SI Research: Is Lippo Malls Indonesia Retail Trust’s Yield Realistic?

With a distribution per unit (DPU) of $0.0344 in FY17 and based on the closing price of $0.40 as at the last trading day of last year on 29 December 2017, Lippo Malls Indonesia Retail Trust’s (LMIRT) historical dividend yield of 8.6 percent placed it among one of the highest-yielding real estate investment trust listed on the Singapore Exchange.

Just last month on 11 April 2018, LMIRT announced that the Indonesian government has passed certain amendments to the tax regulations with effect from 2 January 2018, requiring all income received or earned from land or building leases in Indonesia to be subjected to an income tax at 10 percent of the gross amount of the value of the land or building lease, including service charges and utilities recovery charges. According to management’s pro forma assessment of the impact of the new regulations as if they were in effect on 1 January 2017, distribution per unit would have been lower by 7.3 percent. This caused LMIRT’s share price to plunge more than 14.5 percent from $0.38 to $0.325 as at 14 May 2018.

If management’s assessment were accurate, adjusted DPU of $0.0319 after the changes would translate to a yield of 9.8 percent based on its current battered price, making LMIRT’s already attractive yield all the more mouth-watering. That being the case, SI Research seeks to find out if this is a rare opportunity for yield seekers or a yield trap in disguise.

Proxy To Indonesia’s Bustling Retail Scene

Since its listing in November 2007, LMIRT, with Indonesia’s largest property company Lippo Karawaci as its sponsor, offers investors a unique opportunity to participate in the thriving retail property sector of the largest economy in Southeast Asia. On a macro-economic front, the Indonesian government sets its 2018 gross domestic product growth target at 5.4 percent, which is significantly higher as compared to the global average growth of 3.1 percent.

Indonesia is blessed with a huge population of around 266 million based on the latest United Nations estimates, coupled with a high fertility rate of 2.5 births per woman, the healthy population growth allows the ratio of dependent population to the size of the working population to remain low and conducive for further economic growth. In 2016, more than 54 percent of the population is living in urban centres and with one of the highest rate of urbanisation in the world, the World Bank projected that this figure will rise to 68 percent within the next 10 years. This will fuel the rapid expansion of the retail industry in Indonesia.

Indonesia’s steady economic growth together with healthy demographic trends gave rise to a group of young and affluent middle class. Armed with higher disposable income and greater consumer spending power, the richer middle class continues to drive demand for retail spaces and contribute to the vibrancy of the retail real estate sector. On average, retail sales growth in Indonesia stood at around 11.5 percent from 2006 until 2018. Undeniably, the outlook for the retail industry is indeed encouraging.

Over the last 10 years, LMIRT has seized on various opportunities through accretive investments and asset enhancement initiatives to drive growth. From an initial asset size of 14 properties valued at IDR5,928 billion, the group has since tripled its portfolio value to IDR19,475 billion comprising 30 properties strategically located across key cities in Indonesia. As at 31 December 2017, LMIRT’s portfolio include 23 retail malls and seven retail spaces with a total gross floor area of 1.7 million square metres (sqm) and net lettable area of 0.9 million sqm.

Depreciating Indonesian Rupiah

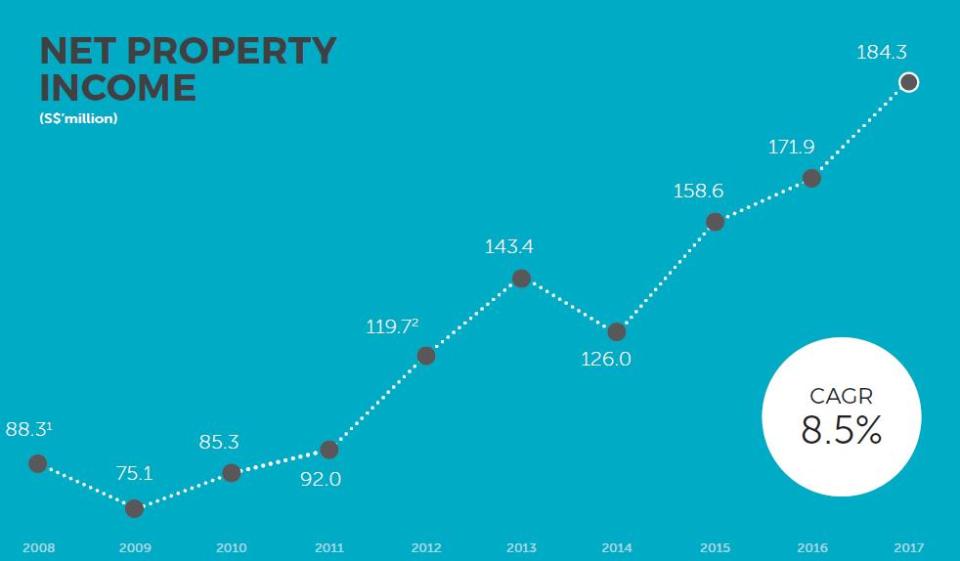

Underpinned by a growing portfolio and generally positive rental revisions, LMIRT saw its revenue and net property income on a steady advance which increased at compounded annual growth rate (CAGR) of 7.6 percent and 8.5 percent respectively.

