Sunak's £30bn spending spree set to save 2m jobs

Rish Sunak’s spending spree could be enough to save as many as two million jobs, economists said, as up to £30bn of support will stop some workers being laid off and should encourage businesses to hire more staff.

However, it will not be able to negate the entire economic impact of the pandemic lockdown recession, with unemployment still expected to rise when the furlough scheme winds down in the coming months.

Companies will get a £1,000 bonus for every furloughed worker that they are still employing in January.

A "kickstart scheme" offers £2bn for workplaces, covering the minimum wage for 25 hours a week for six months businesses taking on under-24s at risk of long-term unemployment. And employers will get £2,000 for every new apprentice aged under 25 and £1,500 for each one aged over 25.

“Our plan has a clear goal: to protect, support and create jobs. It will give businesses the confidence to retain and hire. To create jobs in every part of our country. To give young people a better start. To give people everywhere the opportunity of a fresh start,” the Chancellor said.

Economists cheered the plan as a good start to supporting jobs and businesses as the economy cautiously reopens.

The Institute for Employment Studies called it “a how-to kit for dealing with consequences of a big recession” with the £1,000 bonus “particularly well targeted at supporting lower paid workers at risk of job loss”.

“Even with these announcements, we will almost certainly see unemployment rising above 3m in the coming year to levels that we have not seen since the 1980s,” the Institute said. “But with today’s measures there is a good chance that we can avoid it reaching the 4m or 5m that many of us had feared.”

Combined with subsidies for cafes and restaurants, a VAT cut for hospitality, lower stamp duty and support for energy saving home improvements, economist Kallum Pickering at Berenberg Bank said the Chancellor’s plans “pack a sizeable punch and support higher private spending with significant implications for hard hit sectors such as construction, housing and hospitality”.

Lobby groups welcomed the action but said more will be needed.

"Businesses will celebrate many of the Chancellor’s announcements today, although it is likely that the scale of the stimulus needed to help the UK economy restart, rebuild and renew will need to be greater still over the coming months,” said Adam Marshall, director-general of the British Chambers of Commerce.

A key risk is that large numbers of furloughed workers will be laid off if their employers have not recovered enough by October when the scheme ends.

Chris Sanger, head of tax at EY, pointed out that the furlough retention bonus of £1,000 amounted to £333 a month per employee kept on after the closure of the furlough scheme. That is far below the £2,500 in support enjoyed until the end of this month and would be "unlikely to affect many redundancy decisions”.

He said: "It is a much smaller amount. It signifies the Treasury moving from looking to support businesses to looking to stimulate the economy. It does not seem to be enough to dampen the hit of the furlough ‘cold turkey’ come the end of October."

Jonathan Geldart, head of the Institute of Directors, warned that some parts of the economy have missed out altogether.

“A glaring omission throughout this pandemic has been the exclusion of small company directors, many of whom have not been able to access income support," he said. "Widening grant schemes could help those who have been left struggling without assistance, and help more firms to re-open.”

The spending spree takes support measures since March to almost £190bn, which risks building up longer-term problems as the national debt ramps up.

"These measures are likely to push the deficit further above £300bn, which would be easily the highest as a share of national income since the Second World War," said Carl Emmerson at the Institute for Fiscal Studies.

"Of course this additional borrowing is all currently being borrowed at very low interest rates. What matters more for the public finances will be the extent to which the economy manages to bounce-back strongly. If, as is likely, the economy does not fully recover then future fiscal events are likely to involve a less pleasant set of announcements over the extent to which taxes need to rise to restore the health of the public finances."

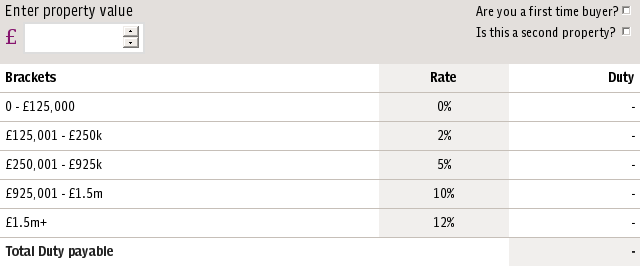

Mr Sunak also announced that the threshold for paying stamp duty will be raised to £500,000 until March, saving home buyers up to £15,000.

“The immediate stamp duty cut will certainly create a buzz among buyers, sellers and housebuilders,” said Emma-Lou Montgomery at Fidelity. “The big question is whether this will be enough to get the market moving. A lack of consumer confidence is likely to be the biggest challenge for the government.”