman, executives she had brought to Starling from AIB.

Baroness Kingsmill, the former deputy chair of the monopolies and mergers commission who Boden had approached to chair Starling, also followed Blomfield out the door. She went on to chair Monzo until 2019 and remains a shareholder in that business.

Most of the people involved with the events of February 2015 are reluctant to speak openly about the period. Many are bound by confidentiality agreements. Some faced legal threats from Boden over their decision to join Blomfield’s rival banking start-up.

Blomfield has chosen to remain silent, continuing his time out of the public eye since his decision to become president of Monzo earlier this year.

However, Baroness Kingsmill has responded publicly to Boden’s account of the split. “In all start-ups there are strong personalities and conflicts can emerge,” she says. “It’s in the best interests of everyone to resolve these quietly. Anne’s position is very one-sided and I would always advise discretion.”

Accusations of spying and revenge

The rivalry remained long after the split. Years later, the two companies found themselves headquartered on either side of a narrow road in East London with their office windows facing each other.

Boden was concerned that Monzo employees were spying on her employees so frosted the glass on the windows. The incident became a running joke inside Monzo.

"We jokingly used to say at Monzo we believe in transparency, at Starling they believe in translucency,” recalls one insider with a laugh.

Another incident saw Starling publicly prank its rival when Monzo was forced to change its name from its original choice of "Mondo."

After a report suggested "Monzo" was the frontrunner for the rebrand. Starling bought the web domain getmonzo.co.uk and posted a tongue-in-cheek message promoting Starling on the site. “Congrats on the rebrand,” the advert read, “lots of love, Anne.”

Monzo has since expanded to the US, picking up thousands of customers in the competitive market and applying for a US banking licence.

Meanwhile, Starling is planning to expand across Europe starting with a planned launch in Ireland. Boden’s company has also built up a thriving business banking service with 200,000 customers as well as a Starling Kite card for children.

And this year, Monzo has embarked on a new strategy of premium subscriptions cards, most recently launching a £180-a-year metal card as well as a £5-a-month Plus tier.

For years, the feud faded into the background and became a footnote in the histories of Starling and Monzo. But now, as both companies search for ways to turn their hi-tech banking apps into profitable businesses, the rivalry has resurfaced.

Boden said in a statement: “I have written a book about the story of Starling Bank. This is my story. It’s a book about entrepreneurship and starting a business that has gone on to disrupt a whole sector. It’s not every day that you get to do that. That’s worth writing about. When the book is published on 5 November, you’ll see a lot more detail in it."

A Monzo spokesman declined to comment.