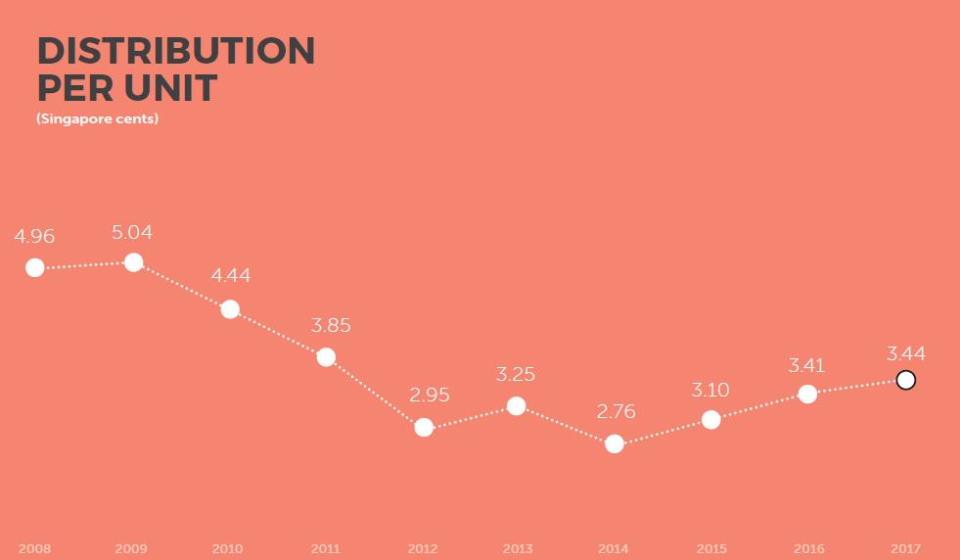

Source: Company Annual Reports

Unfortunately, these were not accompanied by higher DPU accordingly, which instead shrank at a CAGR of negative four percent from $0.0496 back in 2008. We attributed this in large part due to the depreciation of Indonesian Rupiah (IDR) against Singapore Dollar (SGD) in the last few years. At around IDR6,570 for every SGD in early 2008, IDR has depreciated by more than 33.3 percent in the last decade to around IDR10,430 for every SGD as at May 2018.

The Monetary Authority of Singapore recently announced that it will increase the slope of the Singapore Dollar nominal effective exchange rate policy band slightly while setting the width of the band and the level at which it is centered unchanged. This effectively means that the Singapore Dollar would be placed on a modest and gradual appreciation path.

On the other hand, Bank Indonesia cut its benchmark interest rate six times in 2016 bringing it down from 7.5 percent to 4.75 percent. The central bank left its seven-day reverse repo rate unchanged at 4.25 percent as at the meeting on 19 April 2018 in correspondence to the easing inflation. Amidst rising reference rate in the US, Indonesia faces the risks of a potential capital outflow given its relatively unattractive interest rate. The situation is further aggravated by Indonesia’s modest foreign exchange reserves of US$126 billion as at March 2018 to defend its domestic currency. In contrast, Singapore’s foreign reserves are more than double that of Indonesia’s savings at US$287 billion.

Hence from the look of it, the trend of depreciating IDR against SGD seems likely to continue at least for the near term.

Rising Gearing

Apart from the shrinking DPU, the depreciating IDR also plays a part in the declining net asset per unit which fell 19.2 percent from a year ago to $0.3018 in 1Q18. While LMIRT’s portfolio valuation grew at a CAGR of 13.2 percent over the last 10 years to IDR19,475 billion in FY17, the trend is not so distinct if looked at in Singapore Dollar term. In fact, portfolio valuation slid 1.1 percent from $1,941.9 million to $1,920 million in FY17 despite a 7.5 percent increment in IDR terms recorded over the same period.

LMIRT added $44.3 million to its total borrowings of $695 million in FY17 to support new acquisitions. With escalated borrowings compounded with lower asset value, gearing climbed by 2.2 percentage points to 33.7 percent.

An update from LMIRT’s latest 1Q18 results revealed a continuation of its existing trend that we have seen so far. Total gross revenue and net property income in IDR terms climbed 10.3 percent and 4.1 percent respectively, but available DPU declined 24.7 percent attributable to the impact of the weakening IDR as well as the $1.6 million higher income tax expense because of the new tax regulations in Indonesia.

While LMIRT’s almost double-digit yield looks very appealing, one should also consider if the attractive dividends are compelling enough to compensate for the additional foreign exchange risk he has to bear. The weakening IDR is indeed a major concern in our opinion, which would be very destructive to LMIRT’s share price if its DPU and net asset value continue to be eroded.