Red Rock Resorts (RRR) Q2 Earnings Beat Estimates, Stock up

Red Rock Resorts, Inc. RRR reported second-quarter 2020 results, wherein earnings and revenues surpassed the Zacks Consensus Estimate. However, the top and the bottom line declined on a year-over-year basis.

Although the pandemic severely impacted the company’s operations during the second quarter, the company’s Las Vegas properties witnessed solid performance post-reopening from Jun 4 through Jun 30, 2020. Adjusted EBITDA during this period increased 46.8%, while adjusted EBITDA margin increased 2,192 basis points to 45.9%. Following the results, shares of the company inched up 2.1% during after-hour trading on Aug 4.

Earnings & Revenues

In the quarter under review, adjusted loss per share came in at $1.01, narrower than the Zacks Consensus Estimate of a loss of $1.04. In the prior-year quarter, the company had reported adjusted earnings of 13 cents per share.

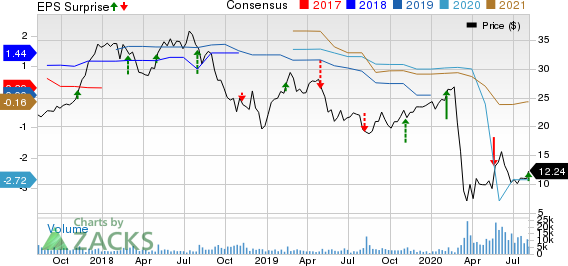

Red Rock Resorts, Inc. Price, Consensus and EPS Surprise

Red Rock Resorts, Inc. price-consensus-eps-surprise-chart | Red Rock Resorts, Inc. Quote

Revenues during the quarter totaled $108.5 million, beating the consensus mark of $82 million by 32.3%. However, the top line declined 77.5% on a year-over-year basis primarily because of the temporary closure of all properties owing to the coronavirus outbreak.

Segmental Details

Las Vegas Operations: Revenues at this segment totaled $101 million, down 77.9% year over year primarily due to the temporary closure of all of the company's Las Vegas properties. Also, adjusted EBITDA declined 111.4% from the prior-year quarter’s figure to ($12.1) million.

Native American Management: Revenues at the segment declined 74.9% to $5.9 million. Meanwhile, adjusted EBITDA declined 76.3% from the prior-year quarter’s figure to $5.2 million, mainly due to the temporary closure of Graton Resort.

Other Financial Details

As of Jun 30, 2020, Red Rock Resorts had cash and cash equivalent of $270.1 million. Outstanding debt at the end of the second quarter was $3.3 billion.

Zacks Rank & Key Picks

Currently, Red Rock Resorts carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Some better-ranked stocks in the Zacks Consumer Discretionary sector are Monarch Casino & Resort, Inc. MCRI, YETI Holdings, Inc. YETI and Pool Corporation POOL, each sporting a Zacks Rank #1.

Earnings in 2021 for Monarch Casino are expected to surge 1033.4%.

YETI Holdings has a three-five-year earnings per share growth rate of 16.2%.

Pool Corporation has a trailing four-quarter earnings surprise of 16%, on average.

Biggest Tech Breakthrough in a Generation

Be among the early investors in the new type of device that experts say could impact society as much as the discovery of electricity. Current technology will soon be outdated and replaced by these new devices. In the process, it’s expected to create 22 million jobs and generate $12.3 trillion in activity.

A select few stocks could skyrocket the most as rollout accelerates for this new tech. Early investors could see gains similar to buying Microsoft in the 1990s. Zacks’ just-released special report reveals 8 stocks to watch. The report is only available for a limited time.

See 8 breakthrough stocks now>>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Pool Corporation (POOL) : Free Stock Analysis Report

Monarch Casino Resort, Inc. (MCRI) : Free Stock Analysis Report

Red Rock Resorts, Inc. (RRR) : Free Stock Analysis Report

YETI Holdings, Inc. (YETI) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research