PepsiCo (PEP) Gains as Q2 Earnings & Sales Beat Estimates

PepsiCo, Inc. PEP has reported strong second-quarter 2020 results, wherein earnings and sales surpassed estimates. Despite the challenges presented by the coronavirus outbreak, the company’s better-than-expected performance can be attributed to resilience in the global snacks and foods business. Further, the second quarter benefited from the lifting of restrictions and the gradual easing of challenges, which resulted in improved business performance and channel mix.

The company also gained from its strong portfolio of brands, a responsive supply chain and flexible go-to-market systems, which helped maintain continued supplies amid the coronavirus pandemic.

It notes that there is uncertainty regarding the duration and long-term implications of the coronavirus outbreak. Consequently, the company did not provide any guidance for 2020. However, it expects to maintain a strong balance sheet, increased cash generation and ample liquidity to invest in its business and reward shareholders.

For 2020, the company plans to return $7.5 billion of cash to shareholders, comprising $5.5 billion of dividends and $2 billion of share repurchases. Further, it expects core effective tax rate of 21%. Moreover, the company expects currency headwinds to hurt revenues and core earnings per share (EPS) by 3 percentage points in 2020, based on current rates.

PepsiCo’s shares gained 2.6% in the pre-market session on Jun 13. Shares of the Zacks Rank #3 (Hold) company have lost 1.6% year to date compared with the industry’s 11.8% decline.

Quarter in Detail

PepsiCo’s second-quarter core EPS of $1.32 beat the Zacks Consensus Estimate of $1.25. However, core EPS declined 15% year over year. In constant currency, core earnings were down 11% from the year-ago period. The company’s reported EPS of $1.18 declined 18% year over year.

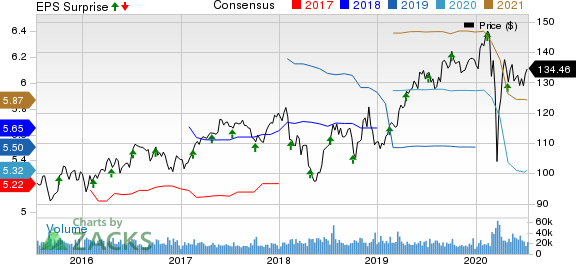

PepsiCo, Inc. Price, Consensus and EPS Surprise

PepsiCo, Inc. price-consensus-eps-surprise-chart | PepsiCo, Inc. Quote

Net revenues of $15,945 million declined 3.1% year over year and surpassed the Zacks Consensus Estimate of $15,542.5 million. On an organic basis, revenues fell 0.3% year over year. Foreign currency impacted revenues and earnings by 4% and 3%, respectively, in the second quarter. The decline in the top line was mainly caused by the impacts of the coronavirus pandemic.

Although revenues were hurt by soft volume, it gained from robust pricing during the quarter. Total volume was down 2% in the reported quarter. Notably, organic volume for snacks/food business improved 5%, while it declined 4% for the beverage business. Meanwhile, net pricing improved 1.5% in the second quarter, driven by strong pricing across almost all segments.

On a consolidated basis, reported gross margin expanded 56 basis points (bps), while core gross margin improved 6 bps. Reported operating margin contracted 205 bps, while core operating margin declined 195 bps. The decline in operating margin was mainly owing to higher SG&A expenses.

Segment Details

On a segmental basis, the company witnessed organic and reported revenue growth for the snacks and food businesses as well as APAC.

Reported revenues improved 7% in FLNA, 23% in QFNA and 10% in APAC, whereas it declined 9% in Europe, 17% in Latin America, 7% in PBNA and 1% in AMESA segments. Organic revenues increased 26% at QFNA, 4% at FLNA and 15% at APAC. However, organic revenues declined 7% each at AMESA and PBNA, and 2.5% at Europe. Meanwhile, organic revenues remained flat in Latin America.

Operating profit (on a reported basis) declined 42% for the PBNA segment, 22% for Latin America and 75% for AMESA. However, it grew 63% for APAC, 3% for Europe, 55% for QFNA and 2% for FLNA.

Financials

The company ended second-quarter 2020 with cash and cash equivalents of $8,927 million, long-term debt of $38,371 million, and shareholders’ equity (excluding non-controlling interest) of $12,491 million.

Net cash provided by operating activities was $1,462 million as of Jun 13, 2020, compared with $1,388 million as of Jun 15, 2019.

Don’t Miss These Better-Ranked Beverage Stocks

The Boston Beer Company, Inc. SAM delivered a positive earnings surprise of 4.7%, on average, in the trailing four quarters. It currently sports a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

National Beverage Corp. FIZZ has delivered a positive earnings surprise of 22.9%, on average, in the trailing four quarters. It presently flaunts a Zacks Rank #1.

Reeds, Inc. REED, with a long-term earnings growth rate of 20%, currently has a Zacks Rank #2 (Buy).

Today's Best Stocks from Zacks

Would you like to see the updated picks from our best market-beating strategies? From 2017 through 2019, while the S&P 500 gained and impressive +53.6%, five of our strategies returned +65.8%, +97.1%, +118.0%, +175.7% and even +186.7%.

This outperformance has not just been a recent phenomenon. From 2000 – 2019, while the S&P averaged +6.0% per year, our top strategies averaged up to +54.7% per year.

See their latest picks free >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

PepsiCo, Inc. (PEP) : Free Stock Analysis Report

National Beverage Corp. (FIZZ) : Free Stock Analysis Report

The Boston Beer Company, Inc. (SAM) : Free Stock Analysis Report

Reeds, Inc. (REED) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research