Philippine Stocks in Best Run Since 1998 Are Asia’s Highlight

By Ian Sayson

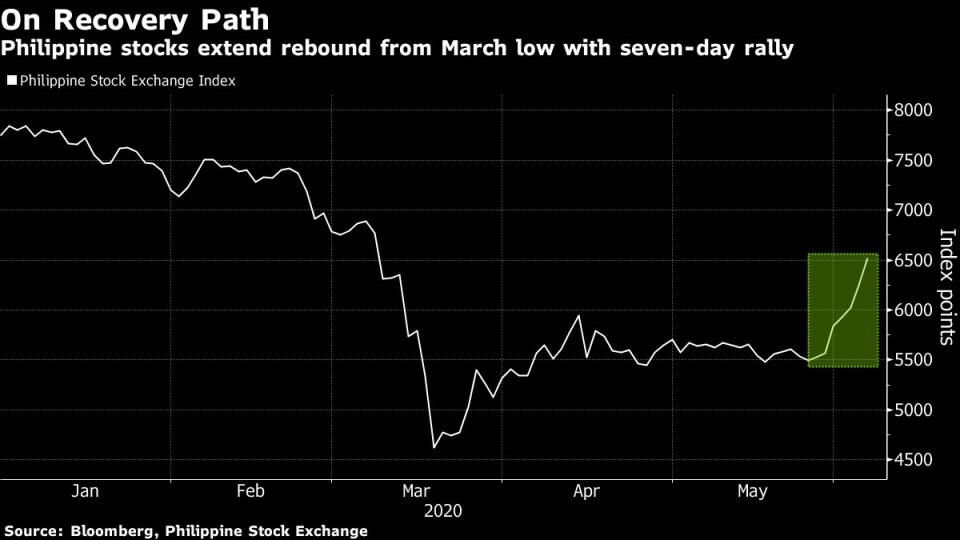

Philippine stocks climbed the most in Asia, rounding their best seven-day rally in more than two decades, on optimism the economic fallout from the coronavirus outbreak won’t be as bad as feared after the central-bank governor said monetary-easing steps were appropriate.

The Philippine Stock Exchange Index climbed as much as 4.4% on Thursday, taking its seven-day rebound to almost 19%. The peso advanced to 50 against the U.S. dollar for the first time since January 2018 as central-bank governor Benjamin Diokno signaled a pause in interest-rate cuts.

The nation’s shares have joined a global rally on hopes that the economic recovery after the coronavirus outbreak will be quick. The Philippine index has rebounded 41% from a low in March, and foreign investors are back to pouring money in the country’s equity funds this month. They bought $27 million worth of shares Thursday, the most since February.

“It’s being driven by optimism from the reopening of economies around the world, not only the Philippines,” said Japhet Louis Tantiangco, an analyst at PhilStocks Financial Inc. “Momentum is building up. Investors are focused on the prospects of a recovery,” shrugging off geopolitical risks between U.S. and China.

The Philippine stock index could return to 8,000 as early as 2021 should the economic reopening be sustained, according to Phillip Hagedorn, chief investment officer of ATR Asset Management Inc. Corporate earnings could grow 25% next year after a contraction in 2020, he added.

The Philippine peso gained 0.2% against the U.S. dollar Thursday, climbing the most among Asian currencies. The nation’s 10-year bond yield was little changed at 3.28%, after rising for a third day on Wednesday.

Investors shifting to risk-on sentiment globally has weakened demand for the U.S. dollar as a safe haven, driving the peso’s appreciation, according to Miguel Liboro, head of fixed income at ATR Asset. The Philippine currency could see “a bit of volatility in the short term” as fund flows look speculative, he said.

“At current levels yields are more or less fairly valued given how much the Bangko Sentral has responded so far,” Liboro said, referring to bonds. “We expect yields to move a little bit higher over the short term.”

Expectations for a shorter economic contraction are building up since lockdowns in Manila and neighboring areas have started to ease on June 1. A sustained climb for the Philippine index above 6,100 is a signal that “the rally has still some gas to test the 6,500” and try to break 6,600, said Jonathan Ravelas, a strategist at BDO Unibank Inc.

Shares of retailer SM Investments Corp. contributed the most to Thursday’s rally, while GT Capital Holdings Inc., Robinsons Land Corp. and International Container Terminal Services Inc. gained the most, rising more than 10%. A total of 23 of the benchmark gauge’s 30 members climbed.

“This reopening comes with risk that infections will further spread as we allow more movements,” Tantiangco said. “The longer this rally goes on the more susceptible it is to profit taking.”

© 2020 Bloomberg L.P.