Prepare for Golds Next Big Breakout

Talking Points:

Gold is consolidating, providing opportunities to trade a breakout

Flag patterns are easily identified and can be an asset to breakout traders

Entries should be set under support, in the event gold moves to lower lows

Gold (XAU/USD) has concluded the trading week consolidating in a pricing range. However, as price consolidates this allows breakout traders the opportunity to prepare for the markets next big move! Today we will review how to identify a flag pattern and trade how to trade them using a breakout based strategy. Let’s get started!

Find The Flag

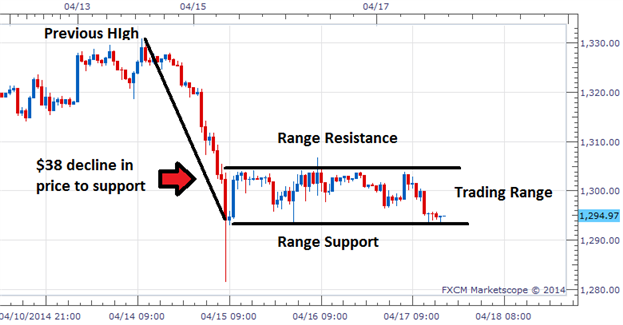

Once you know what to look for, a bearish flag pattern is easy to identify. The pattern is comprised of two specific parts. First traders need to identify the flag pole. This area is identified on the graph as prices initial decline. This decline can be steep or slowly sloping and will establish the basis for our trend. Next we need to identify the flag. The flag is found at the end of the initial decline and is denoted by a period of consolidation. Normally this consolidation is either represented by a trading range or channel. Let’s look at today’s example using the gold graph below.

First the flag pole is identified by connecting the previous swing high at $1,331 to price support at $1,293. It should be noted that the difference between these points is $38. From here price begins to consolidate in a range between resistance near $1,305 and previously mentioned support. Once these two areas have been identified, traders can then prepare for gold’s next potential breakout.

Learn Forex: Gold 1Hour Bearish Flag

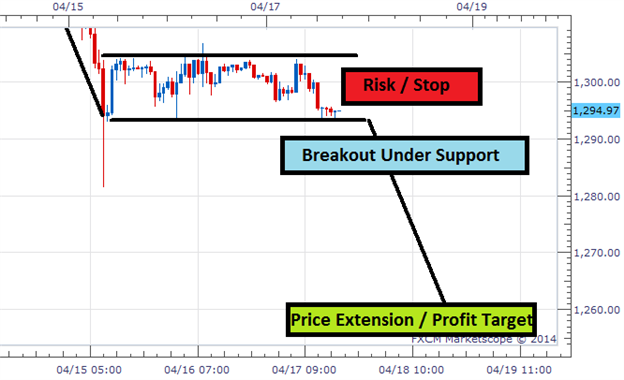

Time The Breakout

Bearish flag patterns are considered bearish continuation patterns. This means traders will use the opportunity of a price decline to sell a breakout of the aforementioned level of price support. The easiest way to accomplish this is to set an entry order under support. This way in the event of a breakout, the entry order will be triggered at the prevailing available price. Also, in the event that price continues to range, or if resistance is broken instead of support, traders can simply delete their pending order.

Learn Forex: Breakout & Entry Orders

Price Targets & Risk

Lastly breakout traders will need to identify price targets and manage risk. Price targets for bearish flag patterns are easily identified using the structure of the pattern itself. Traders should first measure the distance from the previous swing high down to range support. In the example on the gold graph above, this distance is a measured change of $38 dollars an ounce. This value can now be subtracted from our support line to find potential profit taking points on the graph.

As with any trading strategy, traders must have a plan of action for risk management. Traders can consider placing stop orders inside of the trading range of the identified flag pattern. This way in the event of a false breakout trades will be exited at the first convenience.

Now that you are familiar with bearish flag patterns and breakouts, you can use them to find trading opportunities. You can get started following prices for gold and your favorite currency pairs such as the EURUSD with a Free Forex Demowith FXCM. This way you can develop your trading skills while tracking the market in real time!

---Written by Walker England, Trading Instructor

To contact Walker, emailwengland@fxcm.com. Follow me on Twitter at @WEnglandFX.

To be added to Walker’s e-mail distribution list,CLICK HEREand enter in your email information

DailyFX provides forex news and technical analysis on the trends that influence the global currency markets.

Learn forex trading with a free practice account and trading charts from FXCM.