Microloan recipients decline for first time: study

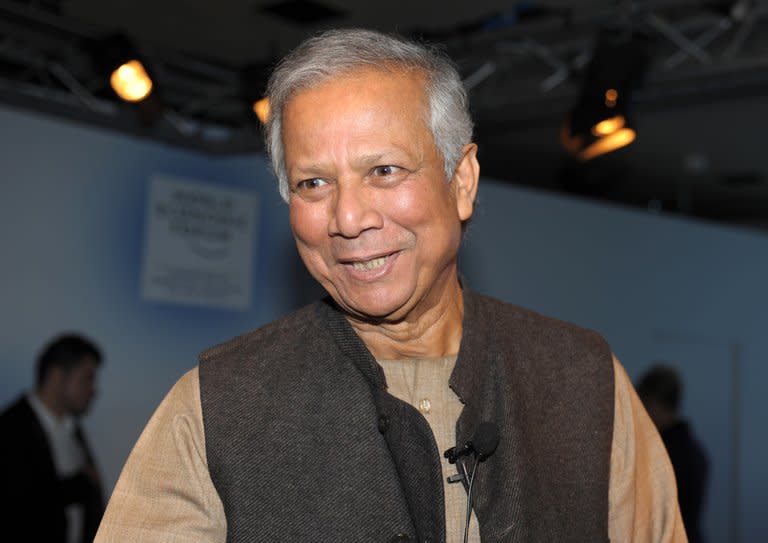

The number of the world's poor people who benefited from small loans has declined for the first time as purported abuses in India cast a shadow over the "microfinance" industry, a study said Tuesday. The report called for microlenders to find ways to be more effective, including by tightening rules on accountability and by embracing mobile technology to better reach the world's desperately poor. Microfinance -- pioneered by Nobel Peace Prize winner Muhammad Yunus of Bangladesh -- seeks to reduce poverty by offering small loans to low-income but entrepreneurial people, especially women, usually shunned by traditional banks. The Microcredit Summit Campaign, which promotes microfinance, said in its report that after more than a decade of sharp growth, the number of microloan recipients slipped to 195 million in 2011 from 205 million a year earlier. The drop, the first since statistics began in 1997, were led by falls in India -- which had 14.2 million fewer microfinance clients in 2011 than in 2010 -- and to a lesser extent in Bangladesh. "I think it could be a very good warning sign, a time for us to pause and take a look at what's happening and to reassess how we are operating," said Larry Reed, director of the Microcredit Summit Campaign, which is based in Washington. "It gives us a chance to really look more closely at what's happening in clients' lives and make sure we have products that are appropriate for them," he said. The southern Indian state of Andhra Pradesh launched a crackdown in 2010 after reports of suicides by microloan recipients. Authorities accused microlenders of exploiting vulnerable people through exorbitant lending rates and abusive debt collection practices. The report said the crisis triggered a chain reaction of funding drying up for Indian microlenders. India's parliament is drafting a law to provide clearer oversight on microlenders and strengthen protections for clients. The study called for microlenders to look more at clients' needs instead of their numbers, saying that Andhra Pradesh's woes showed that poor people with a "psychology of scarcity" are willing to pay dearly to borrow. "If a lending institution focuses on its own growth and not the well-being of its clients, it can make loans that may make their clients worse off financially in the long term," it said. In Bangladesh, Reed said microfinance has seen uncertainty in part because of Yunus' troubles. The Dhaka government has tightened control over Grameen Bank in what Yunus' backers see as a move to sideline the well-known figure. While nearly 89 percent of the world's poorest microloan clients live in Asia, the industry made strides in other regions including sub-Saharan Africa. The report pointed to Kenya's embrace of digital technology, saying that a system for mobile payments now covers more than 70 percent of households in the eastern African nation. The study said that mobile technology -- with its relatively low cost to expand a client base after an initial investment -- could be used to offer more products to microloan customers such as insurance and savings accounts. "There are huge possibilities there because it drastically reduces the cost," Reed said.