The rise of China’s cashless society: Mobile payments trends in 2017

A new research was published to illustrate how mobile payments are becoming a part of Chinese people’s everyday life

The rise of China’s cashless society: Mobile payment trends in 2017 was written by Masha Borak for TechNode.

After Alibaba declared the first week of August “Cashless Week” and WeChat answered by naming August 8 “Cashless Day” and this entire month “Cashless Month,” a new research was published to illustrate how mobile payments are becoming a part of Chinese people’s everyday life.

The Tencent Research Institute along with Ipsos research group and the Chongyang Institute for Financial Studies at Renmin University of China (RDCY) have analysed the penetration and trends of cashless payments in China. The research titled “2017 Mobile Payment Usage in China” published by China Tech Insights is based on WeChat Pay data and an online survey of 6,595 respondents. Here are some of their key insights.

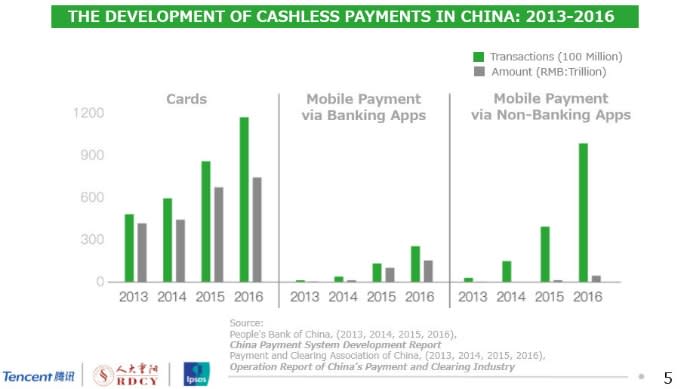

1. Mobile payments have skyrocketed in 2016

Image credit: 2017 Mobile Payment Usage in China Report

Cash is so 2015, according to the Tencent Research Institute. Last year, Chinese consumers spent US$5.5 trillion through mobile payment platforms, about 50 times more than their American counterparts.

More than half (52 per cent) of WeChat users said they conduct less than 20 per cent of their monthly transactions with cash. The post-’80s generation is the leader in cashless transactions: 53 per cent of them said they spend less than one fifth of their money in cash each month. Even the older generation are joining the trend—45 per cent members born in the ’60s saying that they use cash less than 20 per cent of the time.

Also Read: Lessons from a failed mobile payments startup in Singapore

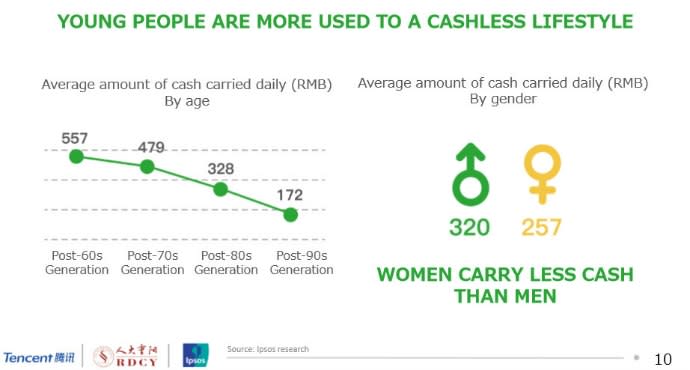

2. Young people (especially women) are leading the cashless trend

Image Credit: 2017 Mobile Payment Usage in China Report

Looking at the graph, it is easy to imagine that cash will become a relic of the past for today’s teenagers. The study cited WeChat users saying that they only pay with cash when no other payment methods are available (73 per cent) or during small transactions (46 per cent).

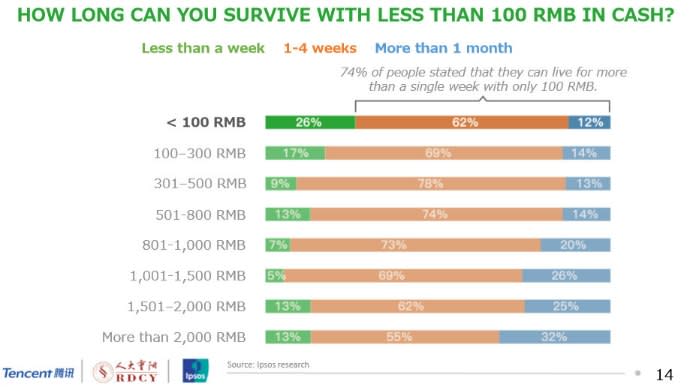

3. Chinese have almost no money in their wallet—and they don’t care

Image Credit: 2017 Mobile Payment Usage in China Report

They are also not worried about going into the world without cash – 86 per cent said that they felt calm without cash because they can use mobile payments. Only 12 per cent interviewees said they would be concerned if their wallet was empty, while four per cent said that was unacceptable for them.

