Pay-as-you-go car insurance – how British drivers could save thousands every year

The traditional system of car insurance is complex and often results in drivers paying a higher premium, based on generalised claim patterns rather than their personal driving record.

From the actuaries, to the brokers and adjusters, there are between five and nine degrees of separation between the insurance underwriter and the customer. As each agent layers his fee on to the transaction, the eventual cost to drivers inevitably rises.

However, thanks to developments in cloud-based data collection and processing technologies, it doesn’t have to be this way. There is now an opportunity to not only reduce the middlemen, but also introduce “hyperflexible” insurance, both more affordable and more personalised than ever.

Hyperflexibility in this case means the application of pricing models we’re seeing everywhere now. From pay-as-you-go gym passes and on-demand food delivery, to hail-where-you-are taxi and smart-energy apps, all these services are designed to maximise convenience and minimise cost and wastage. It’s usage-based, meaning you only pay when you use the service.

Launched in 2016, Cuvva combines usage-based insurance with hyperflexibility. Its first product, Cuvva For Sharers, allows drivers to buy hourly insurance via a smartphone app. Of course, short-term insurance is nothing new. Comparison site Tempcover, insurer DayInsure and even heavyweights such as Admiral give drivers a range of prices for daily and hourly car insurance. The newcomer seems competitive on paper, but is it price alone that makes it so appealing?

The three-minute registration process saves driver and payment card information. To protect against fraud, you snap a photo of yourself and your licence initially, then the vehicle each time you use Cuvva. I found it’s a quick and easy way of accessing fully comprehensive cover for activities such as test driving a vehicle you’re looking to purchase, infrequent use of a friend’s car or even an emergency.

In April, Cuvva had launched its second product, For Owners, with claims of saving some drivers about 70 per cent on their annual policies.

Loren Gould, head of growth at Cuvva, said: “Youngsters pay through the roof, prices fall in the ‘golden years’ of 40 to 60, only to rise again as drivers’ faculties supposedly deteriorate. We aim to reduce the cost of insurance for people who commute via other means, yet have a car for occasional use.”

Using Cuvva For Owners, occasional drivers pay a lower subscription on a monthly basis then “top-up” the cover for only the hours they use the car.

Gould adds: “From students returning home, to children visiting parents or grandparents, there’s an immediate need to be covered on someone else’s car without spending a lot of time trying to get insured or a lot of money for the time you’re not actually driving.”

It’s worth noting that Cuvva has a maximum vehicle value of £40,000, the car must be no more than 15 years old and drivers must be over 19 and have held a licence for at least a year.

The key to getting Cuvva to work for you lies in understanding exactly how many hours you drive each month. It clearly won’t work for everyone, but with a potential 73 per cent to be saved, that’s a calculation worth making.

Will you save? Case study 1

The prudent new businessman

Saving: 56 per cent

Jamie, 22, works from home. With amenities nearby – and no commute – he drives fewer than 16 hours a month.

After losing his previous job, he looked to trim the household budget as his 2004 Land Rover was costing £150 per month to insure.

Although he’s never had an accident, he has never accrued a no-claims bonus as he’s not owned a car for over a year.

He had used For Sharers while borrowing his sister’s car. Now he pays £15.62 a month and about £6.80 for two hours’ driving, costing roughly £66 a month.

His advice? “I generally buy an hour more than I need, in case of delays. That relieves the stress associated with trying to extend your usage while out and about.”

Will you save?

Case study 2: The regular commuter with infrequent visitors

Saving: 0 per cent

William, 34, commutes to work out of Oxford every day by car, doing the school run and dropping off his wife en route. He drives about 50 hours a month.

When his 2015 BMW M135i was due for renewal, his insurer quoted £1,100, which was reduced to £950 after he called to complain. However, after calling a broker and comparing against an internet search, the cheapest quote he found was £760, which his current insurer agreed to match.

William says: “When I work from home, my daughter gets the bus to school, so for freelancers I can see the appeal of Cuvva. The Sharers product seems a bit pricey, but the process is hassle-free.

“When my sister-in-law visited, it wasn’t easy to put her on my policy for a short period, although it was cheaper. I guess you have to consider the price you put on your time, too.

“The fewer hours you drive, the more appealing For Owners becomes.”

Had William not shopped around to get a significantly cheaper quote, Cuvva would have only been £100 more than the renewal quote from his current insurer.

Will you save?

Case study 3: The young city dweller

Saving: just under 73pc

Eddie, 25, doesn’t need to commute to work in his 2005 Ford StreetKa. Working four days on, four days off, he reckons he does about 16 hours of driving a month in all.

His last quote included an accident in 2015. Without a no-claims bonus, the “black box” policy quote was an unaffordable £3,200.

Eddie discovered Cuvva when searching the app store for short-term insurance so he could drive his dad’s car. It was going to cost £1,800 as a fully comp driver on his dad’s policy and that wasn’t a permanent solution.

With Cuvva, Eddie pays £15 a month as a base insurance, with a further £58 a month.

He says, “Cuvva is a no-brainer. My first car was a two-seater convertible and that set me back £5,400 a year.

“This month I have £200 left of my wages. I go on holiday next month so I’m really chuffed.”

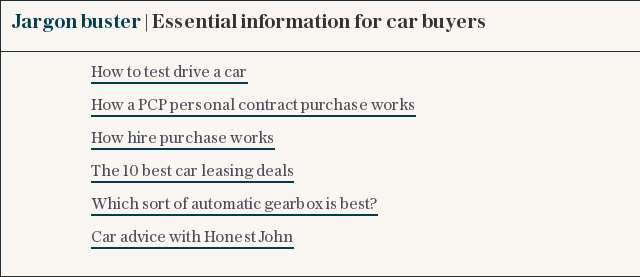

For more tips and advice, visit our Advice section, or sign up to our newsletter here