'Focused on survival': Millions of laid-off Americans still living without health insurance

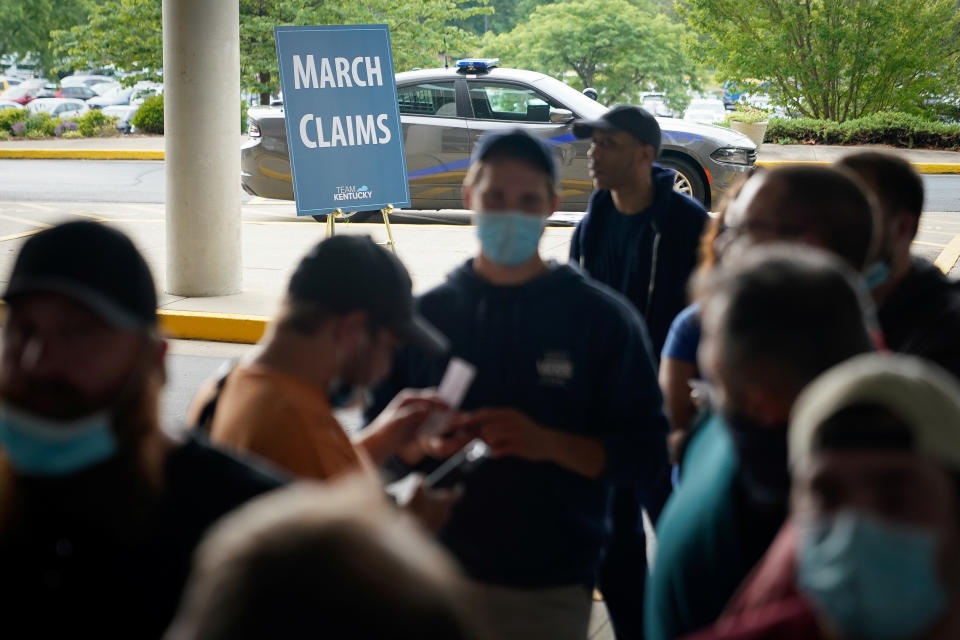

With hundreds of thousands of Americans filing new unemployment claims every week, sobering evidence of the difficulties faced by laid-off workers is showing up in the estimated number of U.S. adults now lacking health insurance.

Since the onset of COVID-19 in mid-March, workers who lost employment-based healthcare insurance (ESI) far outnumber those who gained coverage, either through a public or private option, according to recent surveys and estimates.

Data from recent surveys and historical trends project that approximately 4.6 million to 5.6 million workers who lost job-based coverage since March are now uninsured.

According to the Economic Policy Institute (EPI), an estimated 12 million people previously covered under an ESI plan lost coverage between February and July. Two separate surveys conducted by the U.S. Census Household Pulse Survey and Urban Institute, read together, conclude that between 10 million and 11 million people lost ESI coverage from March to the end of July.

“That’s three times the biggest one-year loss of coverage during the great recession,” Stan Dorn, director of the National Center for Coverage Innovation at Families USA, a non-profit consumer healthcare advocacy organization, said about the figures covering a four- to five-month period. “Which would be the greatest loss of ESI in American history.”

‘We don’t really know how many people lost coverage’

It’s impossible to know the exact number of those who lost coverage and failed to regain it, Dorn explained, because no central reporting service for health insurance exists.

“We don’t yet know how many people have lost their job-based insurance, or would otherwise have become uninsured, but what we are seeing is that the marketplaces are serving as a safety net,” Jennifer Tolbert, associate director for Kaiser Family Foundation’s (KFF) Program on Medicaid and the Uninsured, told Yahoo Finance.

Still, Tolbert said, certain laid-off workers who lost job-based coverage may be unable to replace it.

On Thursday, the Bureau of Labor & Statistics (BLS) reported that 12.6 million U.S. workers filed for continuing unemployment claims during the week ending Sept. 12. New unemployment claims for the week ending Sept. 19 totaled 870,000, bringing the total number of people claiming unemployment benefits across all programs to 26 million.

Based on data extrapolated from historical layoffs, Families USA estimated that between February and May, 5.4 million people became uninsured due to loss of job-based plans.

Yet data from recent surveys indicated the ESI losses are more significant.

America's Health Insurance Plans (AHIP) estimated that 7.5 million people between April and May lost employment-based coverage.

The Robert Wood Johnson Foundation (RWJF) which funded a study conducted by Urban Institute using data from the Household Pulse Survey, estimated that 3.3 million adults under 65 lost ESI between late April and late July.

Together, Dorn said, the overlapping time frames point to between 10 million and 11 million workers having lost job-based coverage between mid-March and then end of July.

In addition he said, “We don't really know how many people lost coverage from March to May, and that's when the deepest employment losses occurred, but we do know that it's more than 2 million.”

During the late April to late July timeframe, RWJF estimates that 2.2 million adults gained public coverage. The majority of that coverage was obtained through Medicaid. Meanwhile, no significant change in private non-group coverage occurred during the timeframe, the foundation concluded.

“A huge number of these enrollees go into Medicaid, not the exchanges,” Dorn said, explaining that during an even broader period from February to the most recent month’s data available from states (varying from June to July to August), the number of people who are covered by Medicaid increased by 4.4 million.

‘People are typically focused on survival needs’

Between December 15, 2019 and May 2020, KFF said 486,954 people obtained Affordable Care Act (ACA) marketplace coverage through special enrollments — enrollments outside of the regular enrollment period. Centers for Medicare and Medicaid Services reported a similar yet more conservative number, estimating that 487,000 people had signed up for an ACA exchange plan between Dec. 15 and June 25.

Dorn said it’s common for those who have lost job-based insurance to go without it. Laid-off workers and their families, he said, are an extremely difficult population to enroll in health insurance. In 2009, less than 15% of people who lost ESI and qualified for special enrollment chose to obtain coverage.

“The issue is that if you lose your job, it's emotional. It’s traumatic,” he said. “The literature reports symptoms of depression and anxiety. People typically are focused on survival needs, not getting unemployment insurance. Unless you have a serious health issue, insurance is just not on the priority list.”

Tolbert said affordability remains a huge issue for those ineligible for Medicaid, which does not charge premiums.

“I think certainly for moderate income individuals there may be an affordability challenge when it comes to enrolling in marketplace coverage,” Tolbert said. “Faced with such economic uncertainty, they maybe make the decision that they just simply can't afford to pay those premiums when they’re worried about paying rent, or buying food.”

Katherine Hempstead, a senior policy adviser for RWJF, said Medicaid eligibility largely depends on the state where the laid-off worker resides, and is based on current monthly income.

In states that have expanded Medicaid, those with current monthly income less than 138% of the federal poverty level are eligible. For a family of 3, the limit is approximately $2,500 per month. For an individual, the limit is approximately $1,466 per month.

In states that have not expanded Medicaid, eligibility is limited to parents with minor children whose median income is below 40% of the federal poverty level, or whose annual income did not exceed $8,532 for a family of three in 2019.

Alexis Keenan is a legal reporter for Yahoo Finance and former litigation attorney.

Follow Alexis Keenan on Twitter @alexiskweed.

Read more:

Nikola could find itself in legal trouble if short seller claims are true

Labor Department proposes definition for independent contractors for the first time ever

Short seller rejects Nikola’s explanation as ‘tacit admission of securities fraud’

Large-scale airline layoffs could cause ‘great, great economic harm’

Follow Yahoo Finance on Twitter, Facebook, Instagram, Flipboard, LinkedIn, and reddit.