Questor: after we all loaded up on lockdown pizza, Domino’s is back in expansion mode. Buy

Lockdown was good for food delivery, even for those companies where colleagues had become used to sinking their teeth into one another. At Domino’s Pizza, the battle between management and some of its store franchisees has been as heated as a large Pepperoni Passion in recent years.

At its heart is a row over how fast Domino’s opens new branches, while the local entrepreneurs who prepare and deliver the takeaways press for a greater share of profits. All told, it meant that David Wild’s tenure as chief executive, which ended in May, was the stuff of kitchen nightmares.

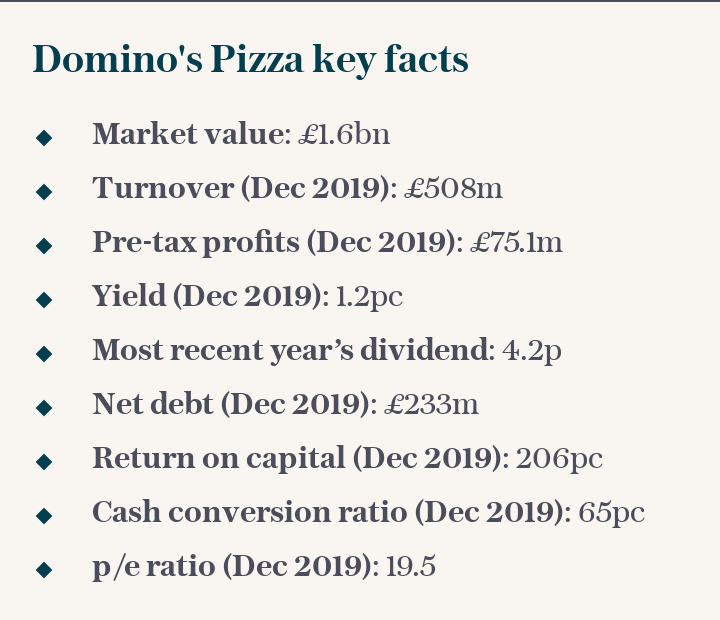

Setting their differences aside during the pandemic benefited everyone. London-listed Domino’s, which holds a master franchise for the American brand in Britain and Ireland, reported a 3.7pc increase in underlying sales in the UK in the first half of the year, twice the rate of growth at the same stage in 2019.

Pizza collection was suspended for some time and order volume was down, but that was offset by a larger average order size as hungry householders clicked on garlic bread and chicken strippers.

The group soaked up the £6.2m cost of supplying personal protective equipment to staff.

Sign up to our Business Briefing newsletter for a snapshot of the day's biggest business stories

Read Questor’s rules of investment before you follow our tips

Food collection saves Domino’s petrol and so is typically more profitable, but franchisees have gained from offering a simpler menu, as well as from business rates relief and a reduction in VAT to 5pc that runs until January. Analysts at Peel Hunt, the broker, have pencilled in £170,000 of earnings per store this year, a 17pc rise compared with last year.

This boost could pave the way for a long-term thaw in relations. That is the hope of Domino’s new management line-up, completed last week when Neil Smith, stand-in finance director, joined the board permanently. Alternatively, it could spell more bad blood if returns in 2021 don’t match this year’s.

For now, tails are up, as the announcement of 5,000 new jobs and 1,000 apprenticeships demonstrated. Trading appears encouraging despite the Eat Out to Help Out drive that urged people to leave their homes. In the medium term, Domino’s could benefit from the economic stress that will mean fewer high street restaurants.

It remains bullish about competing with takeaway apps such as Deliveroo and Just Eat, hoping that maintaining control of its supply chain, including regional food centres in Warrington and Milton Keynes, where pizza dough and toppings are prepared, is a plus. That’s fine, as long as diners aren’t craving a curry or some noodles.

The lack of accord with franchisees has been a brake on the shares, which are down slightly since Questor said in June 2018 that they were worth holding despite some challenging top-line growth. If Dominic Paul, the chief executive, can get them on side, Domino’s could switch to expansion mode once again.

Currently, it is treading carefully by adding about 20 outlets each year. The 1,150-strong estate in Britain is a long way from the 1,600 takeaways management once thought possible. Also in the in-tray for Mr Paul, who used to run the Costa coffee chain, is finding a buyer for operations in Sweden, Switzerland and Iceland, the distracting remnants of overseas misadventure.

With some additional Covid-related costs flagged for the second half, Numis, the joint house broker, trimmed 4pc from its pre-tax profit forecast last month. But Domino’s will still come in within £3m of its 2019 figure.

That progress will please Browning West, the hedge fund that has a 9pc stake and whose founder, Usman Nabi, joined the board last November. Reported net debt of £202m was flattered because the final dividend, worth £26m, was sensibly deferred until last Friday. Borrowings are typically twice covered by earnings, which looks about right.

The company bought back £16m of shares last year, but none so far in 2020.

Domino’s shares trade on 21 times this year’s forecast earnings, which is lower than their historical average and sharply cheaper than the company’s American equivalent. Picking a path forward is not as simple as picking your favourite topping but assuming relations continue to warm, it is worth cutting a slice of Domino’s.

Questor says: buy

Ticker: DOM

Share price at close: 341.8p

Read the latest Questor column on telegraph.co.uk every Sunday, Tuesday, Wednesday, Thursday and Friday from 6am.