SI Research: Keppel Corporation – A Reborn Phoenix Rising From Its Ashes

As Saudi Arabia got mired in a political turmoil coupled with falling inventories and build-up of expectation that Organization of the Petroleum Exporting Countries (OPEC) and major producers will be extending their production-cut deal through the end of next year, Brent crude oil prices have been standing firm above the US$60 a barrel psychological level for the last couple of days.

This led to an extended rally of the oil and gas stocks listed on the Singapore Exchange, with the benchmark FTSE ST Oil and Gas Index propelled to a two-year high of 413.85 on 1 November 2017. The last two months saw offshore and marine conglomerate Keppel Corporation (KepCorp) on track for a long-awaited recovery with its share price surging 20.2 percent from a low of $6.24 on 15 September 2017 to $7.50 as at 6 November 2017. Can this remarkable growth continue to be sustained by the strength of black gold’s rally?

Profits Dragged Down By Global Offshore Slowdown

As we all know, the last couple of years were not good years for companies with rig-building businesses, plagued by oil price volatility and continuing downturn in the offshore sector. Being the leader in the offshore and marine sector, KepCorp was not spared from the doldrums either. The group’s revenue fell 22.5 percent from $13.3 billion to $10.3 billion in FY15, which declined a further 34.3 percent in FY16 to $6.8 billion. Likewise, net profit plunged a total of 58.4 percent from $1.9 billion in FY14 to merely $784 million in FY16.

The deteriorating profitability was in large part attributable to the worsening performances from the offshore and marine (O&M) division because of lower volume of contract work. On a year-on-year (y-o-y) basis, revenue from O&M slid 54.3 percent to $2.9 billion in FY16 while net profit sank 94 percent to only $29 million. Nonetheless, it is commendable that the group’s O&M division remained profitable despite the challenging environment, owing to management’s swift and decisive rightsizing measures to cut down costs and remain competitive.

In FY16, Keppel O&M reduced its direct workforce by 35 percent while cutting down its yard capacity by mothballing two overseas yards and three local yards. As a result of the collective efforts, overheads shrank considerably achieving savings of approximately $150 million y-o-y.

Things were not much better in FY17. As at 30 September 2017, 9M17 revenue slid 8.5 percent to $4.4 billion primarily due to lower contributions from both O&M and property divisions. However, despite the continuing downturn in the offshore business, Keppel O&M managed to breakeven owing to being leaner and contributions from associates. Consequently, net profit rose 11.2 percent to $712.5 million on the back of higher contributions from infrastructure and investments divisions, property trading and divestment proceeds, which more than offset the lower contributions from O&M division. Revenue and net profit for 9M17 came in at 65.3 percent and 90.9 percent of FY16 figures respectively.

Source: Company Annual Reports

Privatization of Keppel Land

KepCorp made a bold move to take full ownership and privatise Keppel Land back in 2015, which raised concerns among many shareholders at that time if the acquisition was appropriate.

Keppel Land then was having its fair share of challenges to handle against strong headwinds of properties over-supply and cooling measures. Investors argued that the $3 billion required for the privatisation could well be put into better use at a time when working capital needs are critical as more O&M customers are deferring their rig deliveries or cancelling their contracts altogether.

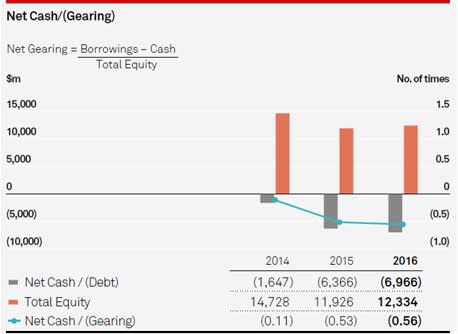

The deal sets KepCorp’s cash assets in FY15 back from $5.7 billion to $1.9 billion while total borrowings jumped from $7.4 billion to $8.3 billion. Consequently, net debt was elevated to $6.4 billion and as a result, the group’s net gearing ratio shot up from 0.11 times to 0.53 times as at end-2015.

Source: Company Annual Reports

As it stands now, the strategic acquisition proved to be a prudent move and could not be timelier. KepCorp’s property division turned out to be a strong pillar for earnings, replacing O&M division as the largest contributor to net profit for the last two years contributing 46 percent and 79 percent to FY15 and FY16 net profit respectively. On hindsight, KepCorp’s multi-business strategy provides the group with the agility and resilience to capture growth opportunities as it navigate through the difficult times.

Apart from that, another major corporate development would be the restructuring of KepCorp’s four asset management businesses – namely Keppel REIT Management, Alpha Investment Partners, Keppel Infrastructure Fund Management as well as 50 percent interest in Keppel DC REIT Management – all under Keppel Capital in FY16. This would allow the group to strengthen its capital recycling capability through a single platform, which will continue to offer a steady stream of recurring income to the group.

With a management team that possesses the foresight and commitment to constantly strive for efficiency, synergy and collaboration across its businesses and divisions, we can be assured that KepCorp was laid in good hands for long-term value creation.

Light At The End Of The Tunnel?

Oil prices have more than doubled from less than US$30 per barrel at the start of 2016 to US$62.26 now as at 6 November 2017. Similarly, KepCorp’s share price has also recovered some of its losses from a low of $4.71 in January 2016 to current price of $7.50. With an uptrend now becoming apparent, do we expect KepCorp to return to its glorious days when it was changing hands at above $10 a share?

Well, probably not. Although a rebound in oil price is generally positive to the offshore sector, oil price by itself is merely just one of several factors which determine if rig orders will return.

Capital expenditure and spending of oil companies need to expand for the market to improve, which could take a while given utilisation of rigs continues to remain weak at present moment amidst an oversupply of vessels. In fact, KepCorp’s FY16 contracts win only stood at around $500 million, and reportedly has secured new contracts of about $1 billion for 9M17. This is a far cry from the $7 billion and $5.5 billion worth of contracts clinched in FY13 and FY14, prior to the oil price crash.

As the market continues to absorb the oversupply of newbuilds, oil companies and fleet operators will continue to focus on capital discipline. As such, we do not envisage a sharp turnaround in rig-building business anytime soon. Nevertheless, having already been through four cycles of difficult periods unscathed, we are confident that KepCorp is not only capable of surviving through this storm, but it will also emerge stronger, entrenching its leadership role in this field. It will be just like what it has done for the last 50 years.