SI Research: Neo Group – A Likely Boost From Lunar New Year Sales?

As we gather with our friends and relatives during this Chinese New Year festive period, food catering tends to be the more convenient option to satisfy our appetite for a large group of people. At the corporate side, companies especially those that are more immersed in the Chinese culture, would also arrange to treat its employees to a feast to mark the beginning of a new year. This was often accompany by a “lo hei” ceremony, also tossing of Cantonese-style raw fish salad, in the belief of bringing in prosperity and good luck for the new year.

This got us interested in Neo Group, the number one event caterer in Singapore with a market share of 14.7 percent. We explore the likelihood of how a potential sales boost arising from increased demand for food catering during the lunar new year period could make Neo Group an investment-worthy candidate.

Opportunity From Stronger Sales

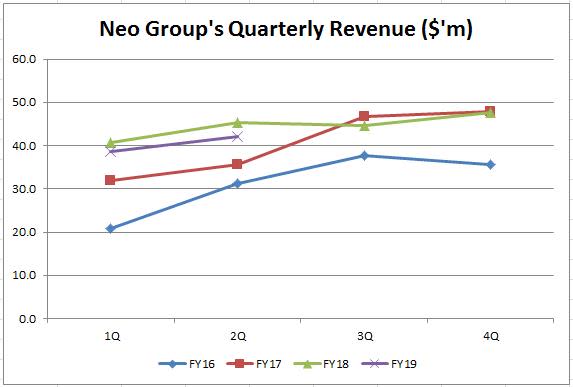

Neo Group broke the Singapore Book of Records with almost 2,000 catering orders served on the first day of Chinese New Year in 2018. And increased businesses naturally translate to higher sales, as the group typically registers much higher revenue in its fourth quarter (Neo Group’s financial year ended in March) varying from 1.1 times to 1.3 times the average of the remaining three quarters seen in the last three years.

Source: Company’s Annual Reports

If that was the case, is it not a good idea to buy into Neo Group’s shares now since we already know that the group is likely to deliver a stronger 4Q19 results? Not quite. Contrary to what we would like to believe, Neo Group’s share prices actually delivered negative returns from the March to June period (with the exception of bull year 2017) as seen from the share prices performances which we had compiled from data in the last four years, during the period when the company is releasing its fourth quarter report. We suspect that this could be due to the market having already factored in a stronger 4Q before the results release, as investors sell into strength once the actual results are reported.

Source: Author’s Compilation

Some Of Our Concerns As Long-Term Investment

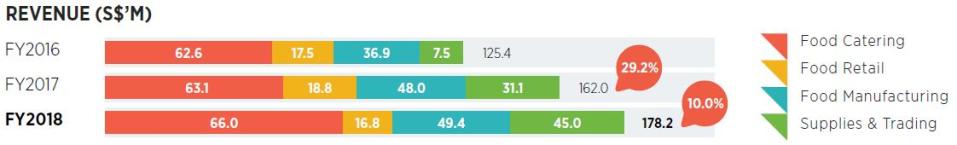

Short-term opportunities aside, does Neo Group make for a sound long-term investment? We have our reservations. Although the group’s revenue grew at a compounded annual growth rate of 19.2 percent from FY16 to $178.2 million in FY18, its net profit did not rise in tandem with the top-line. In fact, net profit declined by 41 percent from $6.1 million in FY16 to $3.6 million in FY18, attributable to increased operating costs from business expansion as well as the absence of one-off gains.

Source: Company’s Annual Reports

Furthermore, weaker performances from Neo Group’s other segments continue to erode the earnings from its core food catering business. For instance, food retail business which had barely turned around in FY18, registered a 3 percent dip in revenue in 1H19 arising from the closure of non-performing outlets. Meanwhile, supplies and trading business revenue sank significantly by 39.8 percent in 1H19 because of an intentional reduction in low margin trading transactions. This segment was still loss-making as at FY18, and seems likely to remain so this year.

As a result, Neo Group reported a net loss of $0.9 million in 1H19 on a 6.1 percent decrease in revenue at $80.7 million. Nonetheless, the group’s performance in the first half of the year tends to be more subdued due to the seasonality effect. The management remained confident that the company can stay profitable for the full year.

Another worrying aspect that we would like to point out would be Neo Group’s highly leveraged balance sheet. The group’s borrowings as at 1H19 stood at $82.3 million, a 24 percent increase from $66.4 million in FY16 in just two and a half year. Consequently, net gearing jumped to 2.1 times from 1.8 times two years ago.

That said, in light of its unimpressive profitability and highly-geared balance sheet, we would prefer Neo Group to be trading at a more attractive level before we would consider making an investment.