Quest Diagnostics' (DGX) Q3 Earnings Beat, Base Volume Rises

Quest Diagnostics Incorporated’s DGX third-quarter 2020 adjusted earnings per share of $4.31 beat the Zacks Consensus Estimate by 14.9%. Adjusted earnings surged 144.9% from the year-ago number.

Certain one-time expenses like the ones related to the COVID-19 pandemic and their resultant impact of 39 cents; amortization expenses and certain restructuring and integration charges were excluded from the quarter’s adjusted figures.

GAAP earnings from continuing operations came in at $4.14 per share, marking a 165.4% decline from the year-ago quarter.

Reported revenues in the third quarter improved 42.5% year over year to $2.79 billion. The same beat the consensus estimate by 1.17%.

Quarterly Details

Volumes (measured by the number of requisitions) improved 19.7% year over year in the third quarter (up 16.6% organically). Revenue per requisition however improved 20.9% year over year.

Diagnostic information services revenues in the quarter were up 44.3% on a year-over-year basis to $2.71 billion.

Margins

Cost of services during the reported quarter was $1.58 billion, up 25% year over year. Gross margin was 43.3%, reflecting expansion of 791 basis points (bps) from the year-ago figure.

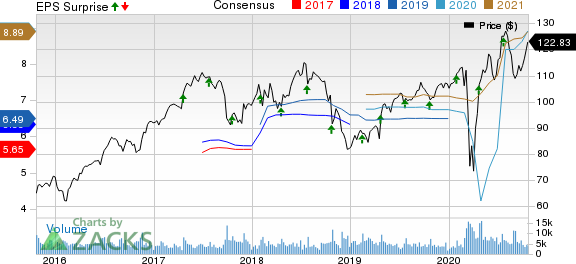

Quest Diagnostics Incorporated Price, Consensus and EPS Surprise

Quest Diagnostics Incorporated price-consensus-eps-surprise-chart | Quest Diagnostics Incorporated Quote

Selling, general and administrative expenses increased 9.4% to $396 million in the quarter under review. Adjusted operating margin of 29.1% represented a 1220-bps expansion year over year.

Cash, Capital Structure and Solvency

Quest Diagnostics exited the third quarter of 2020 with cash and cash equivalents of $1.61 billion compared with $988 million at the end of the second quarter. Cumulative net cash provided by operating activities through the second quarter was $1.46 billion compared with $895 million in the year-ago quarter.

In the three months ended Sep 30, 2020, the company did not repurchase any shares of its common stock. At the end of the third quarter, $1.2 billion remained available under the company's existing share repurchase authorizations. However, Quest Diagnostics has temporarily suspended additional share repurchases under the existing authorization through the end of 2020.

2020 Guidance Updated

The company updated its 2020 projection.

Currently, the company expects to report full-year net revenues in the range of $8.8 billion to $9.1 billion, an expected 13.9% to 17.8% growth from the year-ago reported figure (earlier prediction was $8.4 billion to $8.8 billion, implying 8.7% to 13.9% growth). Full-year adjusted EPS is projected in the range of $9.00 to $10.00 (earlier range was $7.50 to $9.00).

The current Zacks Consensus Estimate for full-year adjusted earnings is pegged at $8.91 while the same for revenues stands at $8.80 billion.

Full-year operating cash flow is expected to be at least $1.75 billion (unchanged). Capital expenditures are expected to be $400 million (compared with the earlier range of $375 million to $400 million).

Our Take

Quest Diagnostics reported better-than-expected third-quarter figures. Strong year-over-year improvement in adjusted earnings and as well as revenues was encouraging. Management noted strong signs of the health care system returning to pre-pandemic levels with base testing volume gradually improving. Updated full-year outlook also looks impressive implying further rebound in base business organic volume ahead.

Zacks Rank & Key Picks

Quest Diagnostics currently carries a Zacks Rank #3 (Hold).

Some better-ranked stocks in the broader medical space are IDEXX Laboratories IDXX, Insulet PODD and Quidel QDEL.

The Zacks Consensus Estimate for IDEXX’s third-quarter 2020 revenues is pegged at $666.7 million, suggesting year-over-year improvement of 10.1%. The same for EPS stands at $1.41, indicating growth of 13.7% from the year-ago reported figure. The company currently carries a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

The Zacks Consensus Estimate for Insulet’s third-quarter 2020 revenues is $220.9 million, implying a 14.9% increase from the year-earlier reported figure. The company currently sports a Zacks Rank #1.

The Zacks Consensus Estimate for Quidel’s third-quarter 2020 revenues is pegged at $476.1 million, suggesting year-over-year improvement of 276.4%. The same for EPS stands at $4.58, indicating growth of 554.3% from the year-ago reported figure. The company currently sports a Zacks Rank #1.

Breakout Biotech Stocks with Triple-Digit Profit Potential

The biotech sector is projected to surge beyond $775 billion by 2024 as scientists develop treatments for thousands of diseases. They’re also finding ways to edit the human genome to literally erase our vulnerability to these diseases.

Zacks has just released Century of Biology: 7 Biotech Stocks to Buy Right Now to help investors profit from 7 stocks poised for outperformance. Our recent biotech recommendations have produced gains of +50%, +83% and +164% in as little as 2 months. The stocks in this report could perform even better.

See these 7 breakthrough stocks now>>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Quest Diagnostics Incorporated (DGX) : Free Stock Analysis Report

Quidel Corporation (QDEL) : Free Stock Analysis Report

IDEXX Laboratories, Inc. (IDXX) : Free Stock Analysis Report

Insulet Corporation (PODD) : Free Stock Analysis Report

To read this article on Zacks.com click here.