Only 1 in 2 Home Loans Are Approved in Malaysia; Are You One Of Them?

Finding the right home that fits not just your budget, but your needs and lifestyle as well, is no easy task. Ask any first-time homebuyer, and they’re sure to tell you of the different types of difficulties they would’ve faced in their property buying journey.

One of the more common issues that most of them have is the high home loan rejection rate. Did you know that only 1 in 2 home loans are approved in Malaysia? That’s why, under the Own Your Home Programme, we’re on a mission to empower 100,000 Malaysians to make confident property decisions and become homeowners by 2020!

Well, we’ve got many initiatives under our belt to achieve this, and one of it is our PropertyGuru Loan Pre-Approval. This is essentially a free online solution that would take only 5 minutes to complete, and it provides you with a comprehensive report that shows whether you can afford to buy your dream home.

Now, wouldn’t that be a wonderful thing, to be able to know immediately and clearly if that property you had your sights on will soon be yours or not?

Let’s take a look at why it’s so important to get Pre-Approved first

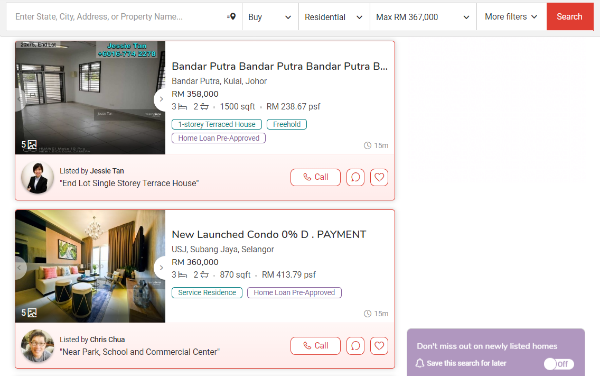

Our solution is able to accurately calculate how much you’re eligible to borrow from the bank, so that you can focus on the right range of property prices.

Based on the eligible loan amount that your generated report states, you can then begin your hunt for your new home. It’ll be more precise, and so much easier than ever before!

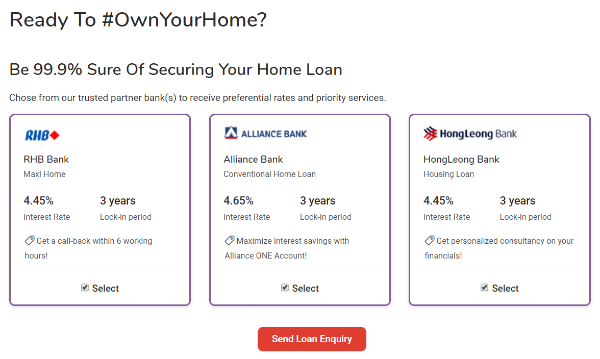

All you gotta do next is submit your chosen Pre-Approved property to our bank partners, and you’ll be able to enjoy better interest rates on your home loan. We call this a win-win situation, since you also get to save more!

To recap: This is solution that’s free, fast, AND completely secure to use!

Here’s how it works:

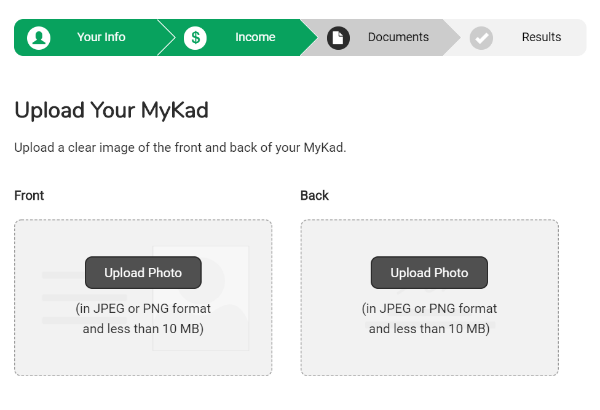

1) Enter your basic information, including your full name, identity card (MyKad) number, and mobile number.

2) Input your basic monthly income and fixed monthly allowance (if any).

3) Upload the front and back of your MyKad for verification purposes.

All your personal particulars that were keyed in earlier will be confirmed (it only takes a few seconds for our system to do this!), so that you can get a customised report that accurately lists out your Debt Service Ratio (DSR) and eligible loan amount.

Unlike the other DSR/loan calculators out there, we provide the most accurate indication of how much banks would be willing to lend you. This is because we provide secure access to your credit information.

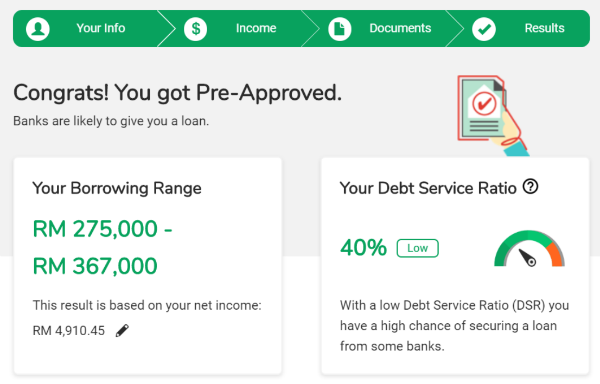

4) You can receive 2 possible results on the eligible loan amount, depending on your DSR.

Your DSR percentage determines the maximum amount that you’re eligible to borrow, and the percentage varies from bank to bank. Keep in mind that this is only a rough indication, based on how much your self-declared monthly income is. So, it’s very important for you to be honest if you want an accurate result!

If your DSR is high, you may not get Pre-Approved just yet. But, don’t worry, your journey to owning a home doesn’t have to end there!

Just click on the ‘How Can I Improve my DSR?’ button to get advice on how you can still secure a bank loan.

If your DSR is low, then this means that you’re more likely to secure a home loan.

As you can see, your borrowing range depends on this one important ratio, so it’s a good idea to learn how it works for you to be able to keep your percentage at a healthy level. It’s a great way to start searching for properties because now, you know the exact price range of properties you can afford!

5) Now that you have all the important details in hand, we’ll provide you with further information from our trusted partner banks. From there, just select which banks you’d like to enquire for a loan (you can even select all of them if you prefer to have a choice!).

6) Finally, get that kickstart you need on home hunting, by searching for properties in your borrowing range. This list is automatically generated for you on our website, based on your Pre-Approved results.

Easy-peasy lemon-squeezy, yes? So, what are you waiting for, try our PropertyGuru Loan Pre-Approval solution for free now!