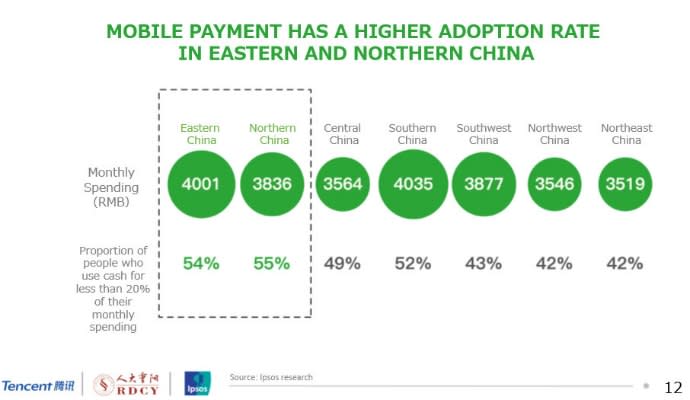

4. Geographical differences are small, but the rural-urban divide is still an obstacle

Image Credit: 2017 Mobile Payment Usage in China Report

When it comes to geography, mobile payments have won almost all of China. Eastern and Northern China have the highest adoption rate, while the lowest is in Northeast and Northwest China.

Likewise, when it comes to adopting a cashless lifestyle, people in the Eastern and Northern China region are the most accepting with 87 per cent and 85 per cent interviewees respectively stating they would feel fine with no cash. Northwest and Northeast China are least enthusiastic about going cashless – 79 per cent and 74 per cent users respectively claim that empty wallets wouldn’t bother them.

Also Read: Blockchain-enabled mobile payments startup Coins.ph raises US$5M led by Naspers; claims 1M customers

However, data also shows that rural and county-level areas which host 30 per cent of all users are lagging behind in going cashless. The penetration rate of mobile payments in rural areas is 17 per cent, while in county-level towns that number is 19.6 per cent. The reason behind this is a higher number of seniors who have different spending habits.

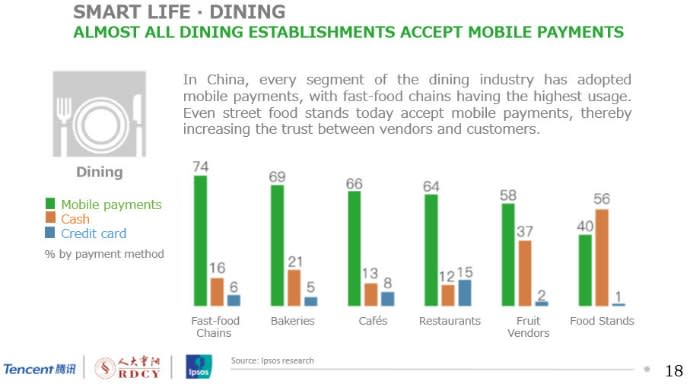

5. Mobile payments have conquered the service industries

Image Credit: 2017 Mobile Payment Usage in China Report

Dining, retail, entertainment, and travel – these are areas that excel in mobile payment. The food industry had highest penetration rates, but other areas are quickly joining the trend. Here are the rest of the statistics:

In retail, convenience stores are the highest-frequency sector for mobile payments with a 68 per cent accepting mobile payment methods, followed by supermarkets (63 per cent), and malls (62 per cent).

For entertainment, mobile payments are most popular when purchasing movie tickets (70 per cent), Karaoke bars come in second place (60 per cent), while beauty salons come third (52 per cent).

When it comes to travel, mobile payments have become routine paying method for taxis (62 per cent), hotels (57 per cent), and tourist attractions (56 per cent).

Also Read: Berrybenka MD steps down to lead Telkomsel’s mobile payment arm Tcash

6. Social credit systems are here to stay

Image Credit: 2017 Mobile Payment Usage in China Report

This week, Tencent started testing its credit rating system which put them in direct competition with Alibaba’s Sesame Credit, the dominant mobile credit score.

According to the research, mobile payments can help lower the entry barrier to financial services by enabling individuals who lack collateral or credit records to accumulate credit worthiness via mobile payment data from everyday life.

—

The article The rise of China’s cashless society: Mobile payment trends in 2017 first appeared in TechNode.

The post The rise of China’s cashless society: Mobile payments trends in 2017 appeared first on e27.