MAS finalises framework for payment services in Singapore

The Monetary Authority of Singapore (MAS) has finalised a new regulatory framework for payment services in Singapore, in a move to guard against risks as the payment landscape evolves.

The Payment Services Bill was introduced in Parliament for the first reading on Monday (19 November) by Ong Ye Kung, Minister for Education, on behalf of Tharman Shanmugaratnam, Deputy Prime Minister and Minister-in-charge of MAS.

Comprising two parallel regulatory frameworks, the Bill aims to streamline the regulation of payment services within a single activity-based legislation, according to a statement from MAS.

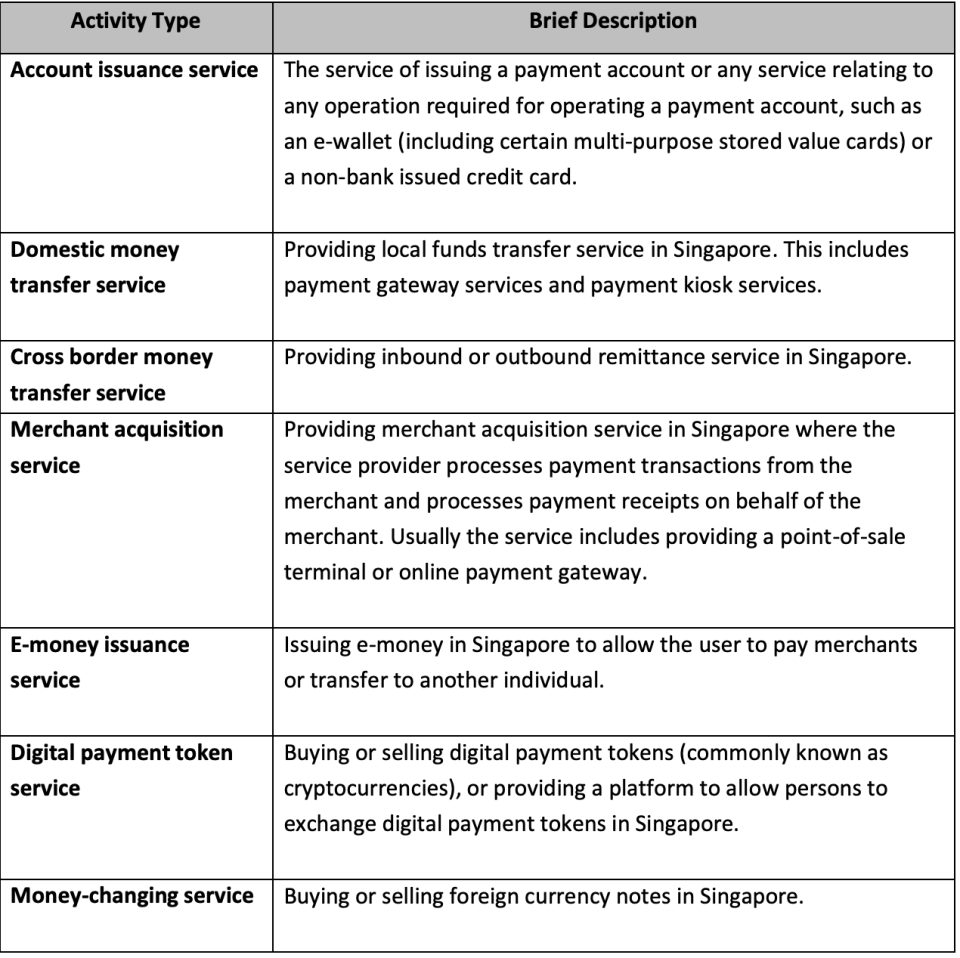

The first framework is a designation regime which enables MAS to designate significant payment systems. The second is a licensing regime to regulate provision of payment services that has been broadened to include domestic money transfers, merchant acquisition and the purchase and sale of digital payment tokens. (see table below)

Measures to mitigate risk will be tailored to the specific payment services that a licensee provides to better safeguard customer and merchant monies, ensure adequate controls against money laundering and terrorism financing risks, reduce fragmentation and strengthen technology and cyber standards in the payments space.

The proposed bill aims to provide a more conducive environment for innovation in payment services, whilst ensuring that risks across the payments value chain are mitigated.

Streamline framework

The MAS currently regulates various types of payment services under the Payment Systems (Oversight) Act and the Money-Changing and Remittance Businesses Act, enacted in 2006 and 1979, respectively. When the new Bill is enacted, both Acts will be repealed.

There will be three classes of licences under the Bill: money-changing licensee; standard payment institution; and major payment institution (MPI). Money-changing licensees can conduct only money-changing services. Standard payment institutions may conduct any combination of regulated activities that are below specified thresholds.

Under the proposed Bill, payment services firms in Singapore may be required to apply for a MPI license if they conduct activities that exceed S$3 million a month, or if two or more activities, excluding e-wallet, combined averaged over S$6 million monthly, and the average daily e-money float held is above S$5 million in a calendar year.

After rounds of consultations the MAS added provisions in the Bill to prohibit e-money issuers from lending money to customers, and conducting activities similar to a deposit-taking business. All licensees are banned from offering cash withdrawals in Singapore dollars, from payment accounts storing e-money that are held by Singapore residents.

Under the new framework, safeguarding options will be expanded to include more options for non banks and non full-banks.

“The Payment Services Bill will enhance the regulatory framework for payment services in Singapore, strengthen consumer protection and engender confidence in the use of e-payments,” MAS Managing Director, Mr Ravi Menon said.

The Bill is expected to be tabled for a second reading in Parliament in January. The new rules will be in effect no earlier than 6 months from the time the Bill is passed.