Only economic ‘war footing’ can beat Biden’s subsidy blitz

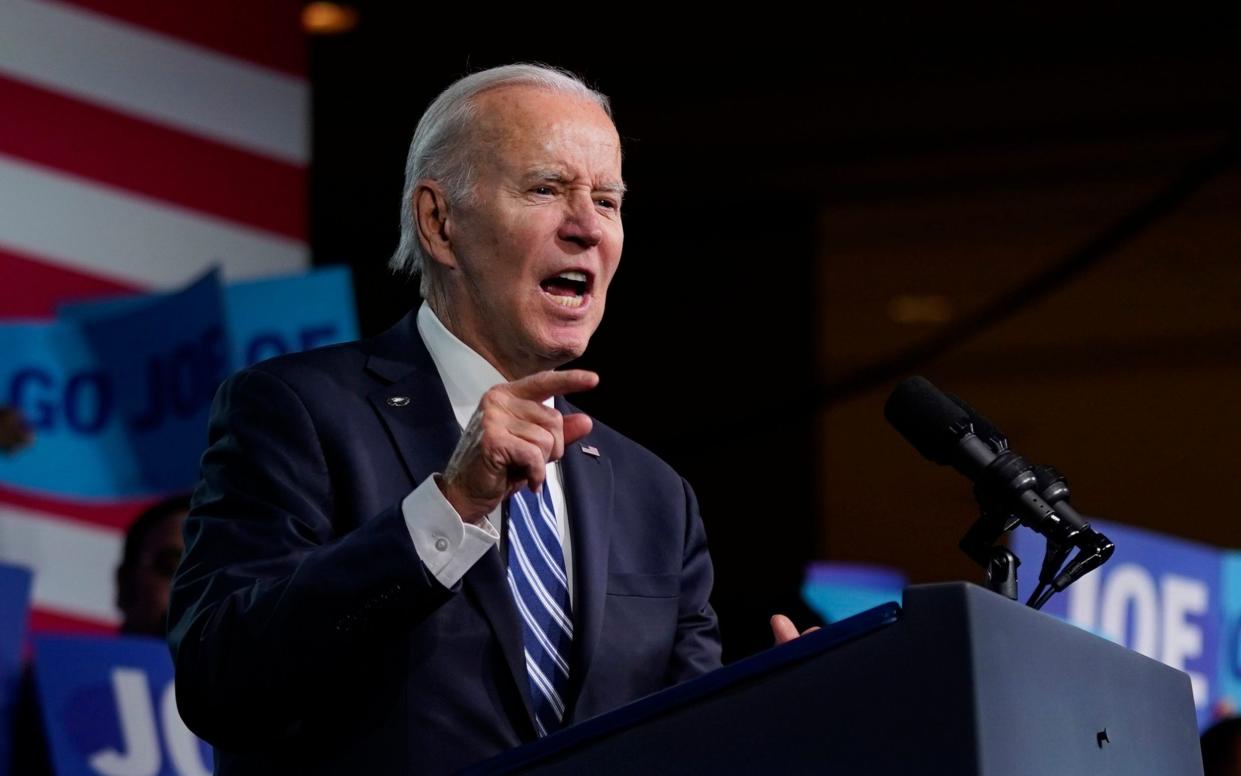

Britain must shift to economic “war footing” with a wave of reform or risk being left behind by President Joe Biden's massive programme of subsidies, business leaders will warn on Tuesday.

In a letter to the Prime Minister Rishi Sunak, the chief executives of Virgin Atlantic, Coutts, Heathrow Airport and Rolls-Royce’s nuclear power project will demand a UK plan to counter the US Inflation Reduction Act.

It comes as Nissan separately said that Britain is becoming “more and more challenging” as a home for manufacturing.

The letter – signed by members of the Global Britain Commission, a business group chaired by the senior Tory MP Liam Fox – calls for tax credits for exporters and a radical overhaul of the relationship between business and government.

It advocates a merger between the Business Department and the Department for International Trade, as well as carving out a new Department for Energy to focus its efforts on the current crisis in gas and electricity prices.

The business leaders argue that the UK must rapidly exploit its existing advantage in energy industries connected to nuclear, wind, hydrogen and biofuels.

It comes amid fears that Mr Biden's act, a $369bn (£307bn) package of green tax breaks, has already tempted investment away from the UK and Europe.

Arrival, a business with UK factories and research centres, has said it will shift production of its electric vans to the US to take advantage of the regime.

Meanwhile Volvo chief executive Martin Lundstedt told Bloomberg that it could switch investment to the US from Europe since more demand will be created in America.

The European Union is currently preparing its own subsidy package, and the letter warns that Britain will be "left behind" unless it acts rapidly.

It says: "We, in the commission, believe that the period of pain for businesses and hardworking people can be shortened by considering a series of recommendations... from our R&D and innovation landscape to infrastructure and connectivity; openness, trade and foreign direct investment to human talent.

"If action is taken now, at little to low cost to the Treasury, recessionary pain will not be unnecessarily prolonged and the relationship between government and businesses will be on a stronger footing, as we look to a better and more prosperous future.

"But we must act now."

The car industry has already warned that the prevailing “laissez faire” approach to investment will not work, as Mike Hawes, the head of the Society for Motor Manufacturers and Traders, said last month that the world is no longer a “level playing field” when it comes to investment.

Ashwani Gupta, Nissan's chief operating officer, told journalists on Monday that the car company needs a secure supply of British-made parts in order for the market to remain attractive.

He said: “The UK is becoming more and more challenging as a manufacturing footprint.

“Having said that, Sunderland is one of the best plants in the world in terms of competitiveness, but whether it is going to continue the same competitiveness is a question to be answered.”

The UK automotive industry is shrinking. Honda left the country in 2021 and no plants have been built since, making it less attractive to suppliers. By 2027, British-made cars for export to the EU must have 55pc of their content made in the UK or EU to avoid tariffs.

Nissan expects to hit this target, and both Mr Gupta and chief executive Makoto Uchida praised Sunderland as a lynchpin plant. But long-term, more suppliers must be tempted to the UK, Mr Gupta said.

Only two of the world’s top 100 automotive suppliers are British, according to research by Berylls Strategy Advisors.

The letter also calls for tax relief for exporters, citing government estimates which suggest 2m businesses which could export goods and services are not doing so.

It says: "The Commission is in the process of writing an energy report, to be published shortly, setting out a range of recommendations on how the UK can take maximum advantage of our existing skills, innovation and infrastructure to boost our investment and export potential across four main energy areas: nuclear; wind; hydrogen and biofuels.”

It highlights “the vital importance of the UK responding to the US Inflation Reduction Act, otherwise we risk being left behind as the EU considers how it too can compete."

There should also be formal secondments between the civil service and business so that they understand each other, the letter says.

It says: “By adopting these changes, we can put UK business and the civil service on an economic war footing."

Heathrow boss John Holland-Kaye; Shai Weiss, who heads Virgin Atlantic; Peter Flavel of private bank Coutts and Tom Samson, head of Rolls-Royce’s Small Modular Reactor business have all lent their support by signing the letter.

Other suggestions from the commission include making it easier for Britons’ private pensions to be invested in smaller, high-risk enterprises and amending the rules capping management fees for such investments, attracting more adventurous and thorough fund managers.

Such a change could swap £105bn of investments from government bonds and slow-growth large companies into newer enterprises, offering much faster growth in jobs and profits, albeit with higher risks.