Merger of Century 21 with Neststac propels firm to fifth biggest agency

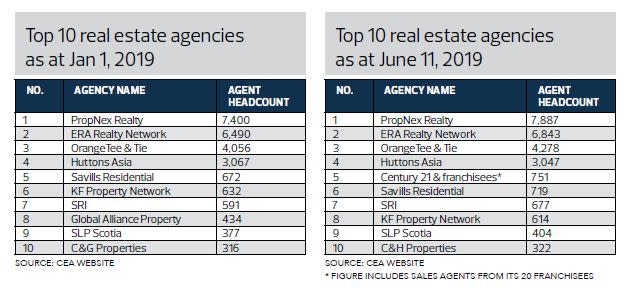

Following a spate of mergers and acquisitions (M&A) over the past two years, the ranking of the four top agencies in Singapore has stabilised. Developers have even coined the acronym “HOPE” for them. In first position is PropNex with 7,887 agents as at June 11. The second biggest is ERA, with 6,843 agents. OrangeTee & Tie is in third place with 4,278 agents, followed by Huttons Asia with 3,047 agents.

There has been a reshuffle in the ranks of firms in the fifth to eighth spots in recent months. Century 21, for instance, was not even among the top 10 agencies at the start of the year.

Reeve Ho of Century 21 and Amanda Yap of Neststac, which became the latest franchisee of Century 21 Holdings Singapore in May, bringing along 158 agents to the fold (Credit: Samuel Isaac Chua/EdgeProp Singapore)

Global Alliance Property (GAP), a franchisee of Century 21, was then No. 8. Now, GAP has disappeared from the Top 10, while Century 21 and its franchisees combined have leapfrogged to fifth place with 751 agents (see tables below).

“However, there is quite a big gap between the four biggest agencies and the fifth biggest,” concedes Reeve Ho, CEO of Century 21 Singapore Holdings.

M&A of smaller firms

Century 21 has grown through a series of M&A with smaller firms that have since become its franchisees. These include REA Realty Network with 78 agents, PTO Property Services with 45, and Wild Wild West with 22. The latest firm to join Century 21 as a franchisee was Neststac on May 1. The brokerage firm headed by its CEO and key executive officer (KEO), Amanda Yap, has 158 agents. It specialises in marketing overseas projects, especially from Bangkok.

Founded in 2013, Neststac was originally known as Trump Property, renamed ShentonMore Property, then SMP Realty before its latest incarnation as Neststac. According to Yap, the name “Neststac” was coined as a combination of “nesting” and “stack”, which in property terms indicate the unit and facing.

The reason for the merger with Century 21 is the brand franchise and its international network, says Neststac’s Yap. Century 21 is said to be the world’s largest real estate franchise chain, with 8,800 offices in 64 countries and 122,000 agents. Established in the US in 1971, Century 21 is a subsidiary of the New York Stock Exchange (NYSE)-listed real estate company Realogy, which also owns brands such as Coldwell Banker, ERA and Sotheby’s International Realty.

Incidentally, Century 21 was set up in Singapore in 1998. For Ho, the rationale for the Century 21’s tie-up with Neststac is to tap the latter’s reach in terms of overseas project marketing and sales, as well as its pool of foreign buyers. “It’s a great fit,” he adds.

Industry consolidation

Ho was previously the CEO of GAP. Before its merger with Century 21, GAP was previously known as GPS Alliance Holdings Ltd (GPS), which was established in September 2010 and listed on the Australian Stock Exchange in March 2013.

GAP was subsequently acquired by Singapore-listed Asia-Pacific Strategic Investments Ltd (APSIL) and merged with Century 21 in February 2016. APSIL had acquired Century 21 (AsPac) from its two shareholders, Luke Ng Kai Man and Chong Chai Shyong, three years ago.

When APSIL repositioned itself as China Real Estate Group and decided to focus on real estate developments in China, the latter formed a strategic collaboration with PropNex in February. In an announcement then, China Real Estate Group said that GAP “will discontinue its real estate agency business”. The agents at GAP would therefore have the option to operate under PropNex.

The majority of the agents, however, decided to remain as a team at Century 21, says Ho.

External co-broke agents

In Singapore, Century 21 works closely with ERA. “We have a collaborative agreement with ERA and we’re their external co-broke agents [ECB] at new project launches,” says Ho. “All their projects are open to our agents. When we have overseas clients looking to buy property in Singapore, we will bring them to sales galleries as ECB agents of ERA.”

Likewise, ERA is active not just in marketing local, but also overseas projects in Singapore. They include projects from Cambodia, Indonesia, Thailand and the UK, says Jack Chua, CEO of ERA Realty and its Singapore-listed entity, Apac Realty.

Lock Mun Yee, analyst at CGS-CIMB, believes property agencies are poised to benefit from expanding commission rates amid an increasingly competitive landscape due to new project launches scheduled for 2019-2020. Coupled with volume recovery, this could result in as much as “a double-boost” to topline growth for both Apac Realty and PropNex (which is also Singapore-listed), says Lock in her report on June 4.

See Also:

Singapore Property for Sale & Rent, Latest Property News, Advanced Analytics Tools

Five-room HDB flat at Tiong Bahru View sold for $1.2 million

En Bloc Calculator, Find Out If Your Condo Will Be The Next en-bloc