NetApp (NTAP) Signs Deal to Purchase Cloud Startup Spot

NetApp, Inc. NTAP recently announced that it has inked an agreement to acquire Israel-based cloud services startup –– Spot.

The deal will enable NetApp to address the growing demand for efficient and cost-effective cloud infrastructure amid increasing expenses and inefficient resource allocation.

However, the exact financial terms of the deal have not been disclosed by the company. Per a CTECH report, NetApp has agreed to pay $450 million for the deal.

Markedly, Spot’s compute platform provides customers with tools that help optimize workloads, while maintaining service-level agreement (SLA) and service-level objective (SLO). Combined with NetApps’ shared storage platform, the solution will help customers to save up to 90% of their compute and storage cloud expenses, which usually make up 70% of total cloud spending.

Moreover, the acquisition of Spot is expected to strengthen NetApp’s Application Driven Infrastructure capabilities as well as enable it to diversify its portfolio. Also, the optimization of cloud-based workloads and reduction of costs are likely to boost the adoption of public cloud.

This is expected to aid NetApp acquire new customers, consequently bolstering the top line in the quarters ahead.

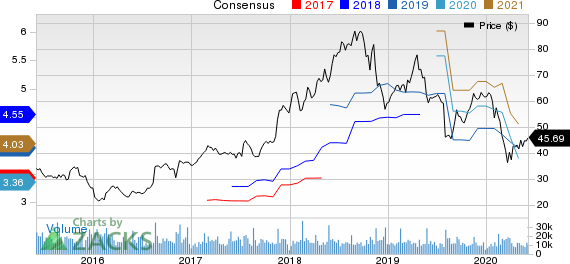

NetApp, Inc. Price and Consensus

NetApp, Inc. price-consensus-chart | NetApp, Inc. Quote

Acquisitions to Strengthen Offerings Hold Promise

Spot buyout is part of NetApp’s focus on bolstering its cloud-based storage offerings through various acquisitions.

Recently, the company announced the acquisition of CloudJumper, a cloud software company offering virtual desktop infrastructure (VDI) solutions and remote desktop services (RDS) that aids enterprises to accelerate public cloud deployments for work-from-home setup, branch offices and enterprises.

In March, NetApp acquired Talon Storage to strengthen NetApp Cloud Volumes and Azure NetApp Files offerings, and aid customers to centralize and consolidate IT storage infrastructure to the public clouds to facilitate remote work.

These endeavors are expected to boost NetApp’s offerings and are likely to aid it acquire more customers. In the fiscal fourth quarter, NetApp’s Cloud Data Services recorded annualized recurring revenues of $111 million, up 113% year over year. Moreover, Cloud Data Services customer count exceeded 3,500, which more than doubled on a year-over-year basis.

Further, the company’s solutions are likely to witness consistent momentum driven by the digital transformations taking place across all industries, triggered by the coronavirus-inducedlockdowns.

Cash Position in Brief

NetApp has a solid balance sheet with net-cash balance of $1.74 billion as of Apr 24, 2020. Moreover, the company generated net cash from operations of $383 million and free cash flow of $359 million during the last reported quarter. Thus, the company’s strong cash reserves and consistent cash flows provide the flexibility required to pursue any growth strategy, whether through acquisitions or otherwise.

COVID-19 is a Headwind

Supply chain disruptions and market uncertainties stemming from the ongoing pandemic is expected to dampen the company’s performance. Notably, in the last reported quarter, NetApp’s Product revenues declined 21% year over year to $793 billion due to coronavirus crisis-induced macroeconomic headwinds.

Moreover, the company did not provide any guidance for fiscal 2021, citing uncertainty in demand visibility due to COVID-19 related business impacts.

Nevertheless, NetApp is banking on improvement in adoption of hybrid multi-cloud offerings, Cloud Data Services and Private Cloud offerings to drive long-term revenue growth. Additionally, partnerships with Alphabet’s GOOGL Google Cloud platform and Amazon’s AMZN Amazon Web Services augur well.

Zacks Rank & Key Picks

NetApp currently carries a Zacks Rank #3 (Hold).

A better-ranked stock worth considering in the broader sector is Bandwidth Inc. BAND, which currently flaunts a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Long-term earnings growth rate for Bandwidth is currently pegged at 13.6%.

These Stocks Are Poised to Soar Past the Pandemic

The COVID-19 outbreak has shifted consumer behavior dramatically, and a handful of high-tech companies have stepped up to keep America running. Right now, investors in these companies have a shot at serious profits. For example, Zoom jumped 108.5% in less than 4 months while most other stocks were sinking.

Our research shows that 5 cutting-edge stocks could skyrocket from the exponential increase in demand for “stay at home” technologies. This could be one of the biggest buying opportunities of this decade, especially for those who get in early.

See the 5 high-tech stocks now>>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Amazon.com, Inc. (AMZN) : Free Stock Analysis Report

NetApp, Inc. (NTAP) : Free Stock Analysis Report

Alphabet Inc. (GOOGL) : Free Stock Analysis Report

Bandwidth Inc. (BAND) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research