Navient (NAVI) Q3 Earnings Beat Estimates as Provisions Fall

Navient Corporation NAVI reported third-quarter 2020 core earnings per share of 99 cents that surpassed the Zacks Consensus Estimate of 78 cents. Also, the bottom line was above the year-ago quarter figure of 62 cents.

Core earnings excluded the impacts of certain other one-time items, including mark-to-market gains/losses on derivatives along with goodwill and acquired intangible asset amortization, and impairment.

Third-quarter results of Navient were supported by a rise in net interest income (NII). Also, a fall in expenses and provisions were tailwinds. However, private education loans declined. Moreover, a year-over-year fall in fee income was an undermining factor.

GAAP net income for the quarter was $207 million or $1.07 per share compared with $145 million or 63 cents in the year-ago quarter.

NII Increases, Provisions Fall (on Core Earnings Basis)

NII increased 3.9% year over year to $321 million.

Non-interest income declined 6.8% year over year to $179 million. The fall was mainly attributed to lower servicing and other revenues, partly offset by higher asset recovery and business processing income.

Provision for loan losses fell 78.1% to $14 million.

Total expenses declined 7.1% from the year-ago quarter to $235 million. Lower operating expenses mainly led to the fall.

Segment Performance

Federal Education Loans: The segment generated core earnings of $137 million, up 7% year over year. Higher NII and a fall in expenses were tailwinds.

As of Sep 30, 2020, the company’s FFELP loans were $59.6 billion, down 1.8% sequentially.

Consumer Lending: The segment reported core earnings of $110 million, up 39% year over year. Lower provisions and rise in revenues were positives. Net interest margin was 3.24%, down 21 basis points.

Private education loan delinquencies of 30 days or more of $499 million were down from $530 million in the prior-year quarter.

As of Sep 30, 2020, the company’s private education loans totaled $21.3 billion, down nearly 1% from the prior quarter. Also, Navient originated $1.3 billion of private education refinance loans in the quarter.

Business Processing: The segment reported core earnings of $16 million compared with $9 million in the year-ago quarter. Higher revenues led to the upside.

Source of Funding and Liquidity

In order to meet liquidity needs, Navient expects to utilize various sources, including cash and investment portfolio, issuance of additional unsecured debt, repayment of principal on unencumbered student-loan assets, and distributions from securitization trusts (including servicing fees). It might also issue term asset-backed securities (ABS).

During the reported quarter, Navient issued $2.3 billion in term ABS. Notably, it had $1.8 billion of cash as of Sep 30, 2020.

Capital-Deployment Activities

In the third quarter, the company paid out $31 million in common stock dividends. Also, it repurchased $65 million of common shares during the quarter. As of Sep 30, 2020, it had $600 million of remaining share-repurchase authority.

Our Take

Navient’s prudent cost-management efforts support bottom-line expansion. Also, non-interest income increased on the back of several measures taken to build its base. However, its involvement in improper lending practices is likely to keep legal expenses elevated. Also, increasing financing costs, subject to substantial volatility in capital markets, is concerning.

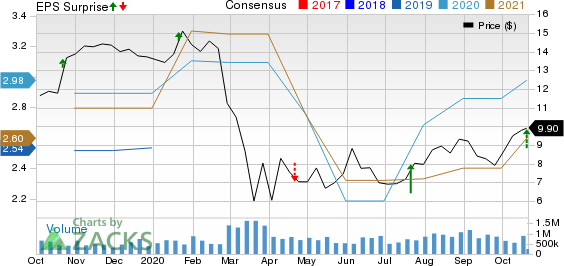

Navient Corporation Price, Consensus and EPS Surprise

Navient Corporation price-consensus-eps-surprise-chart | Navient Corporation Quote

Currently, Navient sports a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Performance of Other Companies

First Republic Bank FRC delivered a positive earnings surprise of 16.7% in third-quarter 2020 aided by solid top-line strength. Earnings per share of $1.61 surpassed the Zacks Consensus Estimate of $1.38. Additionally, the bottom line climbed 22.9% from the year-ago quarter.

Comerica CMA delivered a third-quarter 2020 positive earnings surprise of 65.5%. Earnings per share of $1.44 easily surpassed the Zacks Consensus Estimate of 87 cents. However, bottom line came in lower than the prior-year quarter figure of $1.96.

Regions Financial RF reported third-quarter 2020 adjusted earnings of 49 cents per share, surpassing the Zacks Consensus Estimate of 34 cents. Also, results compare favorably with the prior-year period earnings of 39 cents.

5 Stocks Set to Double

Each was hand-picked by a Zacks expert as the #1 favorite stock to gain +100% or more in 2020. Each comes from a different sector and has unique qualities and catalysts that could fuel exceptional growth.

Most of the stocks in this report are flying under Wall Street radar, which provides a great opportunity to get in on the ground floor.

Today, See These 5 Potential Home Runs >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Regions Financial Corporation (RF) : Free Stock Analysis Report

Comerica Incorporated (CMA) : Free Stock Analysis Report

First Republic Bank (FRC) : Free Stock Analysis Report

Navient Corporation (NAVI) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research