SI Research: 3 Distressed REITs With Yields Over 8%

As we all know, Real Estate Investment Trusts (REITs) are a specialised type of securities that invest in income-producing real estate assets well-sought after by income investors because of their relatively higher yield. While investing in the SPDR Straits Times Index Exchange-Traded Fund offers a dividend return of around 2.9 percent, the average distribution yield of REITs listed on the Singapore Exchange is more attractive at approximately 6.4 percent. Moreover, if we were to look at distressed REITs or business trusts whose share prices have remained depressed owing to a spate of negative news or announcements, it is not unusual for their yield to be driven up to as high as seven or eight percent.

Just like what investment guru, Warrant Buffet, has advised us to be greedy when others are fearful, do distressed REITs present good value buying opportunities when they are shunned by most investors or are they yield traps to be wary of? This issue, we take a closer look at three distressed REITs, namely Sabana Shari’ah Compliant REIT, Accordia Golf Trust and AIMS AMP Capital Industrial REIT.

Source: Author’s Own Compilation (updated 4 December 2017)

Sabana Shari’ah Compliant REIT

Sabana Shari’ah Compliant (Sabana) REIT released an update on 25 November 2017 that it has ceased discussions with ESR Funds Management in relation to potential acquisition of its assets. The immediate trading day following that announcement saw Sabana REIT’s share price sink 4.7 percent to close at $0.41 a share. Investors were disappointed that no definitive agreement could be reached after so much time and resources were put into the strategic review.

This was not the first time that shareholders were frustrated by Sabana REIT manager’s incapability. Earlier this year, a group of disgruntled unitholders criticised the manager’s decision to acquire three properties in Eunos and Changi at questionable valuations while issuing a heavily dilutive rights issue to finance the purchase. The fiasco escalated into an extraordinary general meeting being held to vote out the incompetent manager but the resolution was thwarted by sponsor Vibrant Group and other large shareholders, who rejected the mandate. Nonetheless, the proposed acquisitions were also subsequently terminated.

Over the last five years, a large chunk of unitholders’ value was lost with Sabana REIT’s share price plunging from a high of $1.21 in April 2013 to a low of $0.34 in January 2017. This does not come as a surprise as the group’s net property income (NPI) has been declining from $76.9 million in FY12 to $56.9 million in FY16 at a compounded annual growth rate (CAGR) of negative 7.3 percent per annum. As a result, distribution per unit (DPU) slid from $0.0928 in FY12 to $0.0464 in FY16 at a CAGR of negative 15.9 percent.

Sabana REIT announced that it has successfully renewed for an additional year the master leases of three sponsor-related properties – 51 Penjuru Road, 33 and 35 Penjuru Lane and 18 Gul Drive – for an aggregate rental of approximately $8.8 million, which will provide continuing and stable cash flow and revenue to the REIT. Nevertheless, the master leases, being renewed at $10.1 million in the prior year, in fact came in at a negative rental reversion of around 12.6 percent.

In its latest 9M17 quarter report, Sabana REIT displayed continuing weakness in its distribution with its DPU dropping 24.6 percent to $0.0248 for the period. Trading at $0.415 per unit as at 4 December 2017, annualised dividend yield came in at eight percent. That is, provided that Sabana REIT is able to maintain its payout at the current level. Meanwhile, price-to-book (P/B) ratio and gearing stood at 0.7 times and 36 percent respectively.

Source: Company Annual Reports

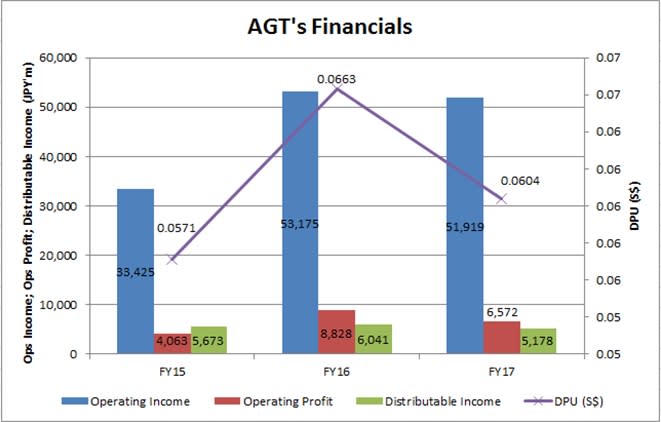

Accordia Golf Trust

Accordia Golf Trust (AGT) was one of the more unique business trusts in that it is the very first business trust listed on Singapore Exchange comprising investment in golf course assets in Japan, whose portfolio includes 89 golf courses located in the three largest metropolitan areas in Japan.

