Which Performs Better, Real Estate Or Stocks? The Answer Might Surprise You

This article was first published by Truewealth Publishing.

In many parts of the world – depending on the period and place – buying a house or flat has the reputation of being a one-way ticket to wealth. Buy, hold, and be rich.

That’s worked for some generations, in some countries – including in much of Asia. But residential real estate’s reputation in many parts of the world as the ultimate wealth creator is often just wrong. In many markets, stocks do a lot better.

There are plenty of good reasons to own residential real estate. You need someplace to live, and you get tired of paying rent. You can borrow money for almost nothing. You can use your retirement money for a down payment. You saw your parents and grandparents grow rich by buying real estate when they were young. You like the tax advantages (in some countries) of owning real estate. You like cashing the checks that your tenants send you.

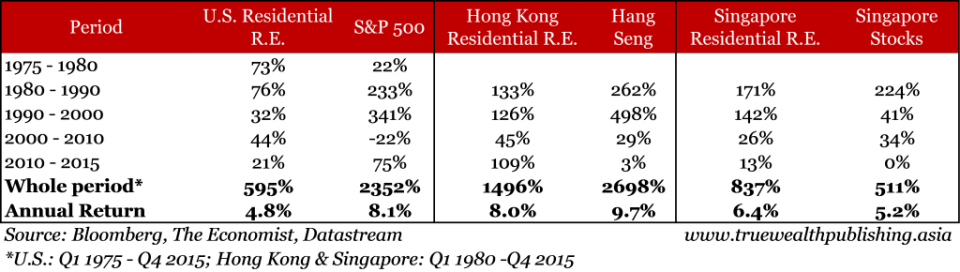

But owning a house or apartment, or several of them, often generates returns that are lower than those of the stock market. The chart below shows the long-term returns for the Singapore, Hong Kong and U.S. housing and stock markets. (Stock market results do not include dividends, and housing prices are nominal returns.)

The U.S. and Hong Kong stock markets win hands down when compared to house prices over time. It’s only in Singapore where owning a house instead of stocks has made more money.

The U.S. stock market rules

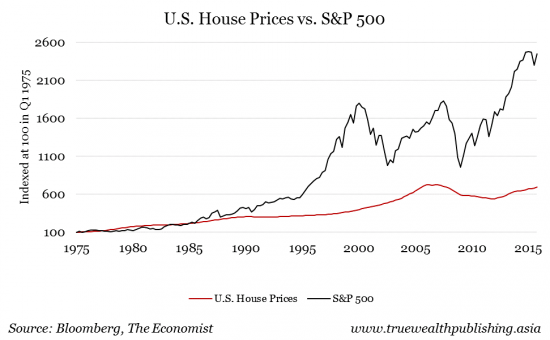

For the U.S. market, the results aren’t even close. The S&P 500 has averaged an 8 percent annual return since 1975. U.S. house prices have earned just 4.8 percent a year since 1975. In fact, over nearly every decade, the S&P 500 does better than housing.

The only decade when housing did better encompassed the recent housing bubble, from 2000 to 2010. Even accounting for the sharp decline in the last two years of that period, U.S. housing prices still outperformed the S&P 500 for the decade.

So far this decade, the U.S. stock market is ahead once again. And for the past 40 years, it would have earned you almost 4 times as much as U.S. residential real estate.

Hong Kong – stocks win again

Hong Kong house prices have done much better than U.S. housing prices (Hong Kong house price data since 1980). But since 1980, Hong Kong real estate (up about 1,500 percent over the period) has trailed Hong Kong’s Hang Seng stock index (up nearly 2,700 percent).

And only since 2000 have Hong Kong house prices started to catch up to stock market performance. During the 1980s and 1990s the stock market was unbeatable. Since 2000, Hong Kong housing has performed much better.

But residential real estate has beaten stocks in Singapore

Since 1980, Singapore real estate has generated better returns than Singapore-listed stocks. It’s the exception in the three markets we looked at.

Singapore house prices have averaged 6 percent annual returns since 1980; stocks have only returned 5 percent a year (based on data from Datastream and the Straits Times Index). But stocks did better than housing in the 1980s and the 2000s. It was Singapore’s hot property market in the 1990s that made the difference. But so far this decade, neither house prices nor stock prices have done well.

Real estate should be part of a well-diversified portfolio. But not at the cost of investing in shares.

This article was first published by Kim Iskyan at Truewealth Publishing, an independent investment research firm focused on taking the mystery out of finance and investing. We want to empower investors to make better and more profitable investment decisions on their own.

Want to receive first-hand information about new announcements and events from us? Or simply looking for more exclusive content that are not available on our website? Subscribe to our free e-newsletter to get insider access to activities, articles and promotions. We will only send you stuff that we too would be interested to know. Follow us on Instagram @DNSsingapore and Facebook @DollarsAndSenseSG to get your daily dose of finance inspirations through photos and articles.

The post Which Performs Better, Real Estate Or Stocks? The Answer Might Surprise You appeared first on DollarsAndSense.sg.