French replace Chinese as top international buyers of London property in 2020

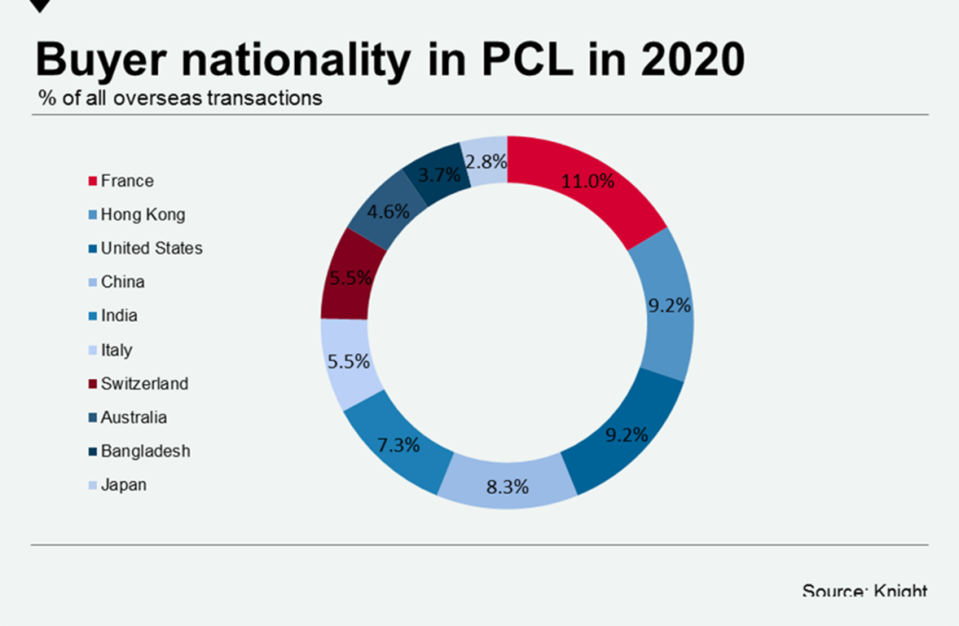

In the first nine months of 2020, buyers from France held the largest share of international purchasers in the prime central London (PCL) property market, accounting for 11% of all transactions involving overseas buyers.

This is a major shift away from the dominance of Chinese buyers, who racked up 8.3% of overseas purchases during the January to September period, according to data from estate agency Knight Frank. This is a decrease from their 15% share over the same period in 2019.

The proportion of UK buyers in the central London market accounted for about 59% of deals compared with 47% in the previous year.

The lifting of international travel restrictions imposed due to COVID-19 remains the primary concern for many international investors, however others are capitalising on this, looking beyond political uncertainty of both the virus and Brexit.

As Brexit negotiations continue, so has the downwards pressure on the pound.

“Despite the background noise of Brexit, there is smart money in Europe targeting London,” said Tom Bill, head of UK residential research at Knight Frank. “The combination of a weak pound, a looming stamp duty hike and less competition from buyers who need to catch a long-haul flight has created a buying opportunity.”

READ MORE: UK property sellers 'too optimistic' as asking prices hit new record high

“Between the period before the EU referendum and the middle of last week, Euro-denominated buyers benefitted from an effective discount (currency plus house price movement) of 30% in PCL. That is a big number, irrespective of the latest rhetoric surrounding Brexit,” Bill said.

“For buyers denominated in US dollars or dollar-pegged currencies, the equivalent discount is 27%.”

When factoring in how much can be saved ahead of a stamp duty hike for overseas buyers next April, it is clear to see why those international buyers who are able to get to London more easily have decided now is the time to act.

This comes alongside news that UK property sales and asking prices both hit new record highs last month, as a housing market boom continues despite the economic toll of the pandemic.

Data from property listings site Rightmove (RMV.L) showed that sales were up 70% in September versus a year earlier, and average asking prices up 5.5% or almost £17,000 ($22,000) year-on-year in October. It marked the highest annual price growth in four years.

The average property on the market earlier this month was on for an all-time high of £323,530, also marking a 1.1% increase on prices last month.

Watch: Why are house prices rising during a recession?