AGT’s share price sank 6.6 percent to $0.71 on 14 November 2017 after it reported a 27.3 percent decline in total income available for distribution in its 1H18 report, attributable to payment of borrowing upfront fee as well as an unusually large repayment of membership deposit. Correspondingly, DPU fell 32.7 percent to $0.0165 for the period.

This brought back memories of how AGT tumbled below its $0.60 support exactly two years ago back in November 2015, when it revealed a surprisingly low 1H16 payout of $0.0232 which shocked investors. The distribution was 59.4 percent lower than the preceding payout of $0.0571 for 2H15, which AGT attributed to lower operating income negatively affected by unusual weather condition coupled with AGT’s holding of 10 percent of distributable cash flows as reserve.

Disappointing distribution in comparison to forecasted figures in the prospectus was further aggravated by the weakening Japanese yen. Consequently, AGT’s share price plummeted from its initial public offering price of $0.97 to a historical low of $0.48 in January 2016.

With AGT’s market price of $0.69 as at 4 December 2017, this translated to a yield of 8.8 percent based on FY17’s full-year dividend payout. The business trust P/B ratio stood at 0.8 times with a net asset value (NAV) of $0.90 per unit, and loan-to-value remained healthy at 28.9 percent as at 31 March 2017.

Source: Company Annual Reports

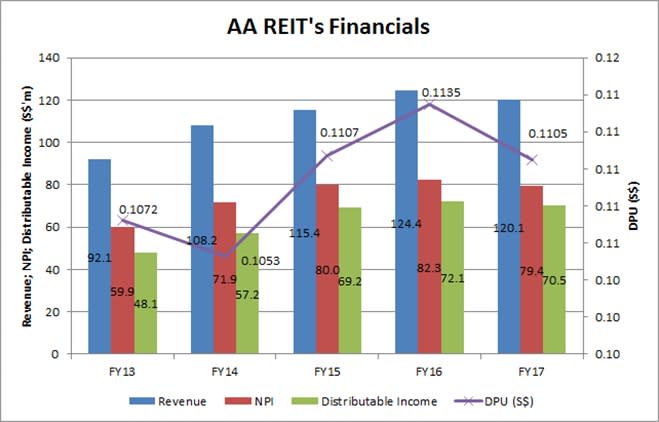

AIMS AMP Capital Industrial REIT

AIMS AMP Capital Industrial (AA) REIT announced on 21 November 2017 a private placement of new units at $1.305 per unit to raise gross proceeds of approximately $55 million. The placement price represented a 6.8 percent discount to AA REIT’s last closing price of $1.40 before the announcement. Upon lifting of trading halt after the announcement, its share price fell 2.9 percent closing at $1.36 on 23 November.

Management disclosed that 87 percent of the proceeds raised would be used to partially repay AA REIT’s existing borrowings to reduce aggregate leverage, which is expected to decrease from 37.3 percent as at 30 September 2017 to around 34 percent. Nevertheless, placement of this nature would be dilutive to the DPU as funds raised from the equities offering to reduce debts will not grow the properties’ income but will enlarge the number of outstanding units, consequently leading to a lower distribution per available unit. A total of 42.1 million new units will be issued as a result of the placement, which represents approximately 6.6 percent over the total number of units currently in issue.

The industrial space in Singapore has been challenging in recent years, weighed down by an oversupply situation and subdued demand. Latest 1H18 report showed that net property income slipped 0.4 percent despite a 1.5 percent climb in revenue. Notably, distribution to unitholders fell 7.8 percent mainly due to the partial retention of distribution to fund the working capital and capital expenditure requirements of the trust. Correspondingly, DPU declined 8.2 percent to $0.0505 for the period. In addition, portfolio occupancy has also dipped marginally to 88.8 percent as at 30 September 2017 from 94.6 percent at the end of financial year 2017.

Trading at $1.35 as at 4 December 2017, AA REIT offered an attractive distribution yield of 8.2 percent based on the FY17 full-year payout of $0.1105. P/B ratio came in at one times with a NAV of $1.3642 while gearing stood at 37.3 percent.

Source: Company Annual Reports