SI Research: ComfortDelGro Corporation – Giving Up Already?

ComfortDelGro Corporation (CDG) has been facing mounting pressures from ride-hailing services such as Uber and Grab. Early this year, despite reports from five brokerages putting the average target price for CDG’s shares at $3.09, we were not convinced that CDG’s shares have hit the bottom. Trading at around $2.50 in early January, the shares have continued on a downward trend making a new 52-week low of $2.13 on 18 August 2017.

However, the transport giant’s shares gained over seven percent by mid-day trading on 23 August 2017, after news of a possible tie-up with Uber. While the deal, if successful, would provide a ray of hope for CDG’s taxi business in Singapore, we have a much different view.

Last Ditch Effort

Since the emergence of Uber and Grab, CDG has been finding ways to go head-to-head with the competition instead of improving themselves.

As the war between taxis and private-hire services goes on, CDG, in July 2017, instructed its hirers to report illegal practices by private-hire operators, which include pulling up at taxi stands. The transport giant also advised it’s hirers to snap photographs if they see other forms of “illegal pick-up anywhere else”.

The move, seen as a cheap shot by many has hardly benefitted CDG in anyway other than providing some form of negative publicity. While negative publicity can result in positive effects, this is not always true, especially when the company’s image has not been to stellar with consumers.

Declining Brand Image

Yesterday, we looked at the Singapore Exchange (SGX) Bull Charge, a corporate social responsibility event. While such events do not directly affect the company’s share price, it does add value to the company’s brand image, which is very much important in today’s business environment.

Consumers in Singapore have long expressed dissatisfaction with the local taxis as they are well-known for being “Busy” during peak hours or refusing to pick-up certain groups of passengers. Some even avoid picking up passengers despite snaking taxi queues in order to receive bookings, which providing them a booking fee of around $3.

With the already largely negative image, such moves to edge out the new competition have not been well received by the public.

Financial Performance

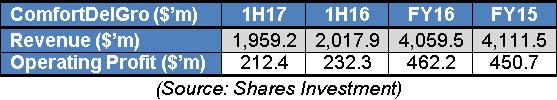

For 1H17, the group’s revenue fell 2.9 percent led by a $55.4 million decline in revenue from the taxi business. Although net profit was up 2.1 percent, operating profit was down 8.6 percent, the higher bottom line was due to an increase in net income from investments and lower finance costs.(Source: Shares Investment)

Always One Step Behind

We view CDG’s recent move to work with Uber as the first step to throwing in the towel. Constantly a step behind, CDG has tried to keep up with the tech giant’s footsteps by reducing rental fees for its hirers and introducing flat fare options for bookings made through its mobile booking application.

Our speculation is that Uber is very asset heavy in Singapore as it owns a huge fleet of rental vehicles through its car rental firm, Lion City Rentals (LCR). In fact, we find Uber’s business model in Singapore quite similar, but superior, to that of CDG’s taxi business. Uber earns through a cut of its drivers earnings and in fact stands to profit from vehicle rentals once the assets under LCR have broken even.

Given that Uber is already ahead in the game, why would they be interested in cutting a deal with CDG?

There could be a possibility that Uber has hit a comfortable level of drivers or may be cutting back on asset spending. Either of these would make a good reason to get CDG on board as it would be adding around 15,000 drivers to its platform while not having to worry about the assets.

The Pros And Cons

While both parties are still in discussion and have not reached a deal, it is unlikely the deal could work out to be in CDG’s favour, at least not for the long-term.

If the deal goes through, CDG’s fleet of 15,000 taxi hirers would be made available on Uber’s ride-sharing platform, allowing them to receive higher earnings, depending on how well the implementation was received. In the short-term, this would help to keep CDG’s taxi business afloat by preventing more taxi hirers from returning their keys

Ultimately, Uber as the platform provider has to reap some from benefits this deal as well. Such benefits could be monetary, similar to the 10 percent to 30 percent fee that it charges its existing drivers for different types of rides. This would have to come from either the 15,000 taxi hirers or from CDG. As such, apart from buying some time, this deal would hardly be as beneficial in the long run. It is after all, a deal between two rivals.