The Pros and Cons of Investing in Art

Noticed the global economy lately? Stocks are performing like horse drawn carriages in the Monaco Grand Prix. Investors are now looking for alternatives, and one of these is art. Since the closest I’ve come to culture is using a Mona Lisa postcard as a beer coaster, I’ve harassed local art collectors about the pros and cons of art investment. If you have some disposable cash lying around, you might want to consider this sophisticated option:

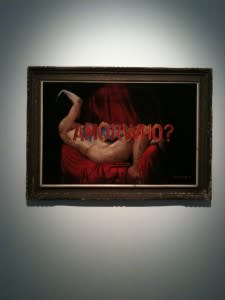

So this is like, an analogue version of Photoshop?

1. Why Are People Investing in Art?

The surge of interest started in 2011, when art investors saw returns of around 11% to 14%. That was also the second consecutive year that art outperformed equities.

Mind you, the art market’s cooled down a bit. The 2011 surge was fueled by China trying to buy back it’s culture from the West (which, frankly, is as stupid as America trying to buy back it’s culture by importing Clint Eastwood DVDs). The good news is that, even with the slowdown, fine art investments are providing solid returns.

I asked Malaysian collector Peter Lok about it:

The Pros of Art Investment

The pros of art investment are:

Blue Chip Art is a Hedge Against Inflation

Fast to Rise, Slow to Fall

More Accessible Than You Think

Investing in What You Actively Enjoy

Let’s just say the less Ryan gets it, the more it’s probably worth.

Blue Chip Art is a Hedge Against Inflation

Blue chip art refers to famous or established art pieces. Names like Rembrandt, Modigliani, Velazquez, etc. come to mind.

“If you do your homework and you’re ‘in the system’, art is a great hedge against inflation,” Peter Lok says, “Blue chip art is tangible asset, and appreciates faster than inflation.”

However, Peter emphasizes the term “blue chip” art. Pieces by an emerging artist might “rise meteorically for a while, then flatten out. You really need to take an interest, and learn to separate the artists of the moment from the artists of the ages.“

Different types of art appreciate at different rates. Peter mentions that expressionist and surrealist art (which he prefers) appreciate at about 5% to 6% per year.

Fast to Rise, Slow to Fall

Art is not not an equity. There are no volatile price changes on a daily basis. And because an art piece isn’t a company that can go bust, sharp plummets are rare:

“A stock can plummet and become worthless overnight. This seldom happens with art,” Peter says, “When art loses value, the process is a gradual one. An artist takes time to fall out of favour. But art prices have the potential to rise quickly when a new artist becomes popular.”

In Peter’s opinion, the tendency of art prices are “Potentially fast to rise, usually slow to fall.”

And by the time I noticed the wrong price tag, we had one millionaire and three bankrupts.

More Accessible Than You Think

So art investment is for rich people, right? I need to have a million bucks, sip champagne at galleries, and not mistake caviar for something that died on the crackers.

Peter assures me the truth is otherwise:”Most art investors don’t hang around in galleries and trade multi-million dollar artworks.”

Peter says an initial capital of $10,000 is enough to enter the market. If you want to be a daredevil, enter with $5,000, and hope the budding artists you buy from become superstars. This was apparently the case with countries like Brazil, China, and Indonesia back in 2010:

“I remember at one point, anything from Indonesia flew. I have one friend who bought a $2,000 piece from an Indonesian artist, and sold it for about $11,000 just months later.”

Investing in What You Actively Enjoy

If you love art, and you’re going to decorate your walls, you may as well buy like an investor. Treat it as part of your Interior Design costs.

“Rather than waste money on generic prints,” Peter suggests, “spend a bit more, do a bit of homework. Think of it as buying beautiful decorations, which have the added benefit of 5% appreciation. I think it’s more prudent than paying for expensive wallpaper or such decor.”

And if you fail at drawing, you can always be an Interior Designer. *Takes Cover*

The Cons of Art Investment

The cons of art investment are:

High Risk, High Returns

Not Completely Immune to Market Conditions

Illiquid Assets

Storage Issues

High Risk, High Returns

Art is not a low risk investment. While it’s possible for art investors to become sudden millionaires, it’s also possible they’ll end up with unsaleable junk (outside of blue chip art).

Peter says: “In particular, pop art seems attractive because the way its value can suddenly spike, but you’re taking a chance. Pop art is based on trends, and your investment might come to nothing.”

Peter also warns that: “Valuation of art is dependent on its history of transactions. When you buy from a new artist, that transaction history doesn’t exist. So if you invest in emerging artists, you are dealing with arbitrary prices.”

Overall, this is the sort of investment you make with a spare $5,000 to $10,000. Unless you can afford to buy something on the level of The Night Watch, art assets should not be a retirement plan.

Other things not immune to market conditions include paint costs, patrons, and artists’ stomachs.

Not Completely Immune to Market Conditions

As we’ve said before, quality art tends to hold its price even on a downtrend. However, this does not mean art will never fall in value. Peter mentions that:

“In the years after 2008, some pieces fell by as much as 50%. So the impact was slower, but it was still there.”

Illiquid Assets

The biggest drawback to art is its illiquid nature. It’s hard to sell a painting on the spot. Peter complains that:

“The process of selling a piece can be quite long and involved. And if you go through auction houses and such, there are additional fees to be paid for the sale. So do not think that art is something you can “flip”. Don’t imagine you can buy today and resell at twice the price next year.”

Peter also mentions that art is not a cash-generating asset. “Not unless you run a gallery”.

I can’t fit it into the backpack, I’m just gonna fold this thing…

Storage Issues

For most Singaporeans, the problem of art investment is space.

“Singaporean homes are just not that big,” Peter says, “And our damp, hot climate is quite bad for paintings. If you hang a painting facing a window, or right under an air-con, you will destroy it. If you blast it with the wrong lighting, it will fade. So these are additional precautions you have to take.”

Still, don’t forget the pros. If you’re doing up your new house, why not spend a bit more and turn the decor into investments? Think about it. And for more on investments, follow us on Facebook!

Image Credits:

Marshall Astor, See-ming Lee, nimbu, edwin.11, Seth Tisue

Get more Personal Finance tips and tricks on www.MoneySmart.sg

Click to Compare Singapore Home Loans, Car Insurance and Credit Cards on our other sites.

More From MoneySmart